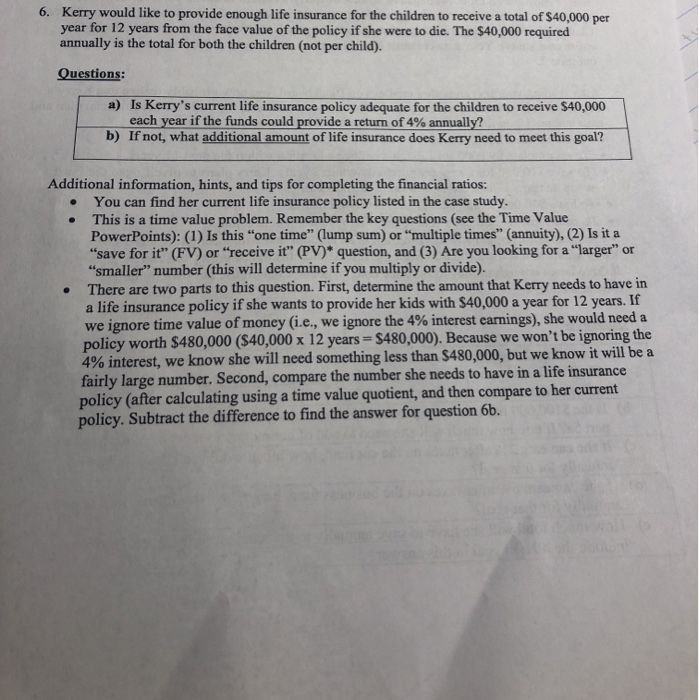

6. Kerry would like to provide enough life insurance for the children to receive a total of $40,000 per year for 12 years from the face value of the policy if she were to die. The $40,000 required annually is the total for both the children (not per child). Questions: a) Is Kerry's current life insurance policy adequate for the children to receive $40,000 each year if the funds could provide a return of 4% annually? b) If not, what additional amount of life insurance does Kerry need to meet this goal? . . Additional information, hints, and tips for completing the financial ratios: You can find her current life insurance policy listed in the case study. This is a time value problem. Remember the key questions (see the Time Value PowerPoints): (1) Is this one time" (lump sum) or "multiple times" (annuity), (2) Is it a "save for it" (FV) or "receive it" (PV)* question, and (3) Are you looking for a "larger" or "smaller" number this will determine if you multiply or divide). There are two parts to this question. First, determine the amount that Kerry needs to have in a life insurance policy if she wants to provide her kids with $40,000 a year for 12 years. If we ignore time value of money i.e., we ignore the 4% interest earnings), she would need a policy worth $480,000 ($40,000 x 12 years = $480,000). Because we won't be ignoring the 4% interest, we know she will need something less than $480,000, but we know it will be a fairly large number. Second, compare the number she needs to have in a life insurance policy (after calculating using a time value quotient, and then compare to her current policy. Subtract the difference to find the answer for question 6b. 6. Kerry would like to provide enough life insurance for the children to receive a total of $40,000 per year for 12 years from the face value of the policy if she were to die. The $40,000 required annually is the total for both the children (not per child). Questions: a) Is Kerry's current life insurance policy adequate for the children to receive $40,000 each year if the funds could provide a return of 4% annually? b) If not, what additional amount of life insurance does Kerry need to meet this goal? . . Additional information, hints, and tips for completing the financial ratios: You can find her current life insurance policy listed in the case study. This is a time value problem. Remember the key questions (see the Time Value PowerPoints): (1) Is this one time" (lump sum) or "multiple times" (annuity), (2) Is it a "save for it" (FV) or "receive it" (PV)* question, and (3) Are you looking for a "larger" or "smaller" number this will determine if you multiply or divide). There are two parts to this question. First, determine the amount that Kerry needs to have in a life insurance policy if she wants to provide her kids with $40,000 a year for 12 years. If we ignore time value of money i.e., we ignore the 4% interest earnings), she would need a policy worth $480,000 ($40,000 x 12 years = $480,000). Because we won't be ignoring the 4% interest, we know she will need something less than $480,000, but we know it will be a fairly large number. Second, compare the number she needs to have in a life insurance policy (after calculating using a time value quotient, and then compare to her current policy. Subtract the difference to find the answer for question 6b