6. For the following questions use table 11-2(located below):

a. The following investment requires a table factor for a period beyond the table. Calculate the new table factor and the present value (principal). Use Table 11-2. Round your new table factor to five decimal places and your present value to the nearest cent.

| Compound Amount | Term of Investment (years) | Nominal Rate (%) | Interest Compounded | New Table Factor | Present Value |

| $36,000 | 34 | 7 | annually | | $ |

b. You wish to have $21,000 in 8 years. Use Table 11-2 to create a new table factor, and then find how much you should invest now (in $) at 6% interest, compounded quarterly in order to have $21,000, 8 years from now. (Round your answer to the nearest cent.)

$________

c. How much (in $) must be invested today at 6% compounded quarterly to have $4,000 in 3 years?

$____________

d. A real estate development company is planning to build five homes, each costing $145,000, in 2 1/2 years. The Galaxy Bank pays 6% interest compounded semiannually. How much (in $) should the company invest now to have sufficient funds to build the homes in the future?

$________

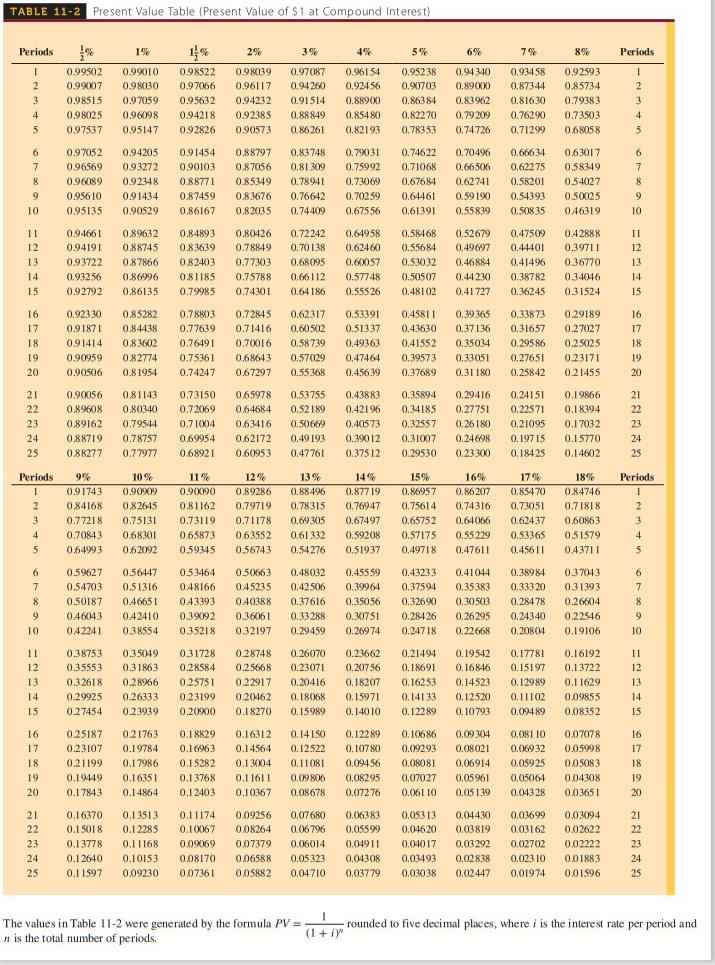

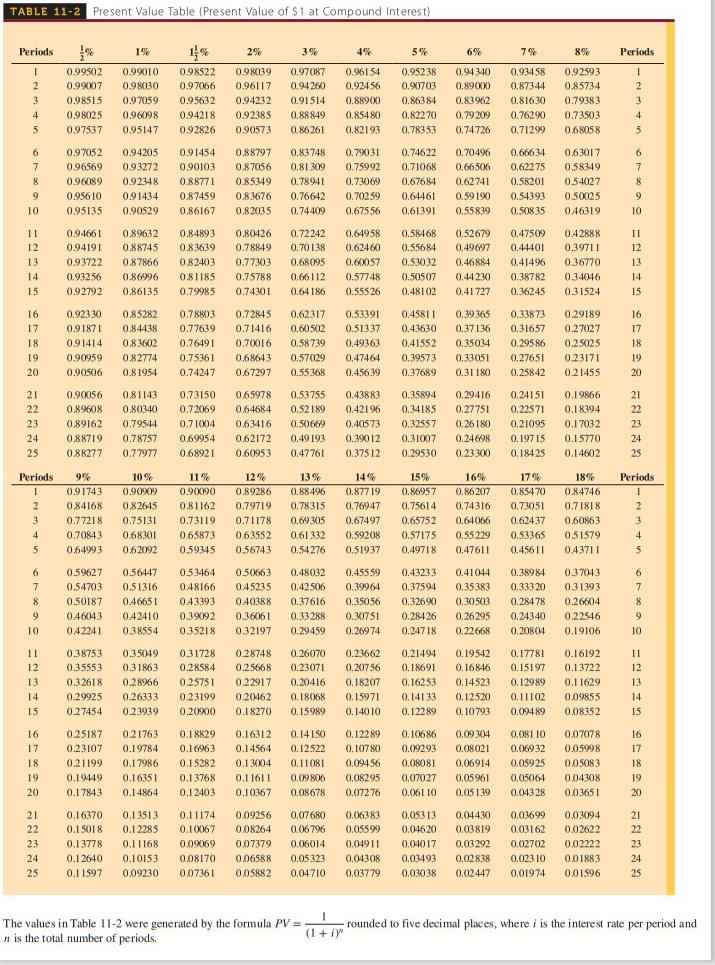

TABLE 11-2 Present Value Table (Present Value of $1 at Compound Interest) Periods 18 28 3% 4% 5% 69 7% 8% Periods 0.96154 1 2 3 4 5 % 0.99502 0.92007 0.98515 0.98025 0.97537 0.99010 0.98030 0.97059 0.96098 0.95147 1% 098522 0.97066 0.95632 0.94218 0.92826 0.98039 0.96117 0.94232 0.92385 0.90573 0.97087 0.94 260 0.91514 0.88849 0.86261 0.92456 0.88900 0.85480 0.82193 0.95238 0.90703 0.86384 0.82270 0.78353 0.94340 0.89000 0.83962 0.79 209 0.74726 0.93458 0,87344 0.81630 0.76290 0.71299 0.92593 0.85734 0.79383 0.73503 0.68058 1 2 3 4 5 6 7 8 9 10 0.97052 0.96569 0.96089 0.95610 0.95135 0.94205 0.93272 0.92348 0.91434 0.90529 0.91454 0.90103 0.88771 0.87459 0.86167 0.88797 0.87056 0.85349 0.83676 0.82035 0.83 748 0.81 309 