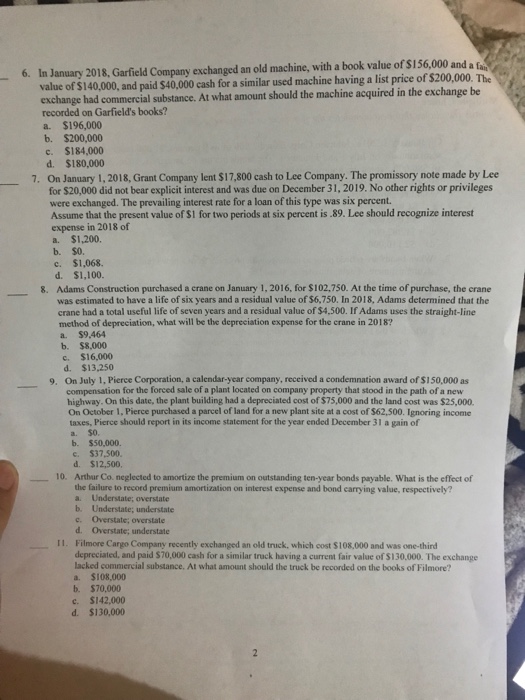

6 In January 2018, Garfield Company exchanged an old machine, with a book value of $156,000 and a fa value of $140,000, and paid $40,000 cash for a similar used machine having a list price of $200,000. The exchange had commercial substance. At what amount should the machine acquired in the exchange be recorded on Garfield's books? a. $196,000 b. $200,000 c. $184,000 d. $180,000 On January 1, 2018, Grant Company lent $17,800 cash to Lee Company. The promissory note made by Lee for $20,000 did not bear explicit interest and was due on December 31, 2019. No other rights or privileges were exchanged. The prevailing interest rate for a loan of this type was six percent. 7. Assume that the present value of S! for two periods at six percent is.89. Lee should recognize interest expense in 2018 of a. $1,200. b. $0. c. $1,068. d. $1,100. Adams Construction purchased a crane on January 1, 2016, for $102,750. At the time of purchase, the crane was estimated to have a life of six years and a residual value of $6,750. In 2018, Adams determined that the crane had a total useful life of seven years and a residual value of $4,500. If Adams uses the straight-line method of depreciation, what will be the depreciation expense for the erane in 2018? a. $9,464 b. $8,000 c. $16,000 8. d. $13.250 9. On July 1, Pierce Corporation, a calendar-year company, received a condemnation award of $150,000 as compensation for the forced sale of a plant located on company property that stood in the path of a new highway. On this date, the plant building had a depreciated cost of $75,000 and the land cost was $25,000. On October 1, Pierce purchased a parcel of land for a new plant site at a cost of $62,500. Ignoring income taxes, Pierce should report in its income statement for the year ended December 31 a gain of a. $0. b. $50,000. c. $37,500. d. $12,500, 10. Arthur Co. neglected to amortize the premium on outstanding ten-year bonds payable. What is the effect of the failure to record premium amortization on interest expense and bond carrying value, respectively? a. Understate; overstate b. Understate; understate c. Overstate; overstate d. Overstate; understate Filmore Cargo Company recently exchanged an old truck, which cost $108,000 and was one-thind depreciated, and paid $70,000 cash for a similar truck having a current fair value of $130,000. The exchange lacked commercial substance, At what amount should the truck be recorded on the books of Filmore? a. $108,000 b. $70,000 c. $142,000 I1. d $130,000