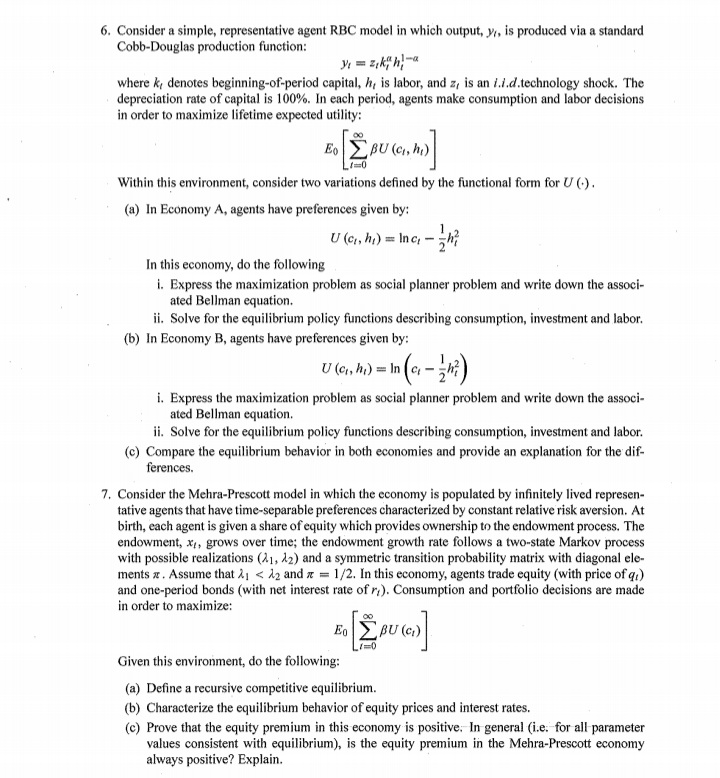

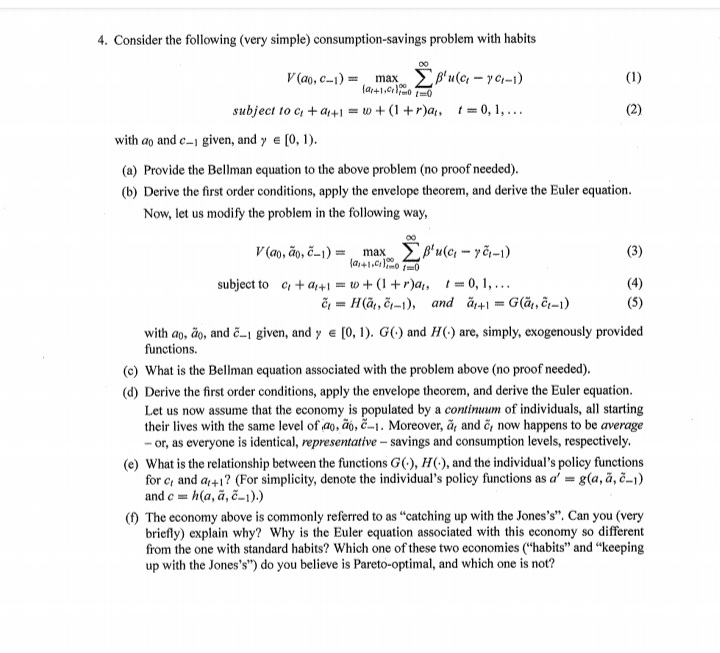

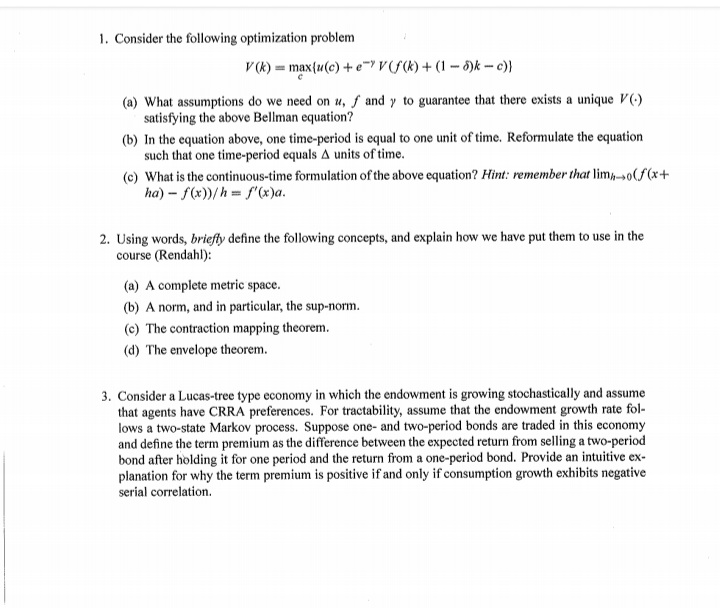

6. Consider a simple, representative agent RBC model in which output, ), is produced via a standard Cobb-Douglas production function: M = Ek, h, - where k, denotes beginning-of-period capital, h, is labor, and z, is an 1./.d.technology shock. The depreciation rate of capital is 100%. In each period, agents make consumption and labor decisions in order to maximize lifetime expected utility: E. EBU (CI, H1) Within this environment, consider two variations defined by the functional form for U (.). (a) In Economy A, agents have preferences given by: U (cq, h,) = Inch; In this economy, do the following i. Express the maximization problem as social planner problem and write down the associ- ated Bellman equation. ii. Solve for the equilibrium policy functions describing consumption, investment and labor. (b) In Economy B, agents have preferences given by: U (c, h;) = In (c - 74?) i. Express the maximization problem as social planner problem and write down the associ- ated Bellman equation. ii. Solve for the equilibrium policy functions describing consumption, investment and labor. (c) Compare the equilibrium behavior in both economies and provide an explanation for the dif- ferences. 7. Consider the Mehra-Prescott model in which the economy is populated by infinitely lived represen- tative agents that have time-separable preferences characterized by constant relative risk aversion. At birth, each agent is given a share of equity which provides ownership to the endowment process. The endowment, x, grows over time; the endowment growth rate follows a two-state Markov process with possible realizations (21, 12) and a symmetric transition probability matrix with diagonal ele- ments x . Assume that 2, B'u(c - ya-1) (3) subject to cta,+1 = w+ (1 + r)a, 1 =0, 1,... (4) & = H(a, C-1), and a;+1 = G(ar, G-1) (5) with an, do, and &_, given, and y = [0, 1). G(.) and H(.) are, simply, exogenously provided functions. (c) What is the Bellman equation associated with the problem above (no proof needed). (d) Derive the first order conditions, apply the envelope theorem, and derive the