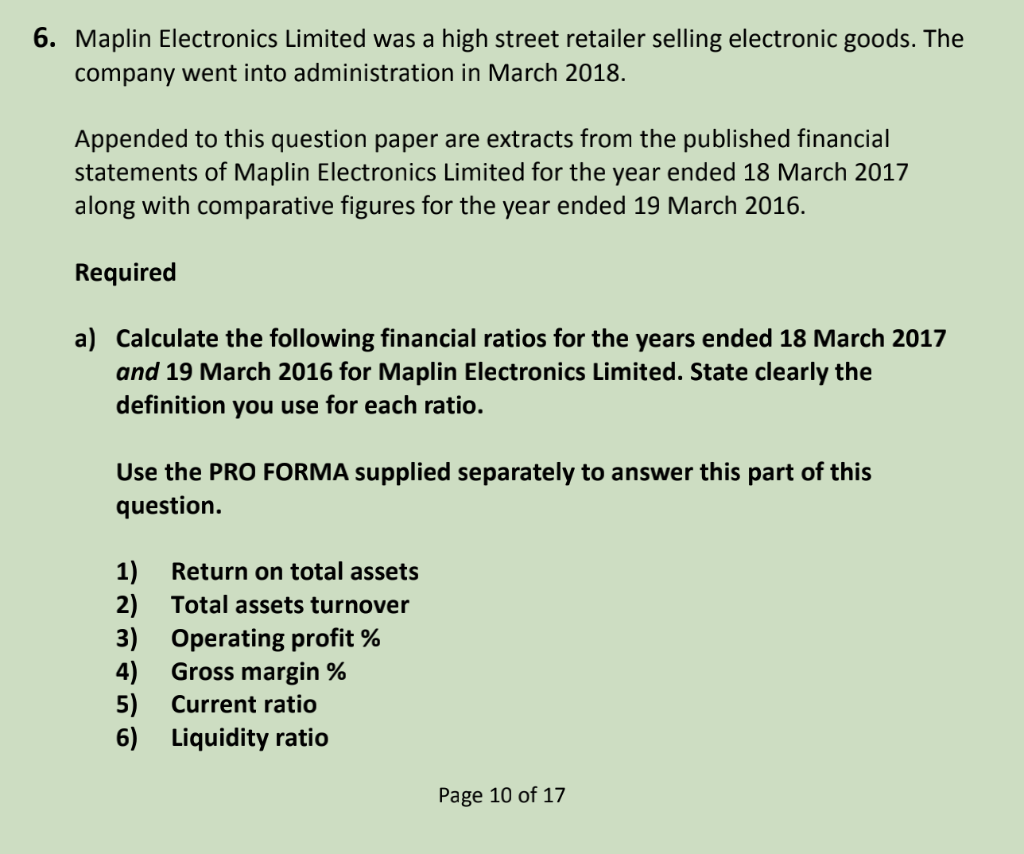

