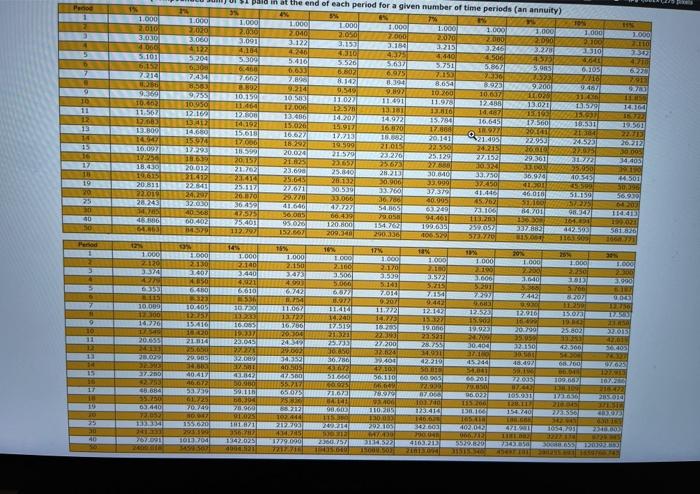

6 Calculate how much you would have in 15 years if you saved $8.500 a year at an annual rate of 5 percent with the company contributing $2,925 a year. Use Exhibit 1:8. (Round time value factor to 3 decimal places and answer to 2 decimal places.) Future value RES Pend 1000 2.110 471 9 10.159 01 11 12 51 paid in at the end of each period for a given number of time periods (an annuity) 1 4% 3% 74 1.000 10 1.000 1.000 1.000 1000 1.000 1.000 1.000 1.000 27010 2020 2.000 2040 2.050 2.000 23070 2000 2090 2100 3500 3.000 09111 3.122 3.150 10 23 2000 310 20 5,440 4.500 5 5.10 WA 5.200 5410 5.520 5567 5.751 5.06.10 6.152 0 62400 6802 72103 2136 2 1214 747662 2. 8.12 20 8.332.892 10260 1067 LEO126 9869 9.755 107503 11022 11709 1240 13.00.579 10.950 177000 125 13.11 2010 14187 19 11.567 12 TO 12200 1746 14.207 14.972 15.784 16.6451 17:560 18.531 1341 14.192 157020 1..912 16.370 17.804 1971 14.680 15.618 16022 17,13 20.1411 22.934523 1537 1100 19.599 21.01 22.550 2013 2015 16.07 1/72931 18.599 2004 2579 23.276 25.129 27.152 11250 2015 21135 P65 2.800 102 18.00 20.012 212702 23.690 25.040 28.213 30.80 33.750 36,970 10243 199615 25.65 28.132 30.000 3.999 SO 101 201310 22640 27.671 301530 37:37 46.00 22701924. 51.159 29.77 30.000 40.995 2576 5125 2243 325000 36.491 54.365 7100 7011 9:34 4056 15751 19.05 401 13.20 101 753401 1202600 1997035 337002 203 34379 112192 15207 209, 5730 14.160 TZ 11361 00 ET CHORU 20,212 15 10 3350 ORE 19 44.501 30,2 parate RA 25 20 40 50 SPE 64203 T413 TRY 561 POOR Perso 1 18% 1.0001 27150 3073 17 1000 22170 3.5391 10% 1.000 1301 30780 1.000 1.000 2140 3440 4.921 6610 56 10.720 18% 1.000 22 3.572 31S 750 1.000 2209 2990 OSET 1000 230 1013 50 799 EVES 3.000 3.201 22 LCOO 22160 3.500 37060 08 272 11 142240 17519 210211 1.640 53305 7442 7 06 CE GOVOR 10.009 12.10 72 . 11.067 17722 7.014 9.07 11.22 12.12 1723 CRO ZSIZE COST 1296 3630 TRE 19 10 360 10 12 125 1574101 100 2100 25.050 20.000 200 227527 TOT 10.237 23.05 12.27 32.000 18.7051 22. 271200 32.626 2703 20.730 23.052 3250 2015 4500 101 56402 20.00 22:30 2.00 5255 ASUS 477560 11 30 36801 14.31 DAL ES EOS 22 37200 1 50 4142 900 16.492 SAW *72035 10 . 5010 LA 51.630 1:01 109,662 110 W TAI 17 6570 71,67 ZX AT OSO 06.023 1552 23239 61.23 2/3/401 99.1 0,394 70.900 It 21.22 ET MA 59 COEL DO TED 146,60 8823 102.444 TO OUT 14/400 22:55 DUP NEC 52016 LZE THE KLASSE 155.620 293599 Toma 90.00 HIS 13033 23007571 TAS RAS 3402012 WE 20 40 GELSE WP NOX 1779200 72177 ACER KRITES ICOS ROOT 410323 ATT