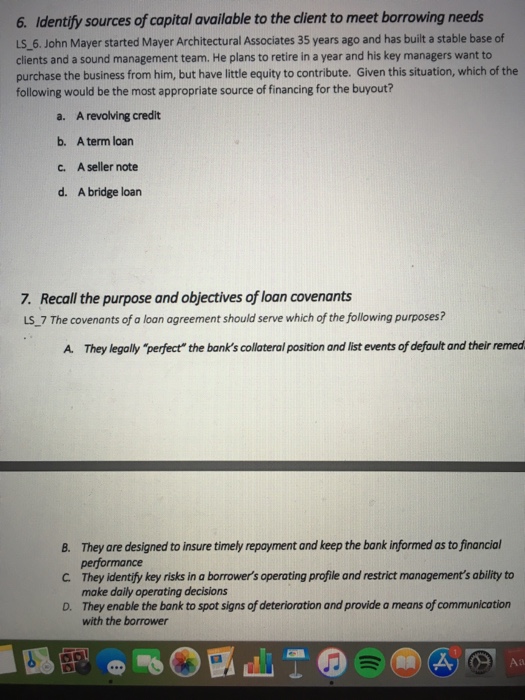

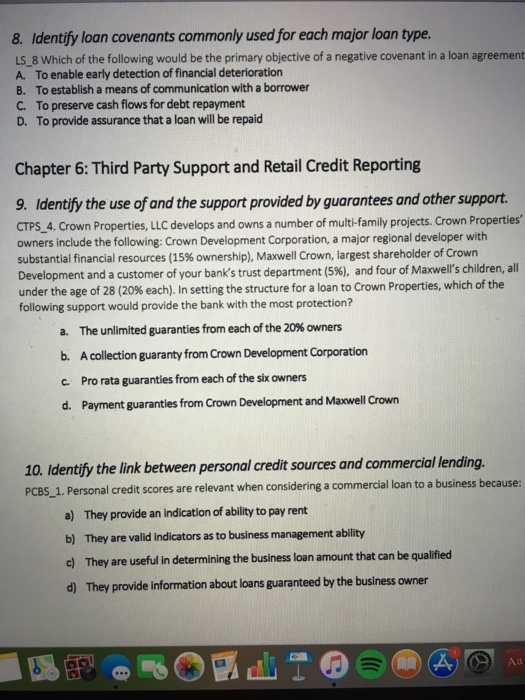

6. Identify sources of capital available to the client to meet borrowing needs LS 6. John Mayer started Mayer Architectural Associates 35 years ago and has built a stable base of clients and a sound management team. He plans to retire in a year and his key managers want to purchase the business from him, but have little equity to contribute. Given this situation, which of the following would be the most appropriate source of financing for the buyout? A revolving credit A term loan A seller note A bridge loan a. b. c. d. 7. Recall the purpose and objectives of loan covenants LS_ 7 The covenants of a loan agreement should serve which of the following purposes? A They legally "perfect" the bank's collateral position and list events of default and their remed B. C. D. They are designed to insure timely repoyment and keep the bank informed as to financial performance They identify key risks in a borrower's operating profile and restrict management's ability to make daily operating decisions They enable the bank to spot signs of deterioration and provide a means of communicotion with the borrower 4A 6. Identify sources of capital available to the client to meet borrowing needs LS 6. John Mayer started Mayer Architectural Associates 35 years ago and has built a stable base of clients and a sound management team. He plans to retire in a year and his key managers want to purchase the business from him, but have little equity to contribute. Given this situation, which of the following would be the most appropriate source of financing for the buyout? A revolving credit A term loan A seller note A bridge loan a. b. c. d. 7. Recall the purpose and objectives of loan covenants LS_ 7 The covenants of a loan agreement should serve which of the following purposes? A They legally "perfect" the bank's collateral position and list events of default and their remed B. C. D. They are designed to insure timely repoyment and keep the bank informed as to financial performance They identify key risks in a borrower's operating profile and restrict management's ability to make daily operating decisions They enable the bank to spot signs of deterioration and provide a means of communicotion with the borrower 4A