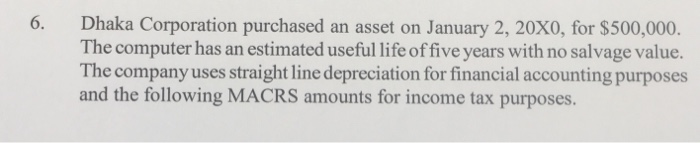

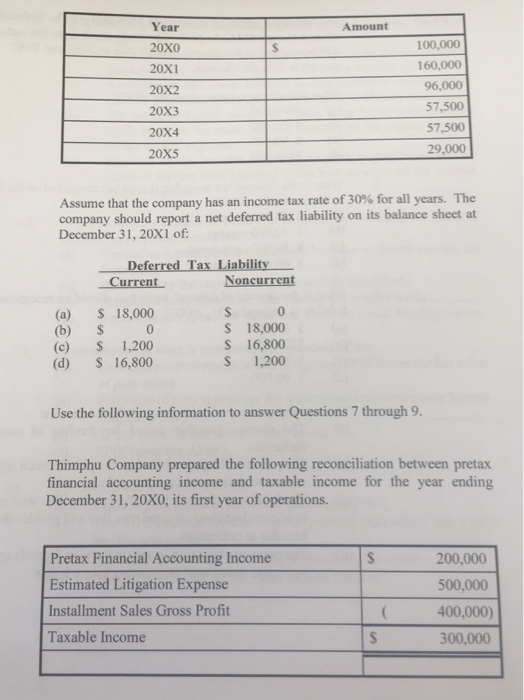

6. Dhaka Corporation purchased an asset on January 2, 20X0, for $500,000. The computer has an estimated useful life of five years with no salvage value. The company uses straight line depreciation for financial accounting purposes and the following MACRS amounts for income tax purposes. Year 20x0 20x1 20X2 20x3 20X4 20X5 Amount 100,000 160,000 96,000 57,500 57,500 29,000 Assume that the company has an income tax rate of 30% for all years. The company should report a net deferred tax liability on its balance sheet at December 3 1 , 20X1 of: Deferred Tax Liability Current (a) S18,000 (b) S0 (c) S 1,200 (d) S 16,800 S 18,000 S 16,800 S 1,200 Use the following information to answer Questions 7 through 9. Thimphu Company prepared the following reconciliation between pretax financial accounting income and taxable income for the year ending December 31, 20X0, its first year of operations. Pretax Financial Accounting Income Estimated Litigation Expense Installment Sales Gross Proft Taxable Income 200,000 500,000 400,000) 300,000 The estimated litigation expense of $500,000 will be deductible in 20X2 when it is expected to be paid. The gross profit from the installment sales will be realized in the amount of $200,000 in 20X1 and 20X2. The income tax rate is 30% for all years. 7. What is the income tax expense for 20X0? (a) $200,000. (b) S 60,000. (c) 90,000. (d) S100,000. 8. What is the deferred tax asset that should be recognized on the balance sheet at December 31, 20X0? (a) S150,000 current. (b) 30,000 current. (c) $150,000 noncurrent (d) 60,000 current. 9. What is the amount of deferred taxes that should be recognized as a current liability at December 31,20X0? (a) 60,000. (b) $120,000. (c) S 30,000. (d) 90,000. The accumulated benefit obligation (ABO) measures: (a) 10. The shortest possible period for funding to maximize the tax deduction. The pension obligation based on the plan formula applied to years of service to date based on future salary levels The level cost that will be sufficient, together with interest expected to accumulate at an assumed rate, that will provide the estimated total benefits at retirement. The pension obligation based on the plan formula applied to years of service to date based on existing salary levels. (b) (c) (d)