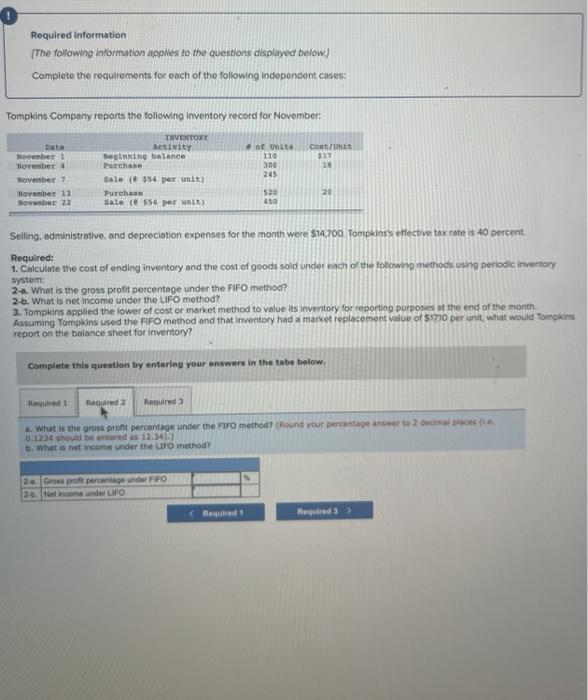

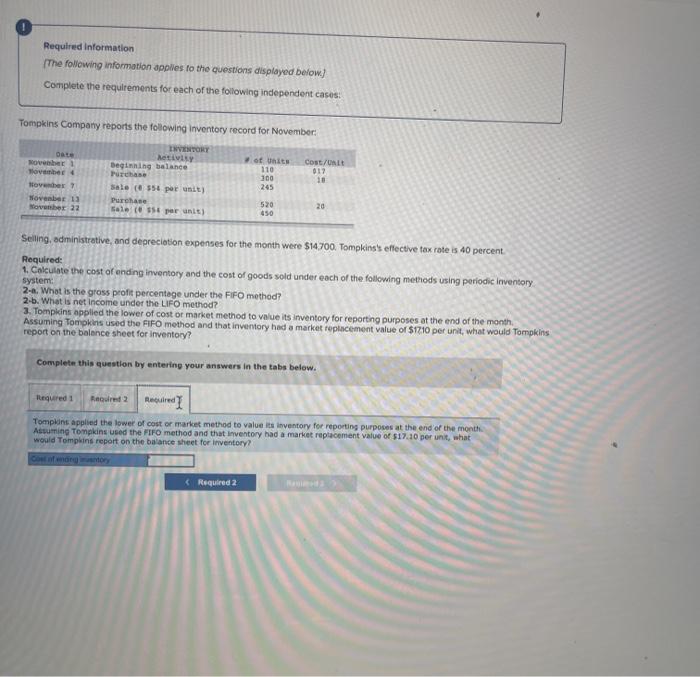

Required information The following information applies to the questions displayed below. Complete the requirements for each of the foliowing independent cases: Tompkins Company reports the following inventory record for November: bate November November 4 November November 13 November 22 Cout/ 927 10 TNVENTORY motivity Deginning balance Purchase sale ($54 per unit) Purchase Sale $54 per unit) or it 110 300 245 520 450 20 Selling, administrative, and depreciation expenses for the month were $14.700. Tompkinss effective tax rate is 40 percent Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic inventory 2-a. What is the gross profit percentage under the FIFO method? 2.b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month Assuming Tompkins used the FIFO method and that inventory had a market replacement value of 51730 per unit what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required a. What is the gross profit percentage under the FIFO method? (Round your percentage answer to 2 decimal places 0.1234 should be stored as 12.34) b. What is net income under the UFO method? 2- Cross profit percentage under FIFO 2- Not income under LIFO (Required Regards Required information The following information applies to the questions displayed below) Complete the requirements for each of the following independent cases. Tompkins Company reports the following inventory record for November! Date November November 4 over November 13 November 22 INVENTORY Metis Beginning balance Purchase sale ( 554 per unit) Purchase Sale (58 per unit) of Units 110 100 245 COSE/URLE 017 10 520 450 20 Seling, administrative, and depreciation expenses for the month were $14700. Tompkins's effective tax rate is 40 percent. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under each of the following methods using periodic Inventory system: 2-a. What is the gross profit percentage under the FIFO method? 2-b. What is net income under the LIFO method? 3. Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month, Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $1710 per unit, what would Tompkins report on the balance sheet for inventory? Complete this question by entering your answers in the tabs below. Required 1 Redred 2 red) Tompkins applied the lower of cost or market method to value its inventory for reporting purposes at the end of the month Assuming Tompkins used the FIFO method and that inventory had a market replacement value of $17.10 per unit, what would Tompkins report on the balance sheet for inventory?