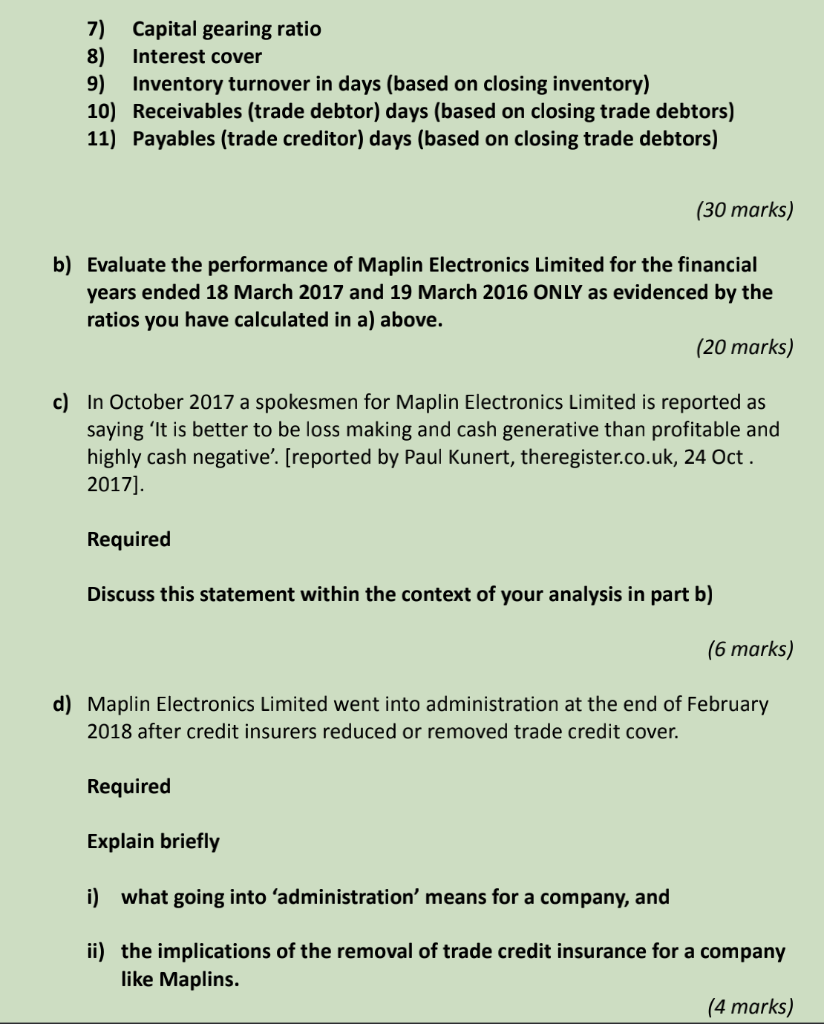

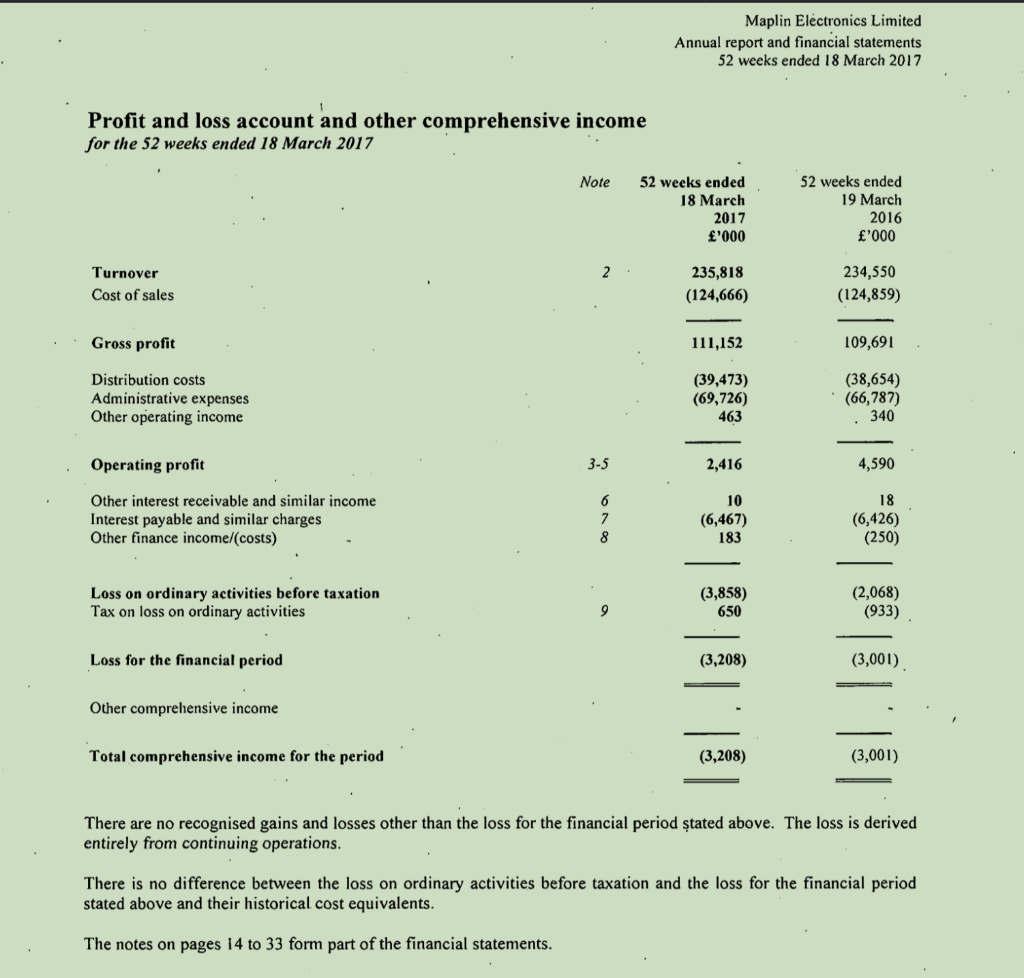

