Answered step by step

Verified Expert Solution

Question

1 Approved Answer

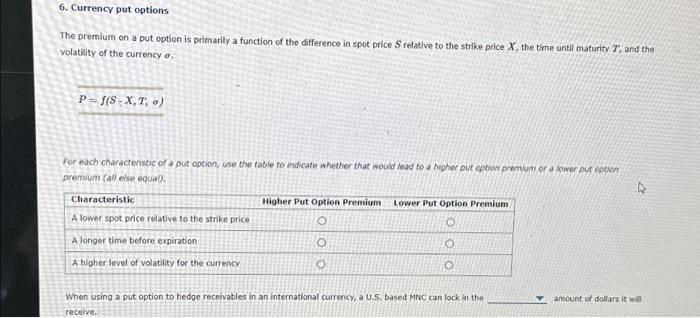

6. Currency put options The premium on a put option is primarily a function of the difference in spot price S relative to the strike

6. Currency put options The premium on a put option is primarily a function of the difference in spot price S relative to the strike price X, the time until maturity T, and the volatility of the currency o. P= f(S-X, T, o) For each characteristic of a put option, use the table to indicate whether that would lead to a higher put option premium or a lower put option premium (all else equal). Characteristic A lower spot price relative to the strike price A longer time before expiration A higher level of volatility for the currency Higher Put Option Premium Lower Put Option Premium 0 O O O When using a put option to hedge receivables in an international currency, a U.S. based MNC can lock in the receive. amount of dollars it will

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started