Question

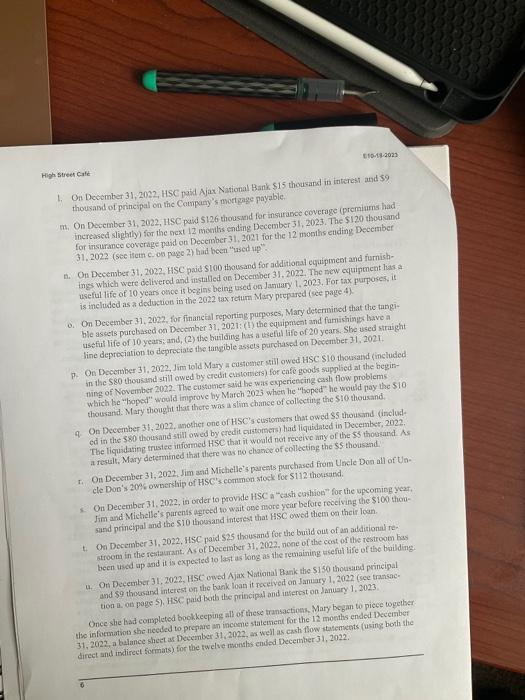

Financial Statement Preparation Questions: Record the transactions (journal entries) and other considerations for the High Street Caf from the period January 1, 2022 through December

Financial Statement Preparation Questions:

Financial Statement Preparation Questions:

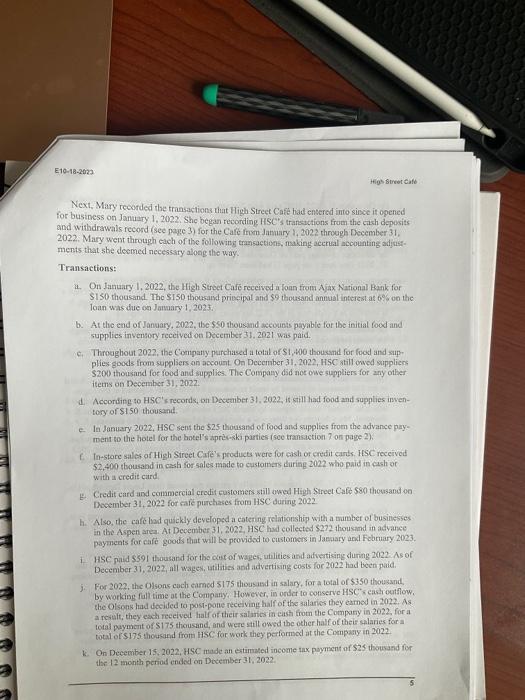

- Record the transactions (journal entries) and other considerations for the High Street Café from the period January 1, 2022 through December 31, 2022. NOTE WELL: Be sure to remember to include any opening balances (shown in BOLD in the T-Accounts listed) when adding up items in the T-accounts.

- Based on you answer to Question 1, for financial reporting purposes (not tax purposes) pre-pare, "in good form" i.e. proper formats for the reports:

- an income statement for the 12-month period from January 1, 2022 through December 31, 2022. Assume an income tax rate of 20% is appropriate for the High Street Cafe

- a statement of financial position (i.e. balance sheet) as of December 31, 2022.

- a statement of cash flows using the direct method for the High Street Cafe for the 12-month period from January 1, 2022 through December 31, 2022.

- a statement of cash flows using the indirect method for the High Street Cafe for the 12-month period from January 1, 2022 through December 31, 2022. You need only show the cash flow from operations section for the indirect cash flow statement.

3. Overall, how would you characterize High Street Cafe's performance in 2022? Should Jim and Michelle be pleased? Uncle Don? Jim and Michelle's parents? What criteria did you use to gauge HSC's performance? Briefly explain your answer.

4. From a cash flow, cash balance and cash needs standpoint, how has High Street performed in 2022? What cash criteria did you use to gauge HSC's cash performance? Briefly explain your

answer.

5. The $150 thousand bank loan to HSC had the following requirements: (1) HSC should have earnings before interest and taxes of at least 2.5 times its interest expense; and, (2) HSC maintain an end-of-year interest-bearing debt to end-of-year equity ratio of not more than 1 to 1. As of December 31, did High Street meet the bank's requirements? If you were the bank lending officer for the bank that lent High Street Café $150 thousand, would you approve HSC's request for a new loan on January 1, 2023? Why or why not? Briefly explain.

6. Compare the tax return on page 4 with your income statement. Which four accounting differences between book and tax accounting were the most significant? Specify if the individual differences initiated a deferred tax liability or a deferred tax asset.

Financial Statement Preparation Questions:

- Record the transactions (journal entries) and other considerations for the High Street Café from the period January 1, 2022 through December 31, 2022. NOTE WELL: Be sure to remember to include any opening balances (shown in BOLD in the T-Accounts listed) when adding up items in the T-accounts.

- Based on you answer to Question 1, for financial reporting purposes (not tax purposes) pre-pare, "in good form" i.e. proper formats for the reports:

- an income statement for the 12-month period from January 1, 2022 through December 31, 2022. Assume an income tax rate of 20% is appropriate for the High Street Cafe

- a statement of financial position (i.e. balance sheet) as of December 31, 2022.

- a statement of cash flows using the direct method for the High Street Cafe for the 12-month period from January 1, 2022 through December 31, 2022.

- a statement of cash flows using the indirect method for the High Street Cafe for the 12-month period from January 1, 2022 through December 31, 2022. You need only show the cash flow from operations section for the indirect cash flow statement.