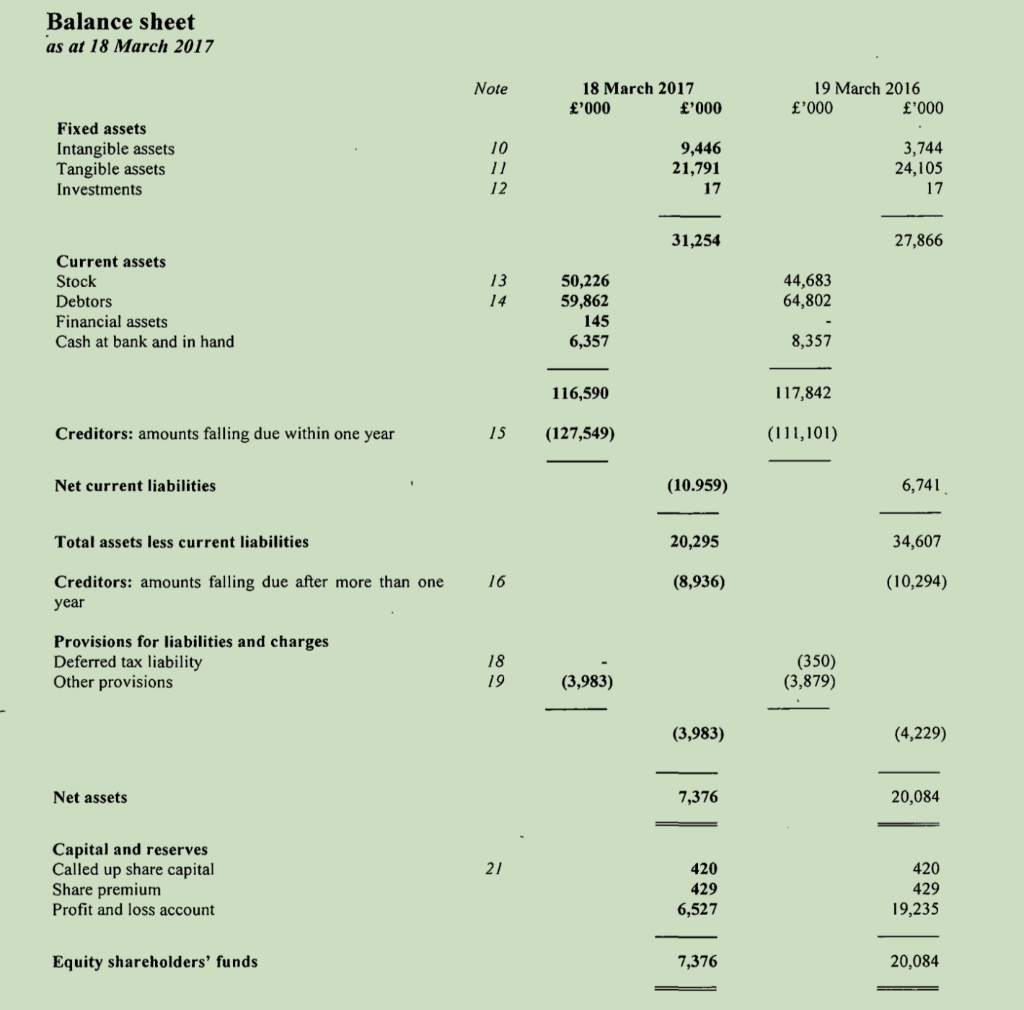