Euler equation. Let us now assume that the economy is populated by a continuum of individuals, all starting their lives with the same level of ao, do, C-1. Moreover, a, and &, now happens to be average - or, as everyone is identical, representative - savings and consumption levels, respectively. (e) What is the relationship between the functions G(), H(.), and the individual's policy functions for c, and at+17 (For simplicity, denote the individual's policy functions as a' = g(a, a, c-1) and c = h(a, a, c-1).) (f) The economy above is commonly referred to as "catching up with the Jones's". Can you (very briefly) explain why? Why is the Euler equation associated with this economy so different from the one with standard habits? Which one of these two economies ("habits" and "keeping up with the Jones's") do you believe is Pareto-optimal, and which one is not?1. Consider the following optimization problem V (k) = maxtu(c) +e " V(f(k) + (1 -5)k - c)} (a) What assumptions do we need on #, f and y to guarantee that there exists a unique V(.) satisfying the above Bellman equation? (b) In the equation above, one time-period is equal to one unit of time. Reformulate the equation such that one time-period equals A units of time. (c) What is the continuous-time formulation of the above equation? Hint: remember that lim-o( f (x + ha) - f(x))/h = f'(x)a. 2. Using words, briefly define the following concepts, and explain how we have put them to use in the course (Rendahl): (a) A complete metric space. (b) A norm, and in particular, the sup-norm. (c) The contraction mapping theorem. (d) The envelope theorem. 3. Consider a Lucas-tree type economy in which the endowment is growing stochastically and assume that agents have CRRA preferences. For tractability, assume that the endowment growth rate fol- lows a two-state Markov process. Suppose one- and two-period bonds are traded in this economy and define the term premium as the difference between the expected return from selling a two-period bond after holding it for one period and the return from a one-period bond. Provide an intuitive ex- planation for why the term premium is positive if and only if consumption growth exhibits negative serial correlation