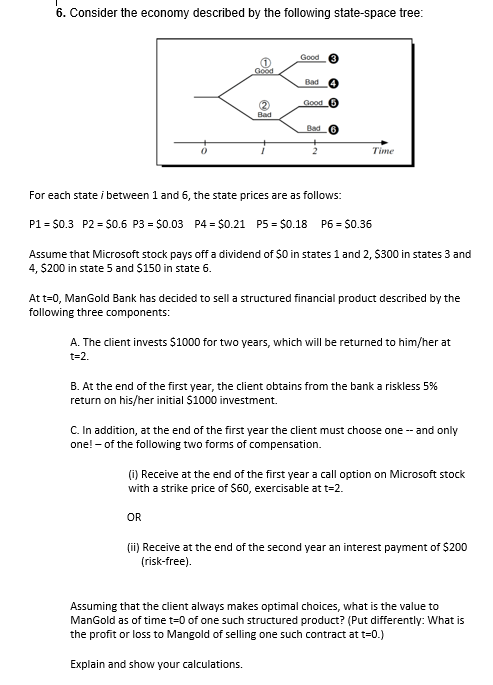

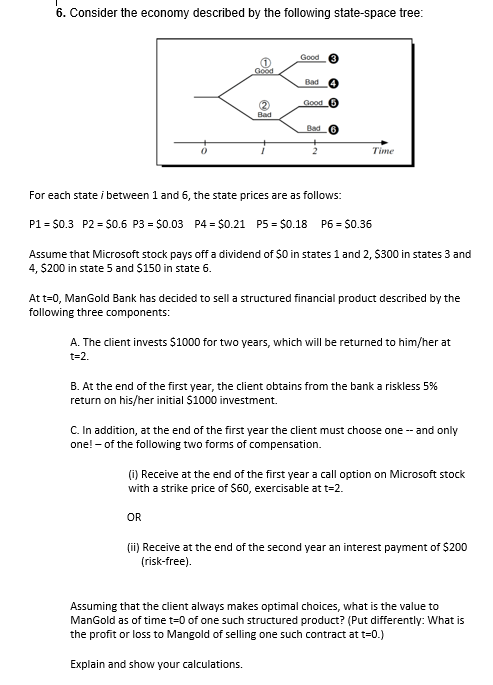

6. Consider the economy described by the following state-space tree: Good 3 Good Bad 4 Good 6 Bad Rad6 2 Time For each state i between 1 and 6, the state prices are as follows: P1 = 50.3 P2 = 50.5 P3 = $0.03 P4 = $0.21 P5 = $0.18 P6 = $0.36 Assume that Microsoft stock pays off a dividend of $0 in states 1 and 2, 5300 in states 3 and 4, 5200 in state 5 and $150 in state 6. At t=0, ManGold Bank has decided to sell a structured financial product described by the following three components: A. The client invests $1000 for two years, which will be returned to him/her at t=2. B. At the end of the first year, the client obtains from the bank a riskless 5% return on his/her initial $1000 investment. C. In addition, at the end of the first year the client must choose one -- and only one! - of the following two forms of compensation. (i) Receive at the end of the first year a call option on Microsoft stock with a strike price of $60, exercisable at t=2. OR (ii) Receive at the end of the second year an interest payment of $200 (risk-free). Assuming that the client always makes optimal choices, what is the value to ManGold as of time t=0 of one such structured product? (Put differently: What is the profit or loss to Mangold of selling one such contract at t=0.) Explain and show your calculations. 6. Consider the economy described by the following state-space tree: Good 3 Good Bad 4 Good 6 Bad Rad6 2 Time For each state i between 1 and 6, the state prices are as follows: P1 = 50.3 P2 = 50.5 P3 = $0.03 P4 = $0.21 P5 = $0.18 P6 = $0.36 Assume that Microsoft stock pays off a dividend of $0 in states 1 and 2, 5300 in states 3 and 4, 5200 in state 5 and $150 in state 6. At t=0, ManGold Bank has decided to sell a structured financial product described by the following three components: A. The client invests $1000 for two years, which will be returned to him/her at t=2. B. At the end of the first year, the client obtains from the bank a riskless 5% return on his/her initial $1000 investment. C. In addition, at the end of the first year the client must choose one -- and only one! - of the following two forms of compensation. (i) Receive at the end of the first year a call option on Microsoft stock with a strike price of $60, exercisable at t=2. OR (ii) Receive at the end of the second year an interest payment of $200 (risk-free). Assuming that the client always makes optimal choices, what is the value to ManGold as of time t=0 of one such structured product? (Put differently: What is the profit or loss to Mangold of selling one such contract at t=0.) Explain and show your calculations