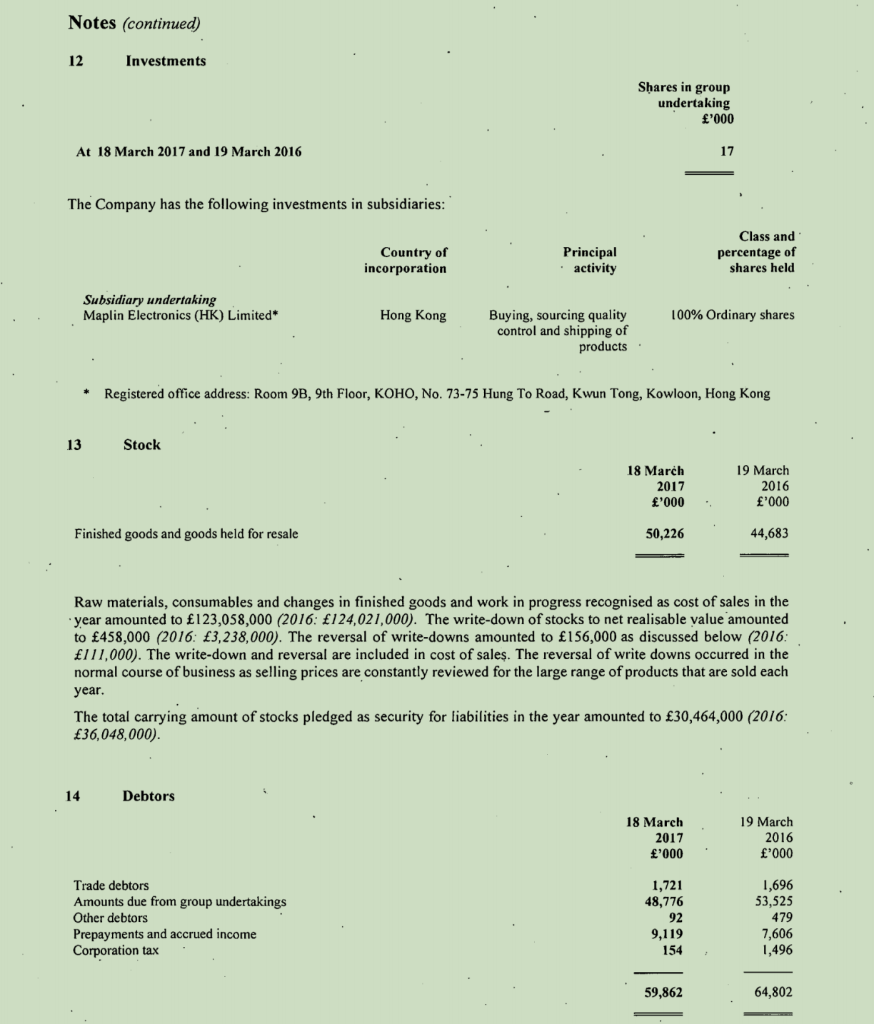

