Question

6. Circle the correct answer for each of the following statements. Use the graphs below as needed. (A)Properties of Duration 1. As the maturity increases,

6. Circle the correct answer for each of the following statements. Use the graphs below as needed.

(A)Properties of Duration

1. As the maturity increases, the duration of a bond (increases/decreases).

2. As the coupon rate increases, the duration of a bond (increases/decreases).

3. As the required yield rate increases, the duration of a bond (increases/decreases).

4. The price change for a drop in the yield rate is (higher/lower) than the price change for a rise in yield rate.

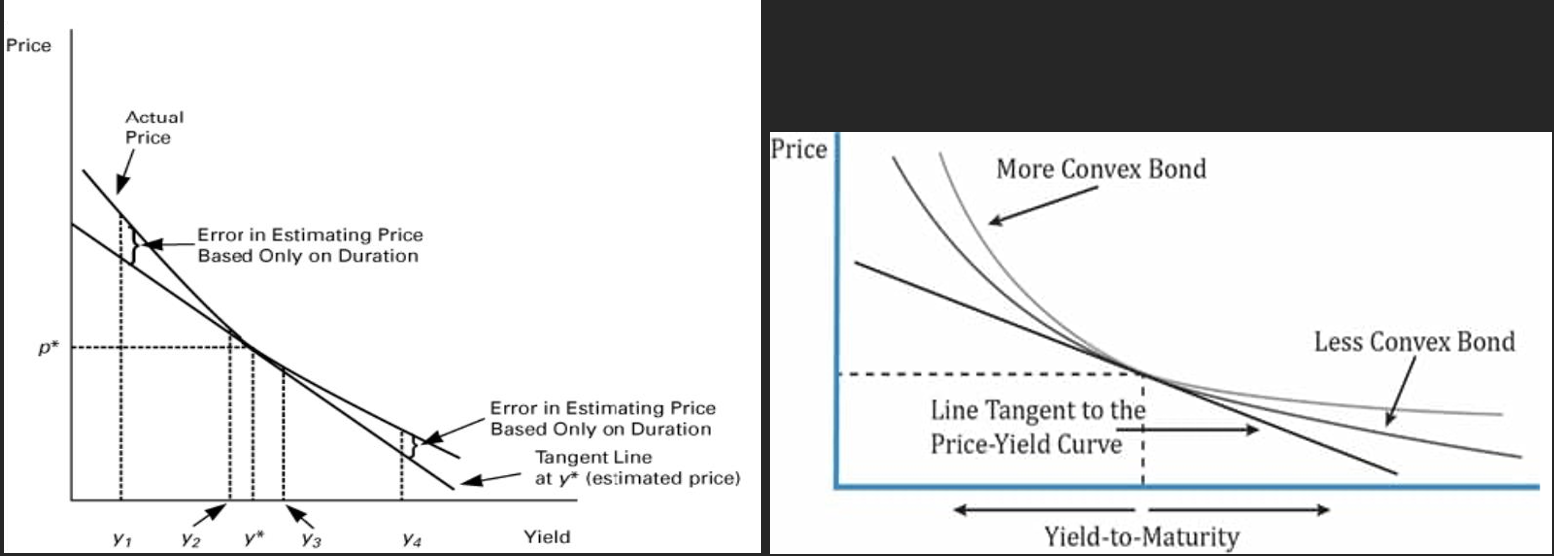

(B) Approximation Error

1. Duration alone always (underestimates/overestimates) the price change when rate changes.

2. When using duration for approximating price changes, the estimation error is (larger/smaller) for an increase in yield rate than for an equal drop.

3. When using duration for approximating price changes, the larger the rate the (smaller/larger) the estimation error.

4. The greater the convexity of a bond, the (lower/higher) the approximation error when using duration for approximation.

(C) Properties of Convexity

1. As the required yield increases, the convexity of a bond (increases/decreases).

2. For a given yield and maturity, (lower/higher) coupon rates will have greater convexity.

3. The greater the convexity, the (lower/higher) the price appreciation in response to a large change in yield rate.

4. Bonds with larger convexity are valued (higher/lower) when investors expect a large volatility in yield rates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started