0.78941 0.76642 0.74409 0.72031 0.75992 0.73069 0.70259 0.67556 0.74622 0.71068 0.67684 0.64461 0.61391 0.70496 0.66506 0.62741 0.59 190 0.55839 0.66634 0.62275 0.58201 0.54393 0.50835 0.63017 0.58349 0.54027 0.50025 0.46319 6 7 8 9 10 11 12 13 14 15 0.94661 0.94191 0.93722 0.93256 0.92792 0.84632 0.88745 0.87866 0.86996 0.86135 0.84893 0.83639 0.82403 0.81185 0.79985 0.80426 0.78849 0.77303 0.75788 0.74301 0.72242 0.70138 0.68095 0.66112 0.64186 0.64958 0.62460 0.60057 0.57748 0.55526 0.58468 0.55684 0.53032 0.50507 0.48102 0.52679 0.49697 0.46884 0.44230 0.41727 0.47509 0.44401 0.41496 0.38782 0.36245 0.42888 0.39711 0.36770 0.34046 0.31524 11 12 13 14 15 16 17 18 19 20 0.92330 0.91871 0.91414 0.90959 0.90506 0.85282 0.84438 0.83602 0.82774 0.81954 0.78803 0.77639 0.76491 0.75361 0.74247 0.72845 0.71416 0.70016 0.68643 0.67297 0.62317 0.60502 0.58739 0.57029 0.55368 0.53391 0.51337 0.49363 0.47464 0.45639 0.45811 0.43630 0.41552 0.39573 0.37689 0.39365 0.37136 0.35034 0.33051 0.31180 0.338 73 0.31657 0.29586 0.27651 0.25842 0.29189 0.27027 0.25025 0.23171 0.21455 16 17 18 19 20 21 22 23 24 25 0.90056 0.89608 0.89162 0.88719 0.88277 0.81143 0.80340 0.79544 0.78757 0.77977 0.73150 0.72069 0.71004 0.69954 0.68921 0.65978 0.64684 0.63416 0.62172 0.60953 0.53755 0.52189 0.50669 0.49193 0.47761 0.43883 0.42196 0.40573 0.39012 0.37512 0.35894 0.34185 0.32557 0.31007 0.29530 0.29416 0.27751 0.26180 0.24698 0.23300 0.24151 0.22571 0.21095 0.19715 0.18425 0.19866 0.18394 0.17032 0.15770 0.14602 21 22 23 24 25 BEERS 655 DETTE 3onva woww-ISO-353 TECHT 30xv2 Periods 1 2 3 4 5 9% 0.91743 0.84168 0.77218 0.70843 0.64993 10% 0.90X0 0.82645 0.75131 0.68301 0.62092 11% 0.90090 0.81162 0.73119 0.65873 0.59345 12% 0.89286 0.79719 0.71178 0.63552 0.56743 13% 0.88496 0.78315 0.69 305 0.61332 0.54276 14% 0.87719 0.76947 0.67497 0.59208 0.51937 15% 0.86957 0.75614 0.65752 0.57175 0.49718 16% 0.86207 0.74316 0.64066 0.55229 0.47611 17% 0.85470 0.73051 0.62437 0.53365 