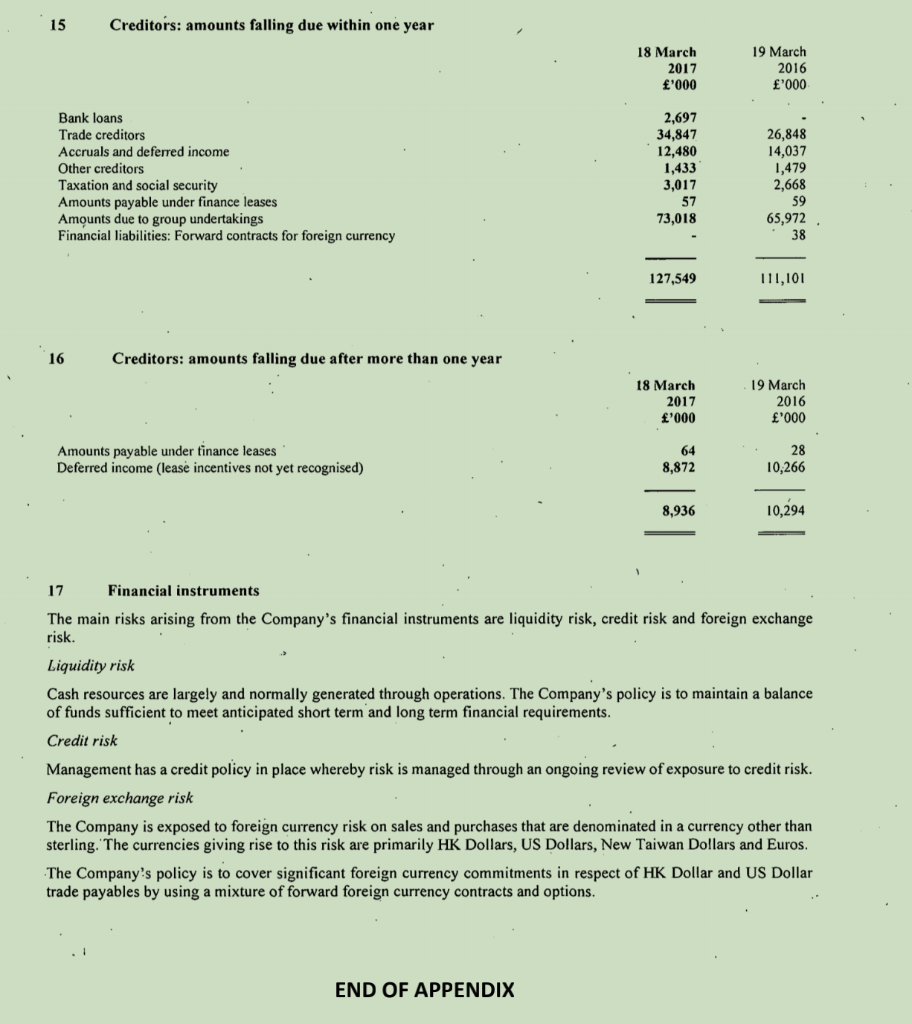

