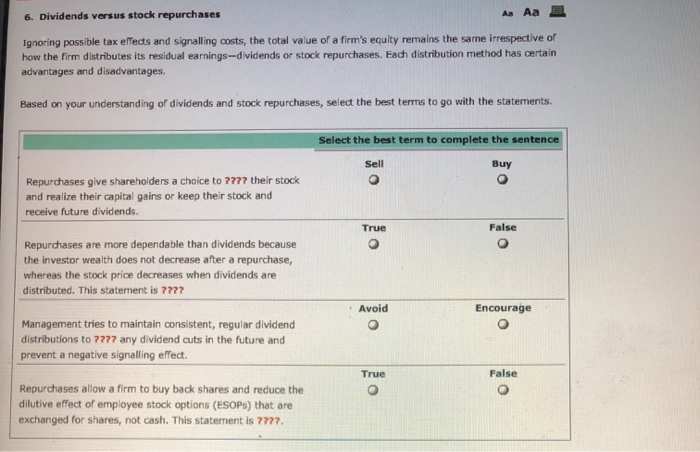

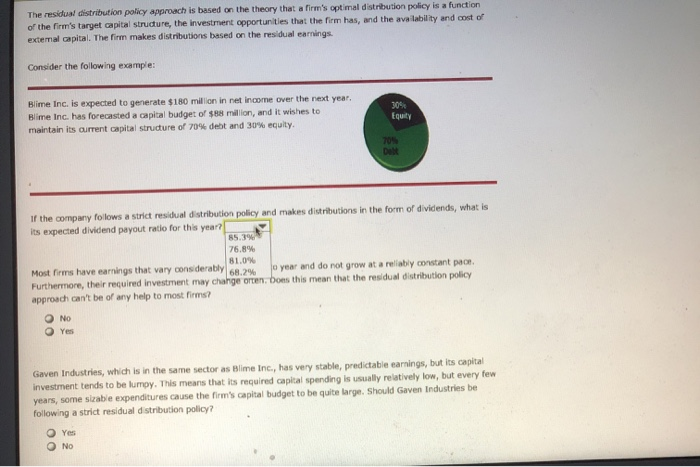

6. Dividends versus stock repurchases A Aa Ignoring possible tax effects and signalling costs, the total value of a firm's equity remains the same irrespective of how the firm distributes its residual earnings-dividends or stock repurchases. Each distribution method has certain advantages and disadvantages. Based on your understanding of dividends and stock repurchases, select the best terms to go with the statements. Select the best term to complete the sentence Sell Repurchases give shareholders a choice to 7777 their stock and realize their capital gains or keep their stock and receive future dividends. Repurchases are more dependable than dividends because the investor wealth does not decrease after a repurchase, whereas the stock price decreases when dividends are distributed. This statement is 7777 Avoid Encourage Management tries to maintain consistent, regular dividend distributions to 7777 any dividend cuts in the future and prevent a negative signalling effect False Repurchases allow a firm to buy back shares and reduce the dilutive effect of employee stock options (ESOPs) that are exchanged for shares, not cash. This statement is 7777 The residual distribution policy approach is based on the theory that a firm's optimal distribution policy is a function of the firm's target capital structure, the investment opportunities that the firm has, and the availability and cost of extemal capital. The firm makes distributions based on the residual earnings Consider the following example: Blime Inc. is expected to generate $180 million in net income over the next year. Blime Inc. has forecasted a capital budget of $88 million, and it wishes to maintain its current capital structure of 70% debt and 30% equity. Equity If the company follows a strict residual distribution policy and makes distributions in the form of dividends, what is its expected dividend payout ratio for this year? SS. 76.8% 81.0% Most firms have earnings that vary considerably . year and do not grow at a reliably constant par Furthermore, their required investment may change orten, boes this mean that the residual distribution policy approach can't be of any help to most firms? O No Yes Gaven Industries, which is in the same sector as Blime Inc., has very stable, predictable earnings, but its capital investment tends to be lumoy. This means that is required capital spending is usually relatively low, but every few years, some sirable expenditures cause the firm's capital budget to be quite large. Should Gaven Industries be following a strict residual distribution policy? Yes NO