Answered step by step

Verified Expert Solution

Question

1 Approved Answer

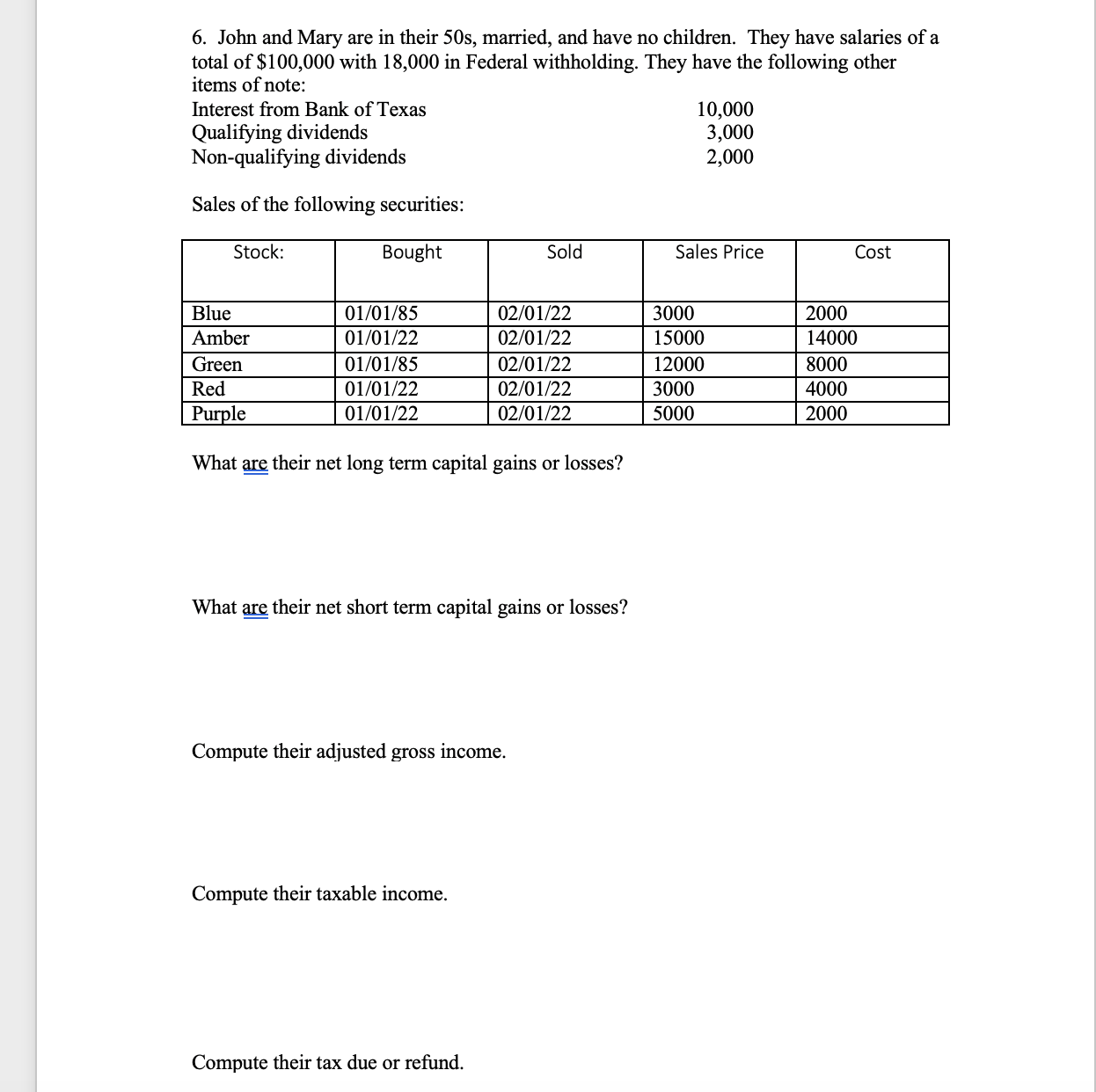

6. John and Mary are in their 50s, married, and have no children. They have salaries of a total of $100,000 with 18,000 in

6. John and Mary are in their 50s, married, and have no children. They have salaries of a total of $100,000 with 18,000 in Federal withholding. They have the following other items of note: Interest from Bank of Texas Qualifying dividends Non-qualifying dividends Sales of the following securities: Bought Stock: 01/01/85 01/01/22 01/01/85 01/01/22 01/01/22 Blue Amber Green Red Purple What are their net long term capital gains or losses? Sold 02/01/22 02/01/22 02/01/22 02/01/22 02/01/22 What are their net short term capital gains or losses? Compute their adjusted gross income. Compute their taxable income. Compute their tax due or refund. 10,000 3,000 2,000 Sales Price 3000 15000 12000 3000 5000 Cost 2000 14000 8000 4000 2000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets work through this stepbystep 1 Interest income 10000 2 Qualifying dividends 3000 taxed at quali...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started