Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. If you borrowed the money for only 4 months, what is the total amount you would owe? 5. 6. 7. If you borrowed the

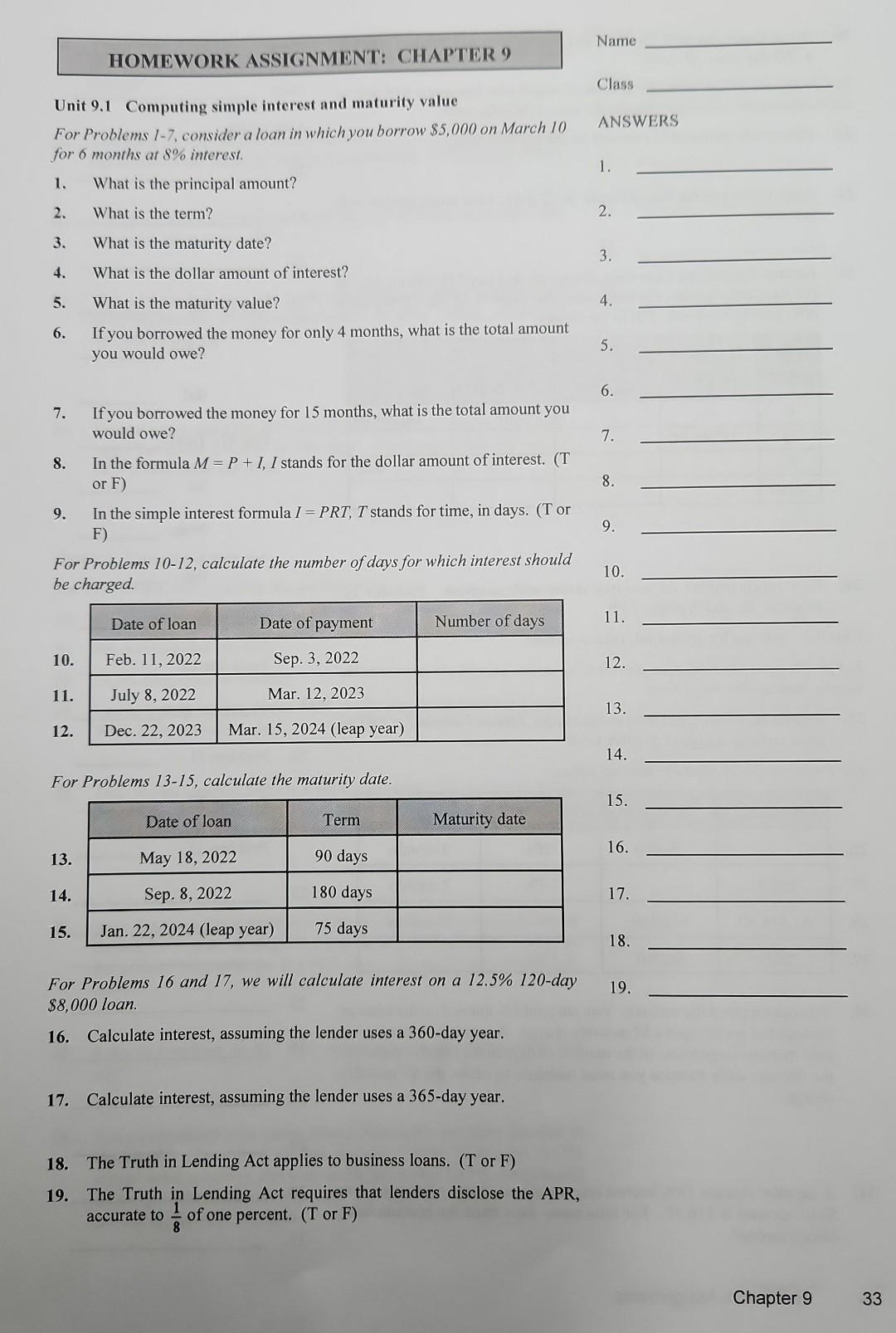

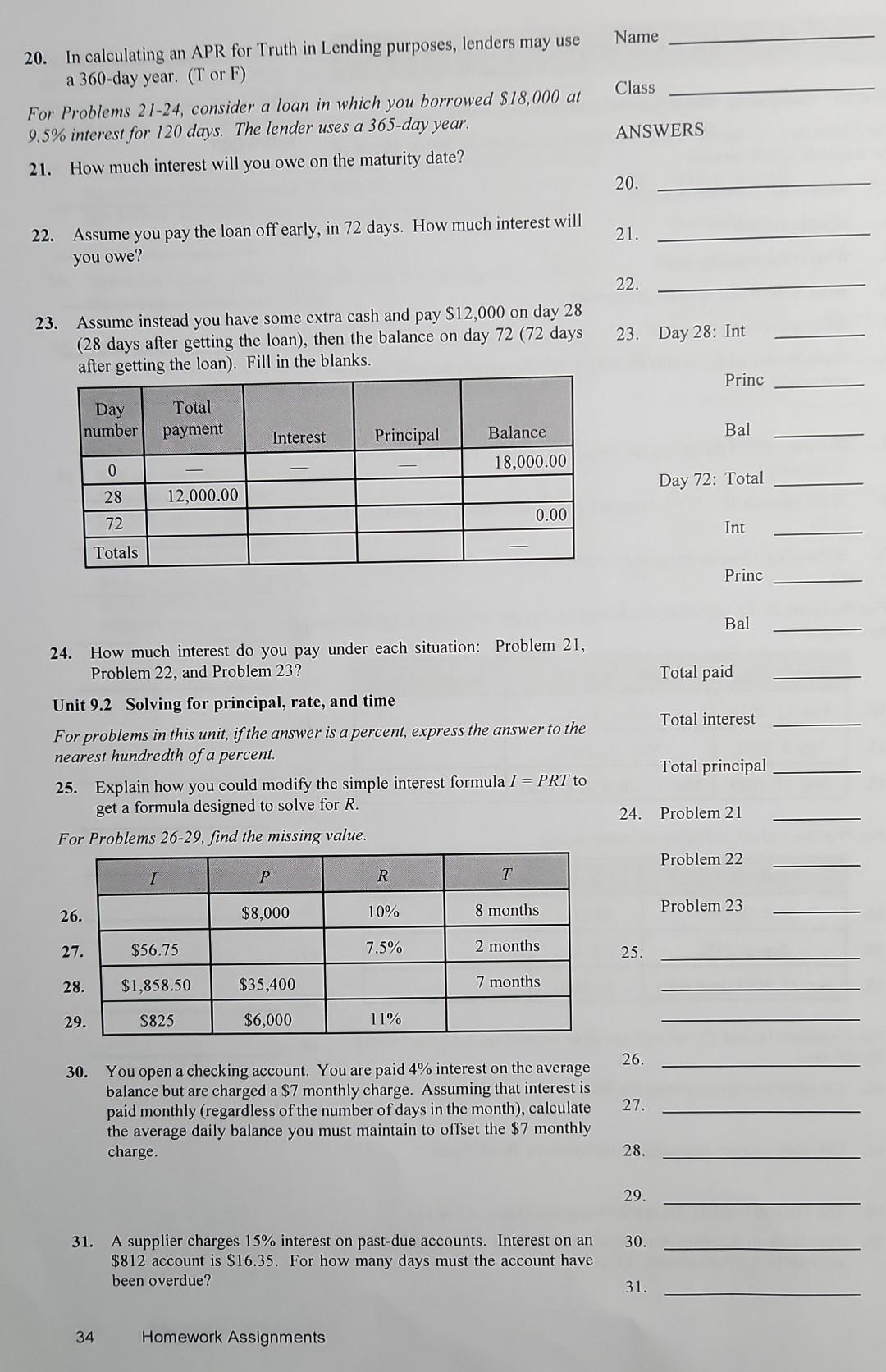

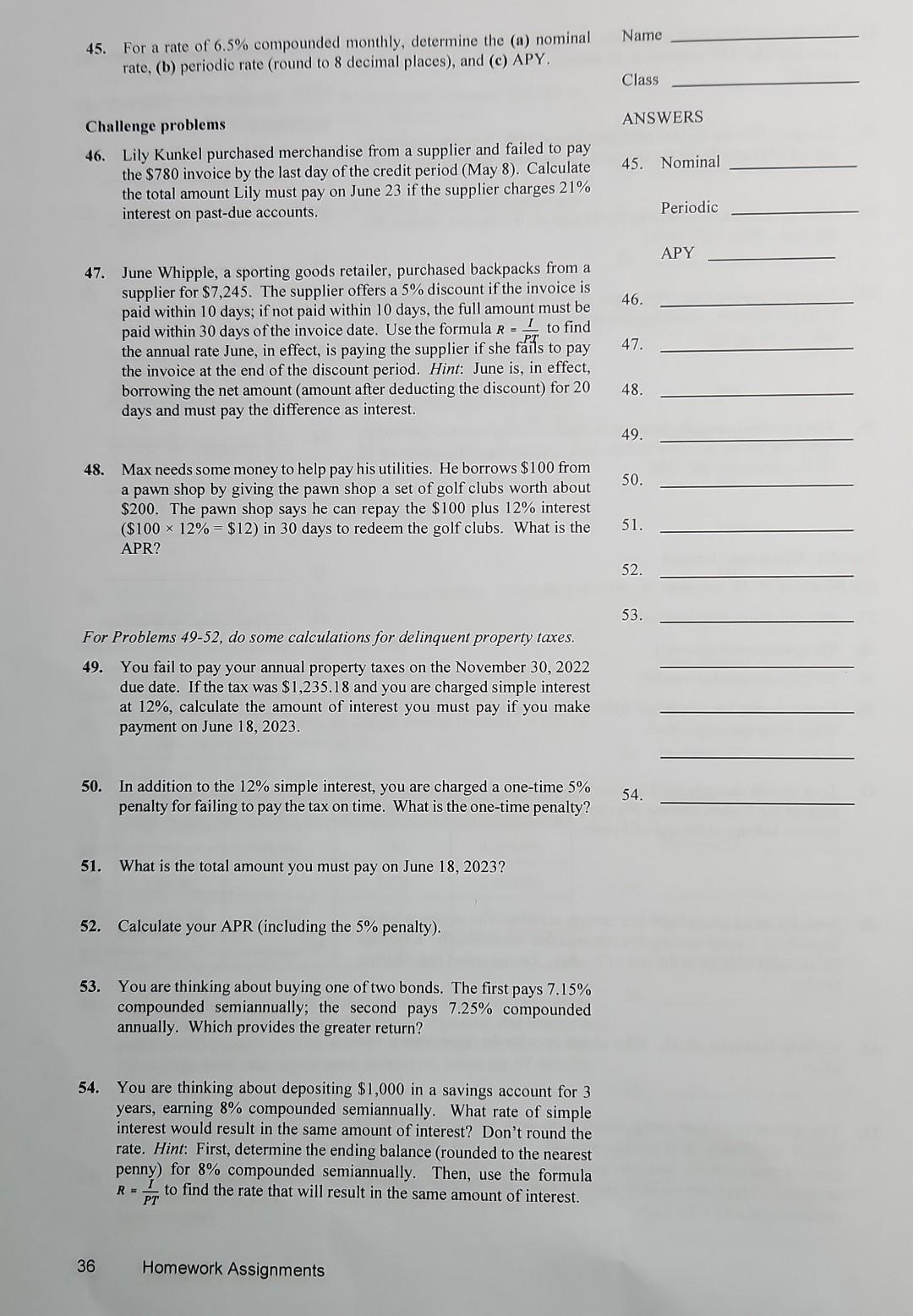

6. If you borrowed the money for only 4 months, what is the total amount you would owe? 5. 6. 7. If you borrowed the money for 15 months, what is the total amount you would owe? 8. In the formula M=P+I,I stands for the dollar amount of interest. (T or F) 9. In the simple interest formula I=PRT,T stands for time, in days. (T or F) For Problems 10-12, calculate the number of days for which interest should be charged. 10. 11 12. 13. 14. For Problems 13-15, calculate the maturity date. 15. 16. 17. 18. For Problems 16 and 17, we will calculate interest on a 12.5\% 120-day $8,000 loan. 16. Calculate interest, assuming the lender uses a 360 -day year. 19. 