Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Child and Dependent Care Credit. (Obj. 2) Bud and Katie Milner file a joint return. During the year, they paid $11,000 to their nanny

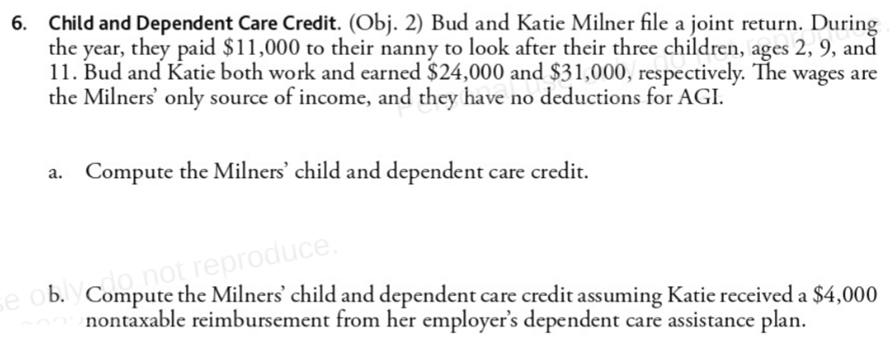

6. Child and Dependent Care Credit. (Obj. 2) Bud and Katie Milner file a joint return. During the year, they paid $11,000 to their nanny to look after their three children, ages 2,9 , and 11. Bud and Katie both work and earned $24,000 and $31,000, respectively. The wages are the Milners' only source of income, and they have no deductions for AGI. a. Compute the Milners' child and dependent care credit. b. Compute the Milners' child and dependent care credit assuming Katie received a $4,000 nontaxable reimbursement from her employer's dependent care assistance plan

6. Child and Dependent Care Credit. (Obj. 2) Bud and Katie Milner file a joint return. During the year, they paid $11,000 to their nanny to look after their three children, ages 2,9 , and 11. Bud and Katie both work and earned $24,000 and $31,000, respectively. The wages are the Milners' only source of income, and they have no deductions for AGI. a. Compute the Milners' child and dependent care credit. b. Compute the Milners' child and dependent care credit assuming Katie received a $4,000 nontaxable reimbursement from her employer's dependent care assistance plan Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started