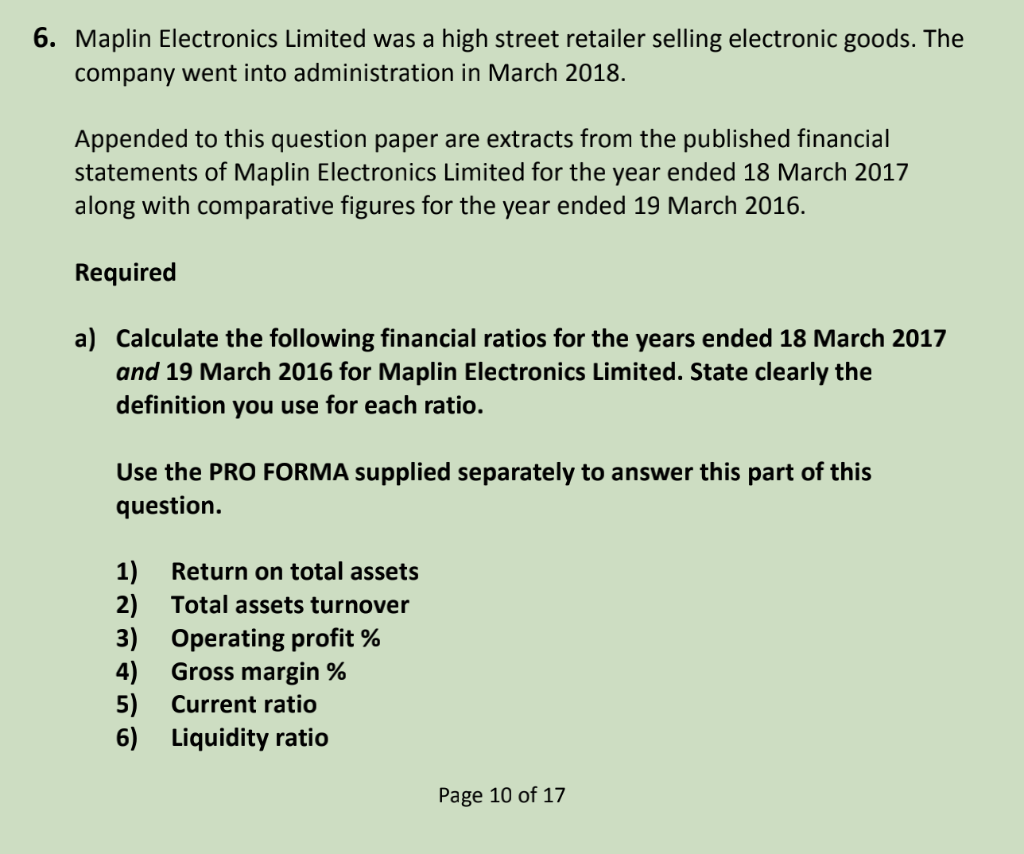

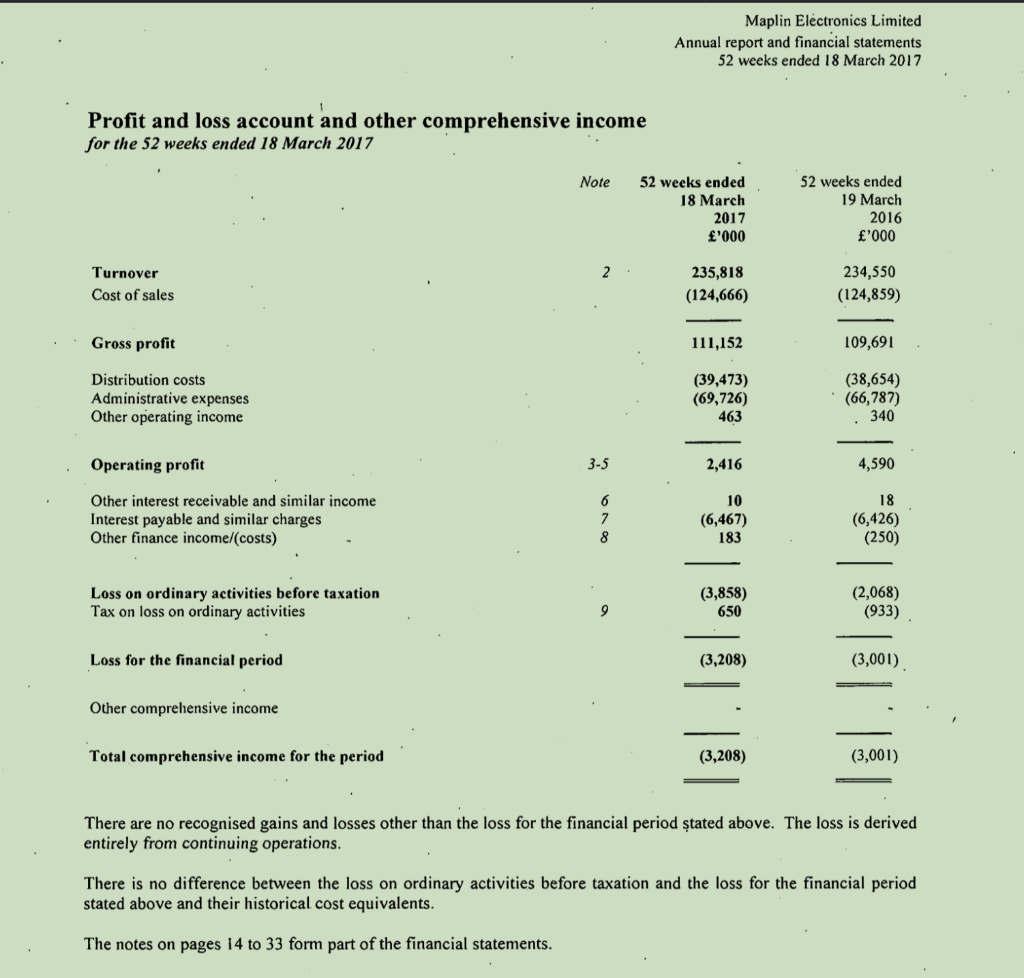

