Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6) If you can earn 4% interest from a GIC (guaranteed income certificate), how much money will you have after 3 years if you invest

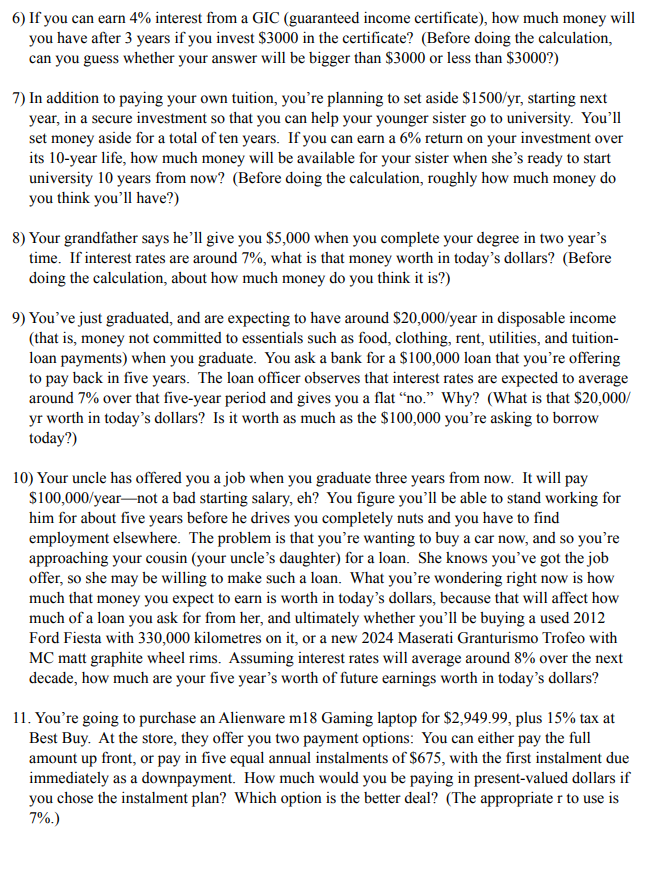

6) If you can earn 4% interest from a GIC (guaranteed income certificate), how much money will you have after 3 years if you invest $3000 in the certificate? (Before doing the calculation, can you guess whether your answer will be bigger than $3000 or less than $3000 ?) 7) In addition to paying your own tuition, you're planning to set aside $1500/yr, starting next year, in a secure investment so that you can help your younger sister go to university. You'll set money aside for a total of ten years. If you can earn a 6% return on your investment over its 10-year life, how much money will be available for your sister when she's ready to start university 10 years from now? (Before doing the calculation, roughly how much money do you think you'll have?) 8) Your grandfather says he'll give you $5,000 when you complete your degree in two year's time. If interest rates are around 7%, what is that money worth in today's dollars? (Before doing the calculation, about how much money do you think it is?) 9) You've just graduated, and are expecting to have around \$20,000/year in disposable income (that is, money not committed to essentials such as food, clothing, rent, utilities, and tuitionloan payments) when you graduate. You ask a bank for a $100,000 loan that you're offering to pay back in five years. The loan officer observes that interest rates are expected to average around 7% over that five-year period and gives you a flat "no." Why? (What is that $20,000 / yr worth in today's dollars? Is it worth as much as the $100,000 you're asking to borrow today?) 10) Your uncle has offered you a job when you graduate three years from now. It will pay $100,000/ year - not a bad starting salary, eh? You figure you'll be able to stand working for him for about five years before he drives you completely nuts and you have to find employment elsewhere. The problem is that you're wanting to buy a car now, and so you're approaching your cousin (your uncle's daughter) for a loan. She knows you've got the job offer, so she may be willing to make such a loan. What you're wondering right now is how much that money you expect to earn is worth in today's dollars, because that will affect how much of a loan you ask for from her, and ultimately whether you'll be buying a used 2012 Ford Fiesta with 330,000 kilometres on it, or a new 2024 Maserati Granturismo Trofeo with MC matt graphite wheel rims. Assuming interest rates will average around 8% over the next decade, how much are your five year's worth of future earnings worth in today's dollars? 11. You're going to purchase an Alienware m18 Gaming laptop for $2,949.99, plus 15% tax at Best Buy. At the store, they offer you two payment options: You can either pay the full amount up front, or pay in five equal annual instalments of $675, with the first instalment due immediately as a downpayment. How much would you be paying in present-valued dollars if you chose the instalment plan? Which option is the better deal? (The appropriate r to use is 7%.)

6) If you can earn 4% interest from a GIC (guaranteed income certificate), how much money will you have after 3 years if you invest $3000 in the certificate? (Before doing the calculation, can you guess whether your answer will be bigger than $3000 or less than $3000 ?) 7) In addition to paying your own tuition, you're planning to set aside $1500/yr, starting next year, in a secure investment so that you can help your younger sister go to university. You'll set money aside for a total of ten years. If you can earn a 6% return on your investment over its 10-year life, how much money will be available for your sister when she's ready to start university 10 years from now? (Before doing the calculation, roughly how much money do you think you'll have?) 8) Your grandfather says he'll give you $5,000 when you complete your degree in two year's time. If interest rates are around 7%, what is that money worth in today's dollars? (Before doing the calculation, about how much money do you think it is?) 9) You've just graduated, and are expecting to have around \$20,000/year in disposable income (that is, money not committed to essentials such as food, clothing, rent, utilities, and tuitionloan payments) when you graduate. You ask a bank for a $100,000 loan that you're offering to pay back in five years. The loan officer observes that interest rates are expected to average around 7% over that five-year period and gives you a flat "no." Why? (What is that $20,000 / yr worth in today's dollars? Is it worth as much as the $100,000 you're asking to borrow today?) 10) Your uncle has offered you a job when you graduate three years from now. It will pay $100,000/ year - not a bad starting salary, eh? You figure you'll be able to stand working for him for about five years before he drives you completely nuts and you have to find employment elsewhere. The problem is that you're wanting to buy a car now, and so you're approaching your cousin (your uncle's daughter) for a loan. She knows you've got the job offer, so she may be willing to make such a loan. What you're wondering right now is how much that money you expect to earn is worth in today's dollars, because that will affect how much of a loan you ask for from her, and ultimately whether you'll be buying a used 2012 Ford Fiesta with 330,000 kilometres on it, or a new 2024 Maserati Granturismo Trofeo with MC matt graphite wheel rims. Assuming interest rates will average around 8% over the next decade, how much are your five year's worth of future earnings worth in today's dollars? 11. You're going to purchase an Alienware m18 Gaming laptop for $2,949.99, plus 15% tax at Best Buy. At the store, they offer you two payment options: You can either pay the full amount up front, or pay in five equal annual instalments of $675, with the first instalment due immediately as a downpayment. How much would you be paying in present-valued dollars if you chose the instalment plan? Which option is the better deal? (The appropriate r to use is 7%.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started