Answered step by step

Verified Expert Solution

Question

1 Approved Answer

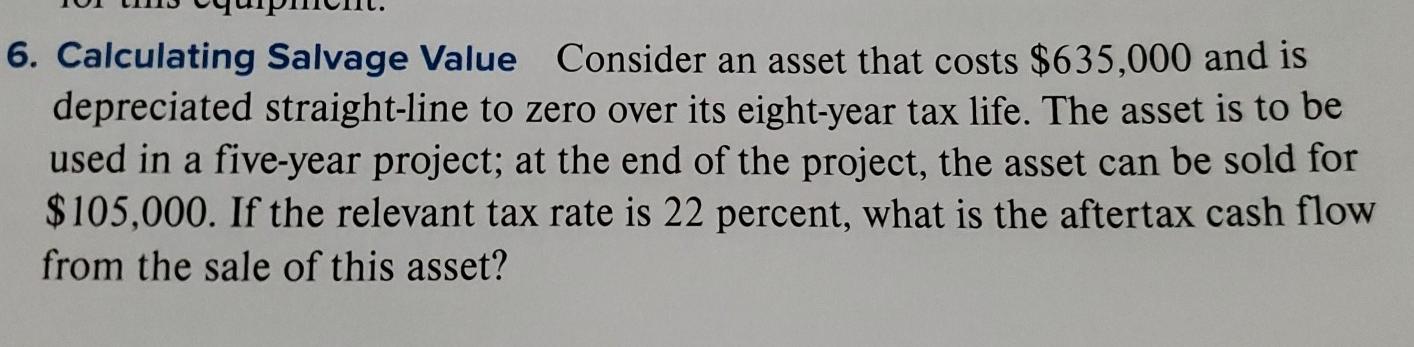

6. Calculating Salvage Value Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to

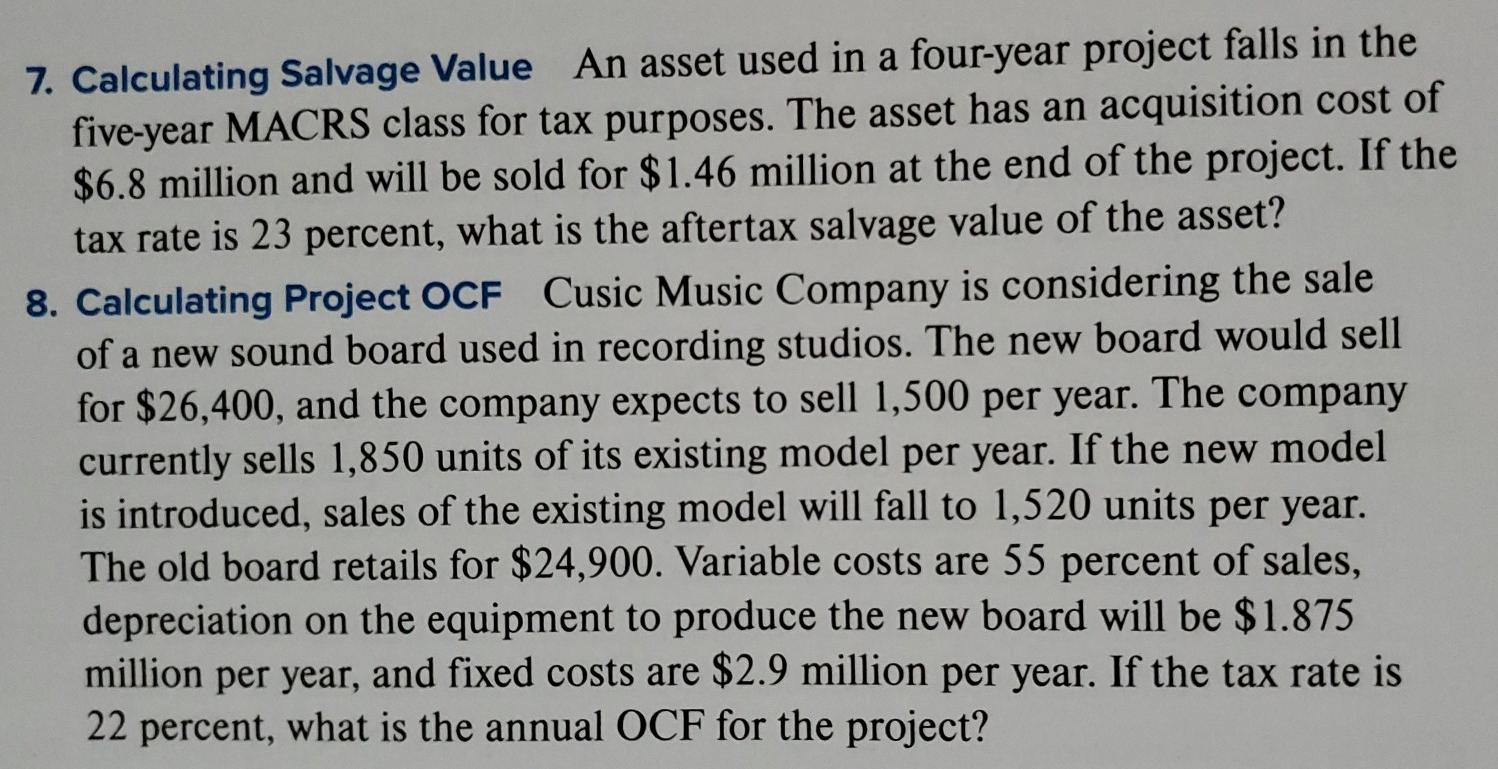

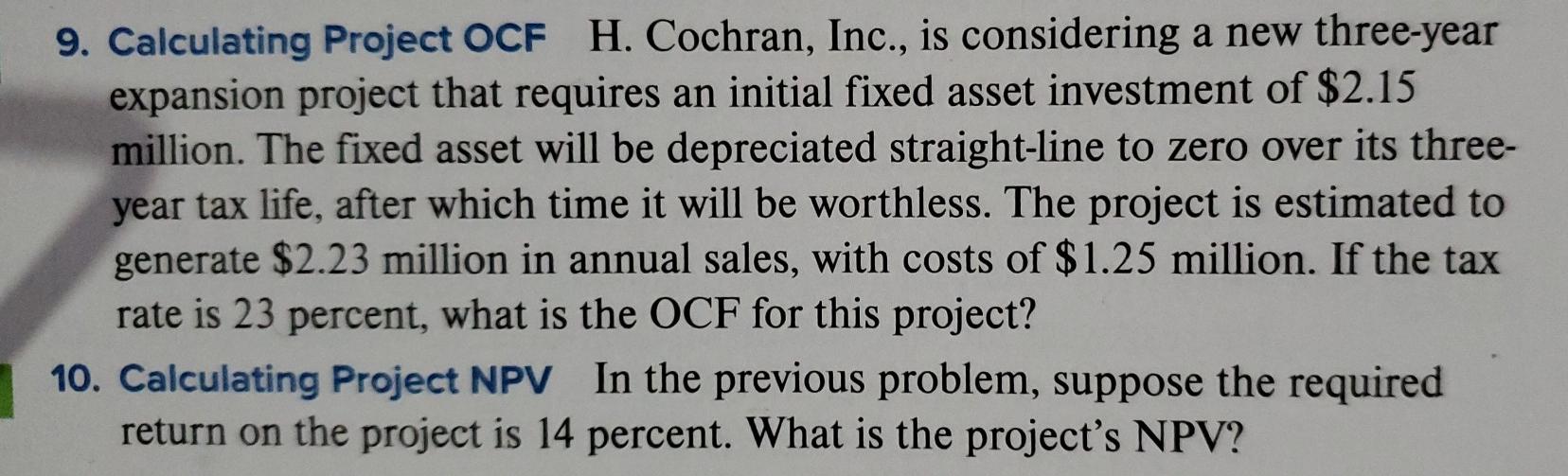

6. Calculating Salvage Value Consider an asset that costs $635,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $105,000. If the relevant tax rate is 22 percent, what is the aftertax cash flow from the sale of this asset? 7. Calculating Salvage Value An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6.8 million and will be sold for $1.46 million at the end of the project. If the tax rate is 23 percent, what is the aftertax salvage value of the asset? 8. Calculating Project OCF Cusic Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $26,400, and the company expects to sell 1,500 per year. The company currently sells 1,850 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,520 units per year. The old board retails for $24,900. Variable costs are 55 percent of sales, depreciation on the equipment to produce the new board will be $1.875 million per year, and fixed costs are $2.9 million per year. If the tax rate is 22 percent, what is the annual OCF for the project? 9. Calculating Project OCF H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight-line to zero over its three- year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. If the tax rate is 23 percent, what is the OCF for this project? 10. Calculating Project NPV In the previous problem, suppose the required return on the project is 14 percent. What is the project's NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started