17. Calculate interest, assuming the lender uses a 365-day year. 18. The Truth in Lending Act applies to business loans. (T or F) 19. The Truth in Lending Act requires that lenders disclose the APR, accurate to 81 of one percent. ( T or F ) 20. In calculating an APR for Truth in Lending purposes, lenders may use Name a 360-day year. (T or F) For Problems 21-24, consider a loan in which you borrowed $18,000 at Class 9.5% interest for 120 days. The lender uses a 365 -day year. ANSWERS 21. How much interest will you owe on the maturity date? 22. Assume you pay the loan off early, in 72 days. How much interest will you owe? 21. 23. Assume instead you have some extra cash and pay $12,000 on day 28 (28 days after getting the loan), then the balance on day 72 (72 days 22. after getting the loan). Fill in the blanks. 45. For a rate of 6.5% compounded monthly, determine the (a) nominal rate, (b) periodic rate (round to 8 decimal places), and (c) APY. Challenge problems 46. Lily Kunkel purchased merchandise from a supplier and failed to pay the $780 invoice by the last day of the credit period (May 8). Calculate the total amount Lily must pay on June 23 if the supplier charges 21% interest on past-due accounts. 47. June Whipple, a sporting goods retailer, purchased backpacks from a supplier for $7,245. The supplier offers a 5% discount if the invoice is paid within 10 days; if not paid within 10 days, the full amount must be paid within 30 days of the invoice date. Use the formula R=PTI to find the annual rate June, in effect, is paying the supplier if she fails to pay the invoice at the end of the discount period. Hint: June is, in effect, borrowing the net amount (amount after deducting the discount) for 20 days and must pay the difference as interest. 48. Max needs some money to help pay his utilities. He borrows $100 from a pawn shop by giving the pawn shop a set of golf clubs worth about $200. The pawn shop says he can repay the $100 plus 12% interest ($10012%=$12) in 30 days to redeem the golf clubs. What is the APR? For Problems 49-52, do some calculations for delinquent property taxes. 49. You fail to pay your annual property taxes on the November 30, 2022 due date. If the tax was $1,235.18 and you are charged simple interest at 12%, calculate the amount of interest you must pay if you make payment on June 18, 2023. 50. In addition to the 12% simple interest, you are charged a one-time 5% penalty for failing to pay the tax on time. What is the one-time penalty? 51. What is the total amount you must pay on June 18,2023 ? 52. Calculate your APR (including the 5% penalty). 53. You are thinking about buying one of two bonds. The first pays 7.15% compounded semiannually; the second pays 7.25% compounded annually. Which provides the greater return? 54. You are thinking about depositing $1,000 in a savings account for 3 years, earning 8% compounded semiannually. What rate of simple interest would result in the same amount of interest? Don't round the rate. Hint: First, determine the ending balance (rounded to the nearest penny) for 8% compounded semiannually. Then, use the formula R=PTI to find the rate that will result in the same amount of interest. 36 Homework Assignments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started