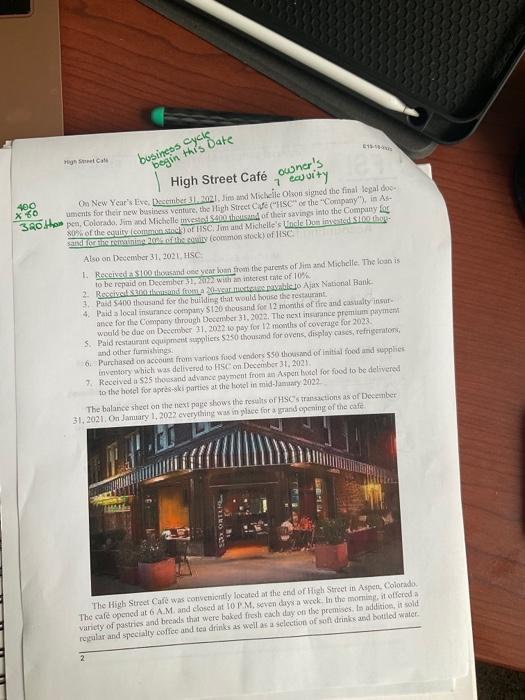

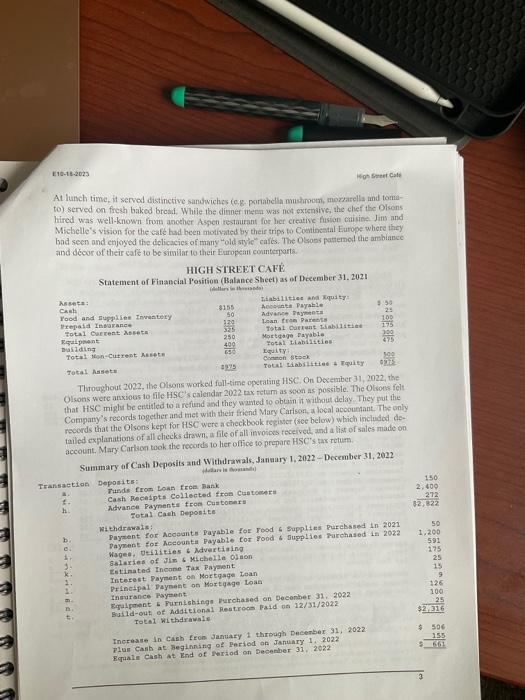

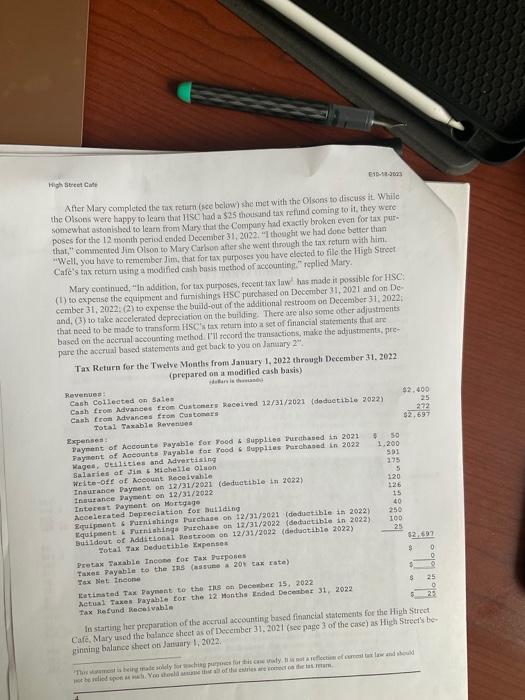

400 x 60 320 Ho High Ca business cycle begin this Date High Street Caf owner's 7 cavity On New Year's Eve, December 31, 2021. Jim and Michelle Olson signed the final legal doc uments for their new business venture, the High Street Cafe ("HSC" or the "Company"), in As- pen, Colorado, Jim and Michelle invested $400 thousand of their savings into the Company for 80% of the equity (common stock) of HSC. Jim and Michelle's Uncle Don invested $100 thou- sand for the remaining 20% of the equity (common stock) of HSC Also on December 31, 2021, HSC 1. Received a $100 thousand one year loan from the parents of Jim and Michelle. The loan is to be repaid on December 31, 2022 with an interest rate of 10% 2. Received $300 thousand from a 20-year morteage payable to Ajax National Bank 3. Paid $400 thousand for the building that would house the restaurant 4. Paid a local insurance company $120 thousand for 12 months of fire and casualty insur ance for the Company through December 31, 2022. The next insurance premium payment would be doc on December 31, 2022 to pay for 12 months of coverage for 2023. 5. Paid restaurant equipment suppliers $250 thousand for ovens, display cases, refrigerators, and other furnishings. 6. Purchased on account from various food vendors $50 thousand of initial food and supplies inventory which was delivered to HSC on December 31, 2021. 7. Received a $25 thousand advance payment from an Aspen hotel for food to be delivered to the hotel for aprs-ski parties at the hotel in mid-January 2022 The balance sheet on the next page shows the results of HSC's transactions as of December 31, 2021. On January 1, 2022 everything was in place for a grand opening of the cafe The High Street Cafe was conveniently located at the end of High Street in Aspen, Colorado. The cafe opened at 6 A.M. and closed at 10 PM, seven days a week. In the morning, it offered a variety of pastries and breads that were baked fresh cach day on the premises. In addition, it sold regular and specialty coffee and tea drinks as well as a selection of soft drinks and bottled water. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the key steps to prepare HSCs 2022 tax return based on the information ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started