Question

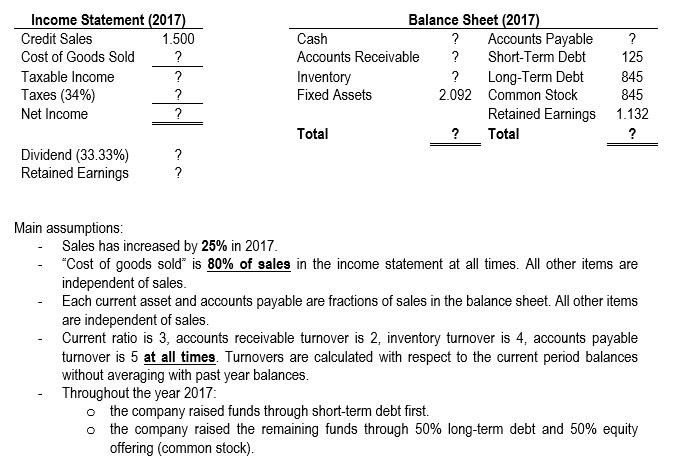

6- Consider the following financial statements (in millions of $). In 2016, the company did not pay any dividends. If this is the case, what

6- Consider the following financial statements (in millions of $). In 2016, the company did not pay any dividends. If this is the case, what was the retained earnings at the end of year 2015?

- 1.000 $

- 842 $

- 868 $

- 974 $

7- Refer to Question 6. What is the cash conversion cycle in year 2017? (1 year = 360 days)

- 342 days

- 162 days

- 198 days

- 18 days

8- Refer to Question 6 and 7. Suppose that the company wants to double each turnover rates in year 2018. With this improvement, the company would like to pay some of its short-term and long-term debts. Assuming that all main assumptions are still valid in 2018 except for the fund raising activities (the last two bullets), what would be the total debt in the 2018 balance sheet?

- 604,99 $

- 1297,01 $

- 501,24 $

- 417,49 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started