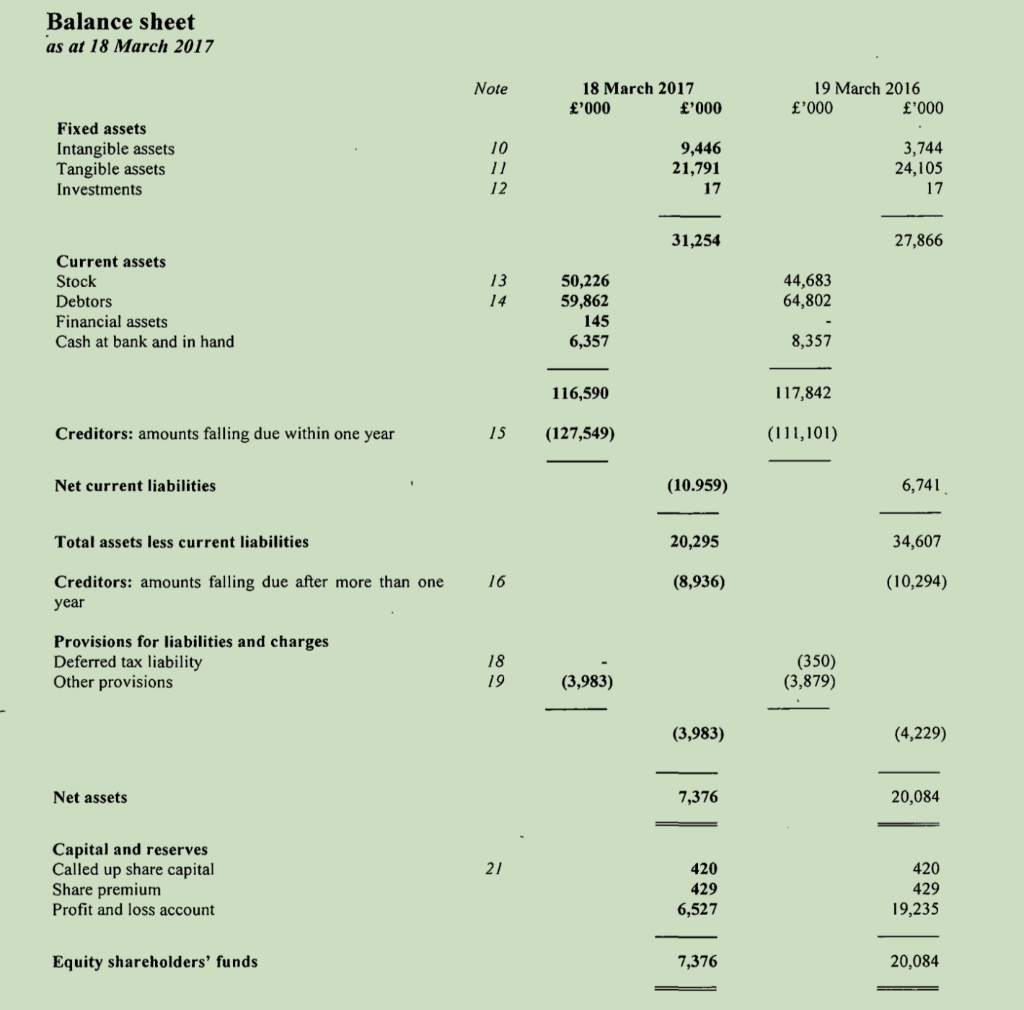

