Answered step by step

Verified Expert Solution

Question

1 Approved Answer

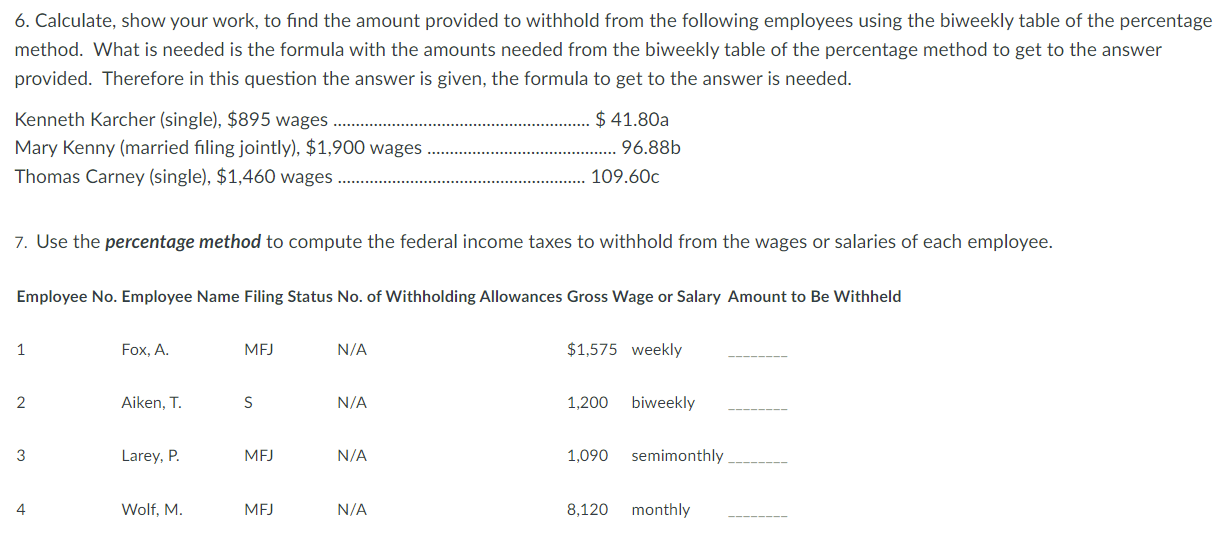

6. Calculate, show your work, to find the amount provided to withhold from the following employees using the biweekly table of the percentage method.

6. Calculate, show your work, to find the amount provided to withhold from the following employees using the biweekly table of the percentage method. What is needed is the formula with the amounts needed from the biweekly table of the percentage method to get to the answer provided. Therefore in this question the answer is given, the formula to get to the answer is needed. Kenneth Karcher (single). $895 wages $ 41.80a Mary Kenny (married filing jointly), $1,900 wages Thomas Carney (single), $1,460 wages _ .... 96.88b 109.60c 7. Use the percentage method to compute the federal income taxes to withhold from the wages or salaries of each employee. Employee No. Employee Name Filing Status No. of Withholding Allowances Gross Wage or Salary Amount to Be Withheld 1 Fox, A. MFJ N/A $1,575 weekly 2 Aiken, T. S N/A 1,200 biweekly 3 Larey, P. MFJ N/A 1,090 semimonthly 4 Wolf, M. MFJ N/A 8,120 monthly

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

6 Kenneth Karcher single 895 wages Formula 895 11920 x 10 7780 Amount to be withhel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started