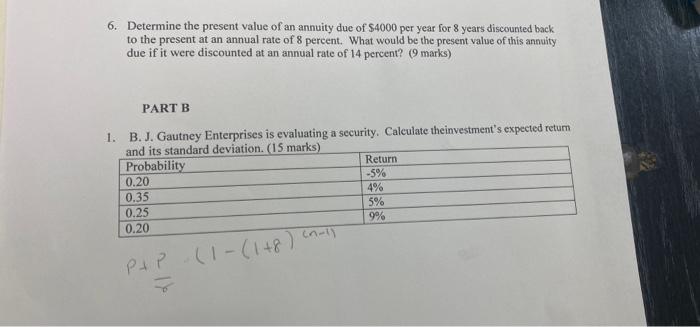

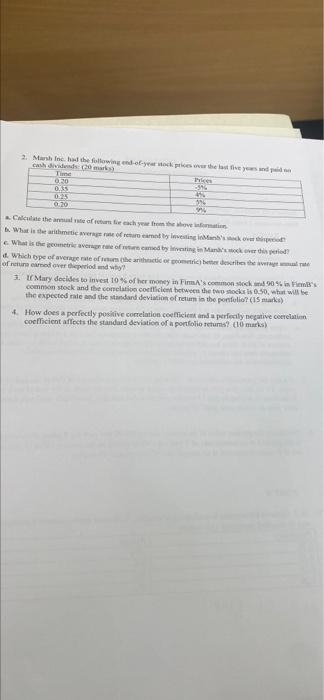

6. Determine the present value of an annuity due of $4000 per year for 8 years discounted back to the present at an annual rate of 8 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 14 percent? (9 marks) PART B 1. B.J. Gautney Enterprises is evaluating a security. Calculate theinvestment's expected retum and its standard deviation (15 marks) Probability Return 0.20 -5% 0.35 4% 5% 0.25 9% 0.20 P+P (1-(1+8) cnol) 2. Marsh the finale che cash is car Time 030 029 05 1 Calculate the name of teach you the wheel What is the richiewers of Man's What is the metrieweg of comedy vingi Mandi . Which ope of average rate of the hometrice describes the of returned over the period and why? 1. Mary decides to invest 10% of her money in Fim's common stock 90% in Finli's common stock and the conclation coefficient between the two odkr is 0.50, what will be the expected rate and the standard deviation of return in the portfolio? (15 marks) How does a perfectly positive correlation coefficient and perfectly negative correlation coefficient affects the standard deviation of a portfolio retums? (to marks) 6. Determine the present value of an annuity due of $4000 per year for 8 years discounted back to the present at an annual rate of 8 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 14 percent? (9 marks) PART B 1. B.J. Gautney Enterprises is evaluating a security. Calculate theinvestment's expected retum and its standard deviation (15 marks) Probability Return 0.20 -5% 0.35 4% 5% 0.25 9% 0.20 P+P (1-(1+8) cnol) 2. Marsh the finale che cash is car Time 030 029 05 1 Calculate the name of teach you the wheel What is the richiewers of Man's What is the metrieweg of comedy vingi Mandi . Which ope of average rate of the hometrice describes the of returned over the period and why? 1. Mary decides to invest 10% of her money in Fim's common stock 90% in Finli's common stock and the conclation coefficient between the two odkr is 0.50, what will be the expected rate and the standard deviation of return in the portfolio? (15 marks) How does a perfectly positive correlation coefficient and perfectly negative correlation coefficient affects the standard deviation of a portfolio retums? (to marks)