Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. For each transaction below: record the journal entries and cumulative T Accounts for: (1) Accounts Receivable transactions and (2) Allowance for Doubtful Accounts

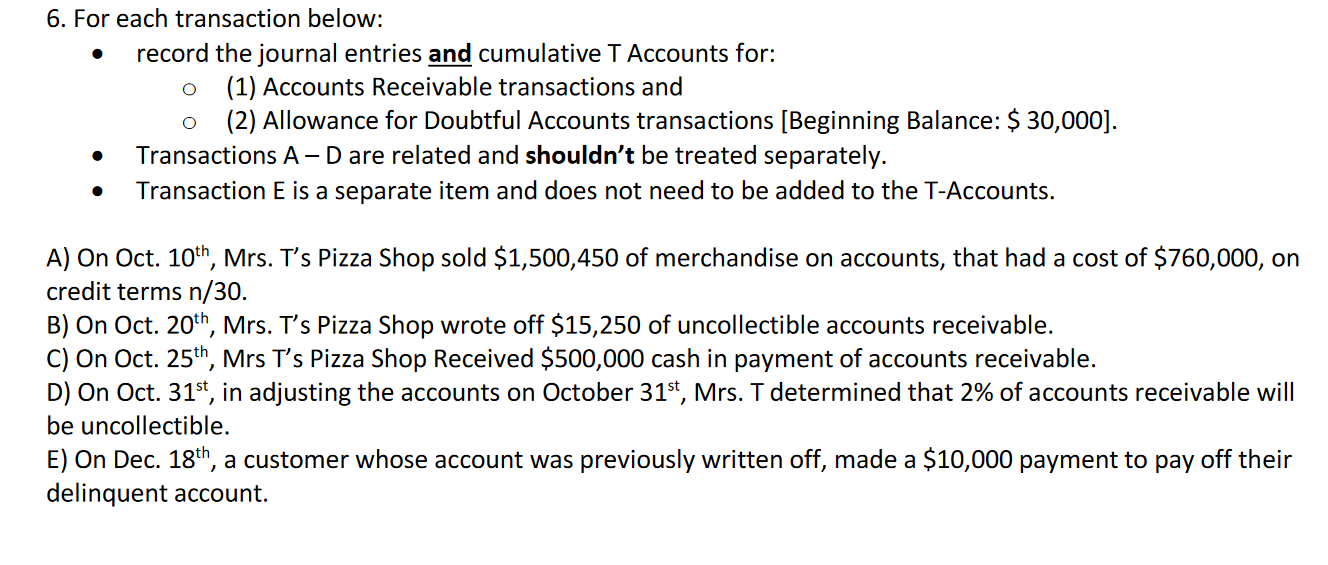

6. For each transaction below: record the journal entries and cumulative T Accounts for: (1) Accounts Receivable transactions and (2) Allowance for Doubtful Accounts transactions [Beginning Balance: $ 30,000]. Transactions A - D are related and shouldn't be treated separately. Transaction E is a separate item and does not need to be added to the T-Accounts. A) On Oct. 10th, Mrs. T's Pizza Shop sold $1,500,450 of merchandise on accounts, that had a cost of $760,000, on credit terms n/30. B) On Oct. 20th, Mrs. T's Pizza Shop wrote off $15,250 of uncollectible accounts receivable. C) On Oct. 25th, Mrs T's Pizza Shop Received $500,000 cash in payment of accounts receivable. D) On Oct. 31st, in adjusting the accounts on October 31st, Mrs. T determined that 2% of accounts receivable will be uncollectible. E) On Dec. 18th, a customer whose account was previously written off, made a $10,000 payment to pay off their delinquent account.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

General Journal Date AccountExplanation PR Debit Credit 10Oct Accounts Receivable 15004...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started