Question

6!! i need help asap with the CORRECT answers! Crimson Tide Incorporated has a bond trading on the secondary market that will mature in six

6!! i need help asap with the CORRECT answers!

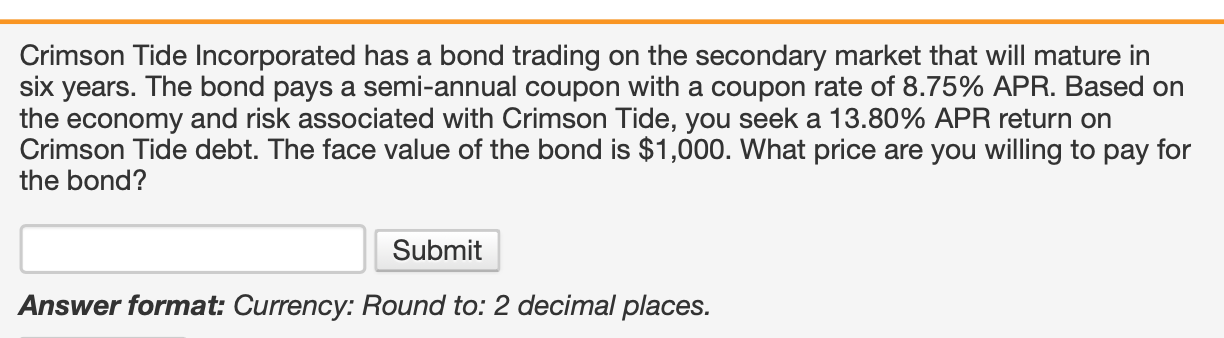

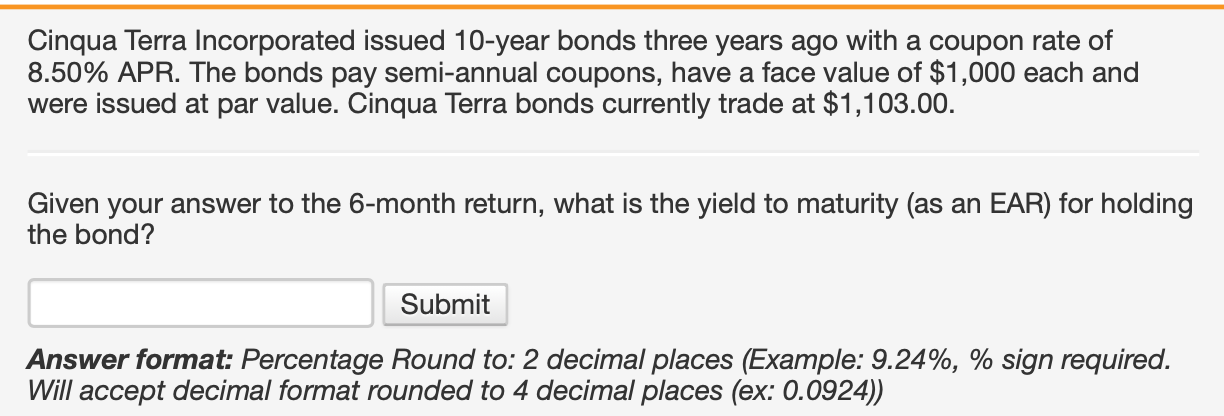

Crimson Tide Incorporated has a bond trading on the secondary market that will mature in six years. The bond pays a semi-annual coupon with a coupon rate of 8.75% APR. Based on the economy and risk associated with Crimson Tide, you seek a 13.80\% APR return on Crimson Tide debt. The face value of the bond is $1,000. What price are you willing to pay for the bond? Answer format: Currency: Round to: 2 decimal places. Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Crimson Tide Incorporated has a bond trading on the secondary market that will mature in six years. The bond pays a semi-annual coupon with a coupon rate of 8.75% APR. Based on the economy and risk associated with Crimson Tide, you seek a 13.80\% APR return on Crimson Tide debt. The face value of the bond is $1,000. What price are you willing to pay for the bond? Answer format: Currency: Round to: 2 decimal places. Cinqua Terra Incorporated issued 10 -year bonds three years ago with a coupon rate of 8.50% APR. The bonds pay semi-annual coupons, have a face value of $1,000 each and were issued at par value. Cinqua Terra bonds currently trade at $1,103.00. Given your answer to the 6-month return, what is the yield to maturity (as an EAR) for holding the bond? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started