0.45611 18% 0.84746 0.71818 0.60863 0.51579 0.43711 Periods 1 2 3 4 5 0.43233 6 7 8 9 10 0.59627 0.54703 0.50187 0.46043 0.42241 0.56447 0.51316 0.46651 042410 0.38554 0.53464 0.48166 043393 0.39092 0.35218 0.50663 045235 040388 0.36061 0.32197 0.48032 0.42506 0.37616 0,33288 0.29459 0.45559 0.39964 0.35056 0.30751 0.26974 0.37594 0.326X0 0.28426 0.24718 0.41044 0.35383 0.30503 0.26295 0.22668 0.38984 0.33320 0.28478 0.24340 0.20804 037043 0.31393 0.26604 0.22546 0.19106 6 7 8 9 10 11 12 13 14 15 0.38753 0.35553 0.32618 0.29925 0.27454 0.35049 0.31863 0.28966 0.26333 0.23939 0.31728 0.28584 0.25751 0.23199 0.20900 0.28748 0.25668 0.22917 0.20462 0.18270 0.26070 0.23071 0.20416 0.18068 0.15989 0.23662 0.20756 0.18207 0.15971 0.14010 0.21494 0.18691 0.16253 0.14133 0.12289 0.19542 0.16846 0.14523 0.12520 0.10793 0.17781 0.15197 0.12989 0.11102 0.09489 0.16192 0.13722 0.1 1629 0.09855 0.08352 11 12 13 14 15 16 17 18 19 20 0.25187 0.23107 0.21199 0.19449 0.17843 0.21763 0.19784 0.17986 0.16351 0.14864 0.18829 0.16963 0.15282 0.13768 0.12403 0.16312 0.14564 0.1 3004 0.11611 0.10367 0.14150 0.12522 0.11081 0.09806 0.08678 0.12289 0.10780 0.09456 0.08295 0.07276 0.10686 0.09293 0.08081 0,07027 0.061 10 0.09.2014 0.08021 0.06914 0.05961 0.05139 0.081 10 0.06932 0.05925 0.05064 0.04328 0.07078 0.05998 0.05083 0.04308 0.03651 9.28 16 17 18 19 20 21 22 23 24 25 0.16370 0.1 5018 0.13778 0.1 2640 0.11597 0.13513 0.12285 0.1 1168 0.10153 0.09230 0.11174 0.10067 0.09069 0.08170 007361 0.09256 0.08264 0.07379 0.06588 005882 0.07680) 0,06796 0.06014 0.05322 0.04710 0.06383 0.05599 0.04911 0.04308 0.03779 0.05313 0.04620 0.04017 0.03493 0.03038 0.04430 0.03819 0.03292 0.02838 0.02447 0.03699 0.03162 0.02702 0.02310 0.01974 0.03094 0.02622 0.02222 0.01883 0.01596 21 22 23 24 25 1 The values in Table 11-2 were generated by the formula PV = n is the total number of periods. (1 + i)" rounded to five decimal places, where i is the interest rate per period and