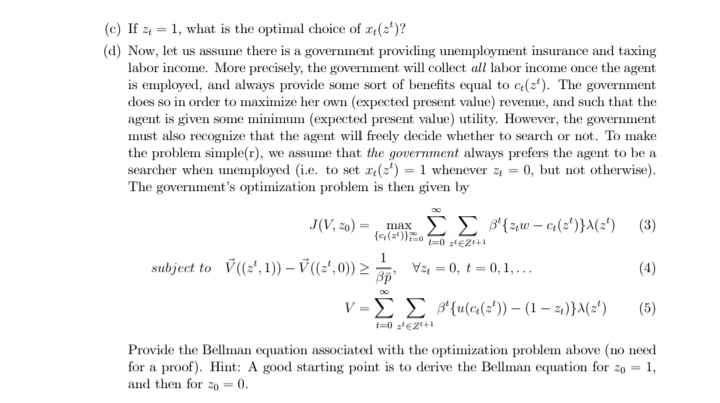

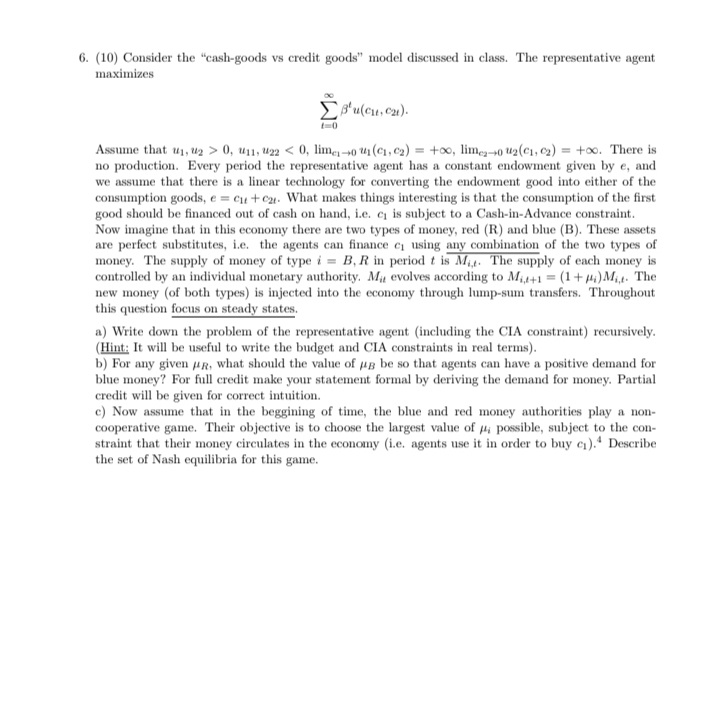

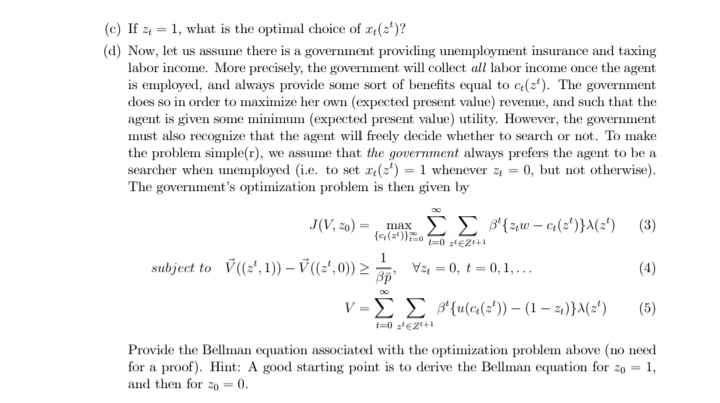

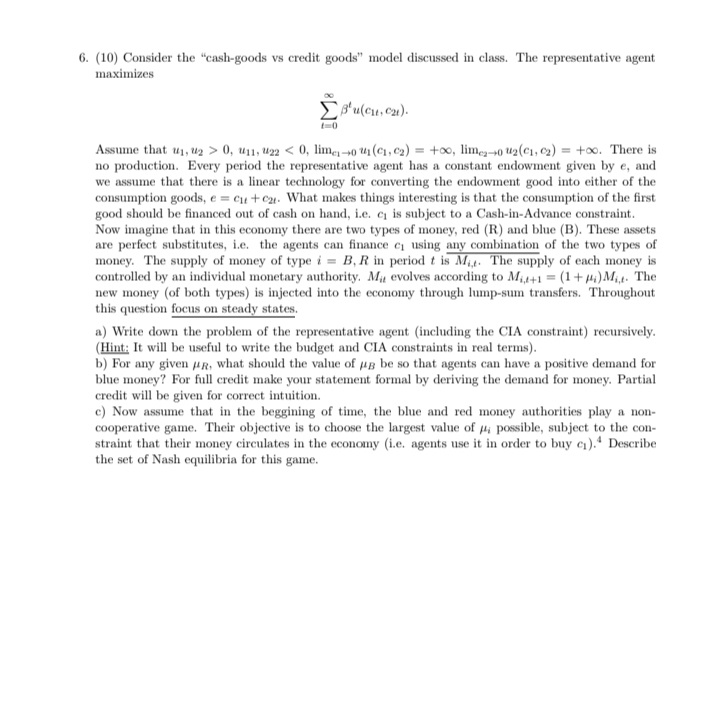

6. In Kydland and Prescott's original RBC model, they made the assumption that investment does not produce capital immediately; i.e. the economy exhibited "time to build". Consider a representative-agent (i.e. no population growth), non-stochastic version of their economy and assume that agents have preferences given by: B' (Ing + eln (1 - 1)) 1=0 where a is consumption and he is time spent in work activity. Aggregate output is produced using a standard Cobb-Douglas production function: ut = kph)-a where y, is output and k, denotes capital. (Note that there is no technological progress in the economy.) In each period, agents choose consumption, work effort and investment in order to maximize lifetime utility. In this economy, an investment project started at time t does not produce capital until period t + 2. The costs associated with this project are spread out over the two-period horizon. Let sy denote an investment project that is finished after i periods (i = 1,2) where households pay the fraction w; of the total costs. Then total investment expenditures are given by: and, of course, wj + w2 = 1. The law of motion for the capital stock is given by: kit1 = ke (1 - 6) + $14 Given this environment, do the following: (a) Express the associated social planner problem for this economy as a dynamic program- ming problem. Be explicit in identifying the states and control variables in each period (along with the laws of motion for the state variables). (Note: it is easiest to write the law of motion for capital as an additional constraint with an associated Lagrange multiplier.) (b) Derive and interpret the necessary conditions associated with an optimum. (c) Solve for the steady-state output-capital ratio, the investment-capital ratio, and the ratio of time spent in work activity to time spent in leisure as a function of the exogenous(c) If # = 1, what is the optimal choice of z, (=)? (d) Now, let us assume there is a government providing unemployment insurance and taxing labor income. More precisely, the government will collect all labor income once the agent is employed, and always provide some sort of benefits equal to c(= ). The government does so in order to maximize her own (expected present value) revenue, and such that the agent is given some minimum (expected present value) utility. However, the government must also recognize that the agent will freely decide whether to search or not. To make the problem simple(r), we assume that the government always