Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $2,400 May 5: Received and paid electricity

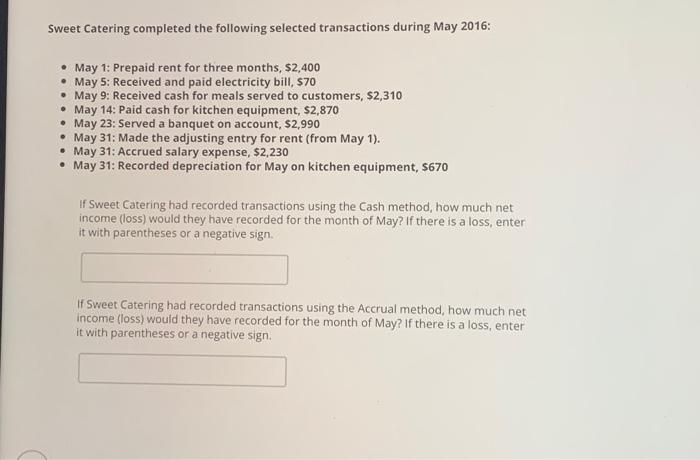

Sweet Catering completed the following selected transactions during May 2016: May 1: Prepaid rent for three months, $2,400 May 5: Received and paid electricity bill, $70 May 9: Received cash for meals served to customers, $2,310 May 14: Paid cash for kitchen equipment, $2,870 May 23: Served a banquet on account, $2,990 May 31: Made the adjusting entry for rent (from May 1). May 31: Accrued salary expense, $2,230 May 31: Recorded depreciation for May on kitchen equipment, $670 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the net income loss for Sweet Catering under both the Cash method and the Accrual metho...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started