Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Hedging strategy to protect against falling prices Aa Aa Price fluctuations in commodities can have significant consequences for companies, especially if the fluctuation involves

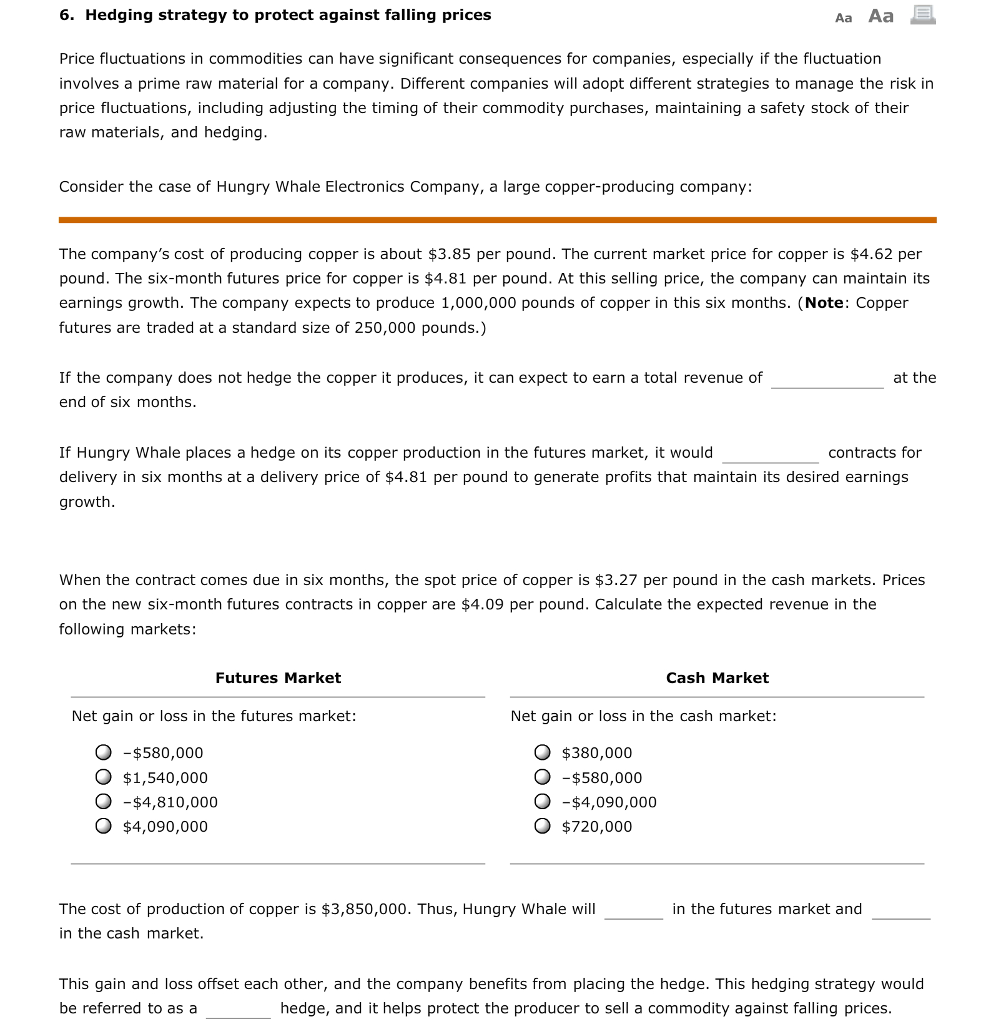

6. Hedging strategy to protect against falling prices Aa Aa Price fluctuations in commodities can have significant consequences for companies, especially if the fluctuation involves a prime raw material for a company. Different companies will adopt different strategies to manage the risk in price fluctuations, including adjusting the timing of their commodity purchases, maintaining a safety stock of their raw materials, and hedging Consider the case of Hungry Whale Electronics Company, a large copper-producing company: The company's cost of producing copper is about $3.85 per pound. The current market price for copper is $4.62 per pound. The six-month futures price for copper is $4.81 per pound. At this selling price, the company can maintain its earnings growth. The company expects to produce 1,000,000 pounds of copper in this six months. (Note: Copper futures are traded at a standard size of 250,000 pounds.) at the If the company does not hedge the copper it produces, it can expect to earn a total revenue of end of six months If Hungry Whale places a hedge on its copper production in the futures market, it would delivery in six months at a delivery price of $4.81 per pound to generate profits that maintain its desired earnings growth contracts for When the contract comes due in six months, the spot price of copper is $3.27 per pound in the cash markets. Prices on the new six-month futures contracts in copper are $4.09 per pound. Calculate the expected revenue in the following markets Futures Market Cash Market Net gain or loss in the futures market: Net gain or loss in the cash market O -$580,000 O $1,540,000 O -$4,810,000 O $4,090,000 O $380,000 O -$580,000 O -$4,090,000 $720,000 The cost of production of copper is $3,850,000. Thus, Hungry Whale will in the cash market in the futures market and This gain and loss offset each other, and the company benefits from placing the hedge. This hedging strategy would be referred to as a hedge, and it helps protect the producer to sell a commodity against falling prices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started