prefers the agent to be a searcher when unemployed (i.e. to set a,(2') = 1 whenever & = 0, but not otherwise). The government's optimization problem is then given by DO J(V, 20)= MAX E E B'(w - G(=)}x(=) (3) subject to V((=', 1)) - V((=',0)) 2 3p 1 I'0=1'0=1A (4) V = E E B'tu(a(=)) - (1-2)}2(2') (5) 10de24+1 Provide the Bellman equation associated with the optimization problem above (no need for a proof). Hint: A good starting point is to derive the Bellman equation for zo = 1, and then for zo = 0.4. Consider the following (very simple) consumption-savings problem with habits V (Go, C-1) = max SBu(a - 70-1) (1) subject to at atti = w+ (1 + r)at, = 0, 1, ... (2) with do and c_, given, and y e [0, 1). (a) Derive the Bellman equation corresponding to the optimization problem above (i.e. prove "Theorem 1" ). (b) Prove that this is a contraction mapping with modulus B. (c) Use the envelope theorem to derive the derivative of the value function with respect to (both) state variables (no proof). (d) Derive the Euler equation. 5. Let z be a random variable that takes on values in Z = {0, 1}. Here, 1 denotes employment and 0 unemployment. Consider an arbitrary process of consumption {a(z')), where q : 21+1 - R+. For this question, the probability of an unemployed individual finding a job is endogenous and depends on her search effort. Search effort is simply the binary choice between being a searcher, or not being a searcher. If the agent is a searcher, she sets variable r to 1, and the probability of finding a job equals p; that is P(at1 = 1/= = 0) = p. If the agent decides not to search, she sets a to 0, and the probability of finding a job is zero; that is P(2+1 = 1/4 = 0) = 0. Let us, for simplicity, assume that once a job is found, it lasts for perpetuity and is unaffected by the agent's choice of a; that is P(#+1 = 1/8 = 1) = 1. We can summarize these assumptions concisely by A(at+1) = p(x)>(='), if z, = 0, and A(at+1) = >(=!), if = = 1 where p(x) = p if a = 1 and zero if a = 0. A(at+1) denotes as usual the probability of history 2'+ occurring. Lastly, an agent's preferences are given by where r, (s') is an agent's choice of search effort in period t, after having observed history a'. Notice that the agent gains disutility 1 of being a searcher. (a) After any history z', define a continuation value in this economy. Denote this V(=!). (b) Show that if = = 0, a necessary condition for an agent to be a searcher (i.e. to set It(=') = 1) is given by V ( ( = ', 1)) - V((=', 0)) 2 3p6. (10) Consider the "cash-goods vs credit goods" model discussed in class. The representative agent maximizes B'u(cut, exx). Assume that u1, u2 > 0, uji, #22