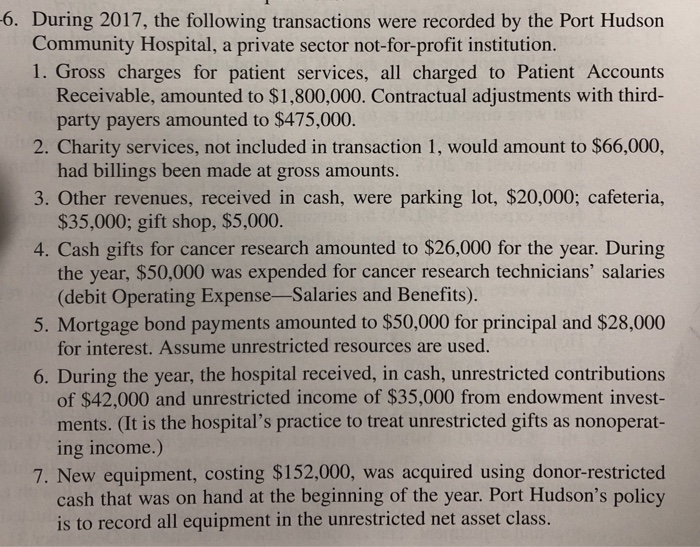

6. During 2017, the following transactions were recorded by the Port Hudson Community Hospital, a private sector not-for-profit institution. 1. Gross charges for patient services, all charged to Patient Accounts Receivable, amounted to $1,800,000. Contractual adjustments with third- party payers amounted to $475,000. had billings been made at gross amounts $35,000; gift shop, $5,000. 2. Charity services, not included in transaction 1, would amount to $66,000, 3. Other revenues, received in cash, were parking lot, $20,000; cafeteria, 4. Cash gifts for cancer research amounted to $26,000 for the year. During the year, $50,000 was expended for cancer research technicians' salaries (debit Operating Expense-Salaries and Benefits) 5. Mortgage bond payments amounted to $50,000 for principal and $28,000 for interest. Assume unrestricted resources are used. 6. During the year, the hospital received, in cash, unrestricted contributions of $42,000 and unrestricted income of $35,000 from endowment invest- ments. (It is the hospital's practice to treat unrestricted gifts as nonoperat- ing income.) 7. New equipment, costing $152,000, was acquired using donor-restricted cash that was on hand at the beginning of the year. Port Hudson's policy is to record all equipment in the unrestricted net asset class. 6. During 2017, the following transactions were recorded by the Port Hudson Community Hospital, a private sector not-for-profit institution. 1. Gross charges for patient services, all charged to Patient Accounts Receivable, amounted to $1,800,000. Contractual adjustments with third- party payers amounted to $475,000. had billings been made at gross amounts $35,000; gift shop, $5,000. 2. Charity services, not included in transaction 1, would amount to $66,000, 3. Other revenues, received in cash, were parking lot, $20,000; cafeteria, 4. Cash gifts for cancer research amounted to $26,000 for the year. During the year, $50,000 was expended for cancer research technicians' salaries (debit Operating Expense-Salaries and Benefits) 5. Mortgage bond payments amounted to $50,000 for principal and $28,000 for interest. Assume unrestricted resources are used. 6. During the year, the hospital received, in cash, unrestricted contributions of $42,000 and unrestricted income of $35,000 from endowment invest- ments. (It is the hospital's practice to treat unrestricted gifts as nonoperat- ing income.) 7. New equipment, costing $152,000, was acquired using donor-restricted cash that was on hand at the beginning of the year. Port Hudson's policy is to record all equipment in the unrestricted net asset class