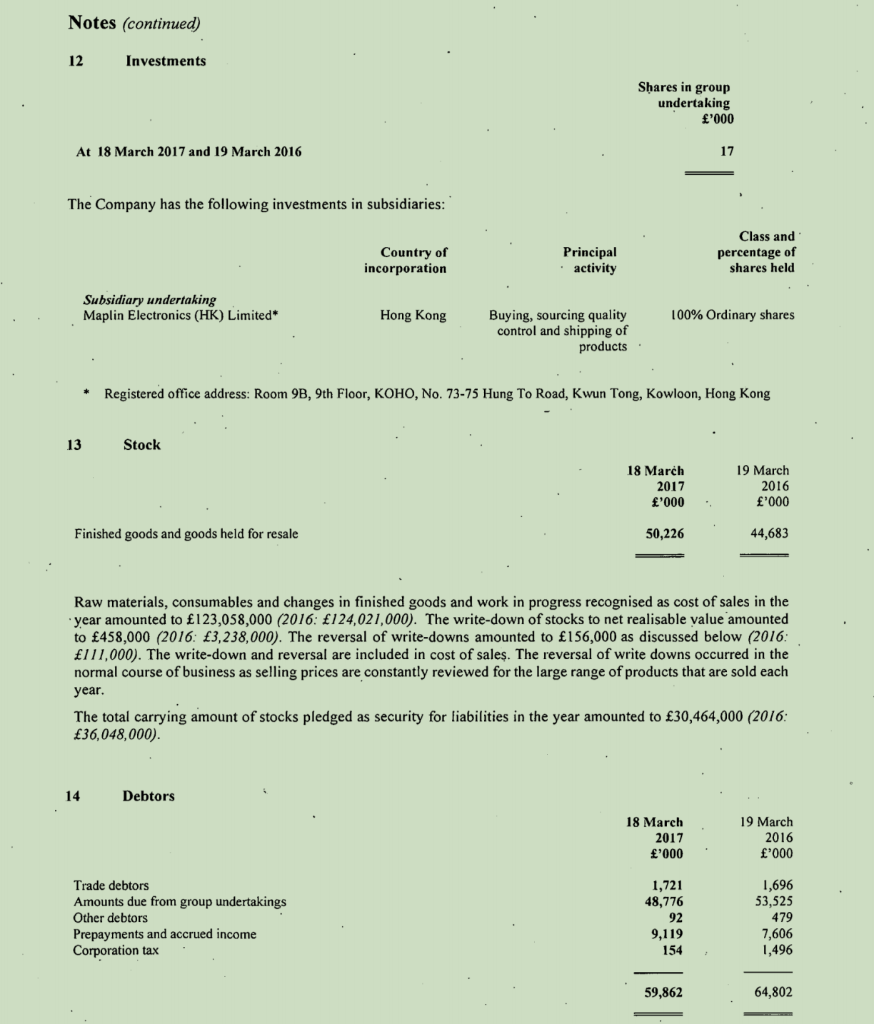

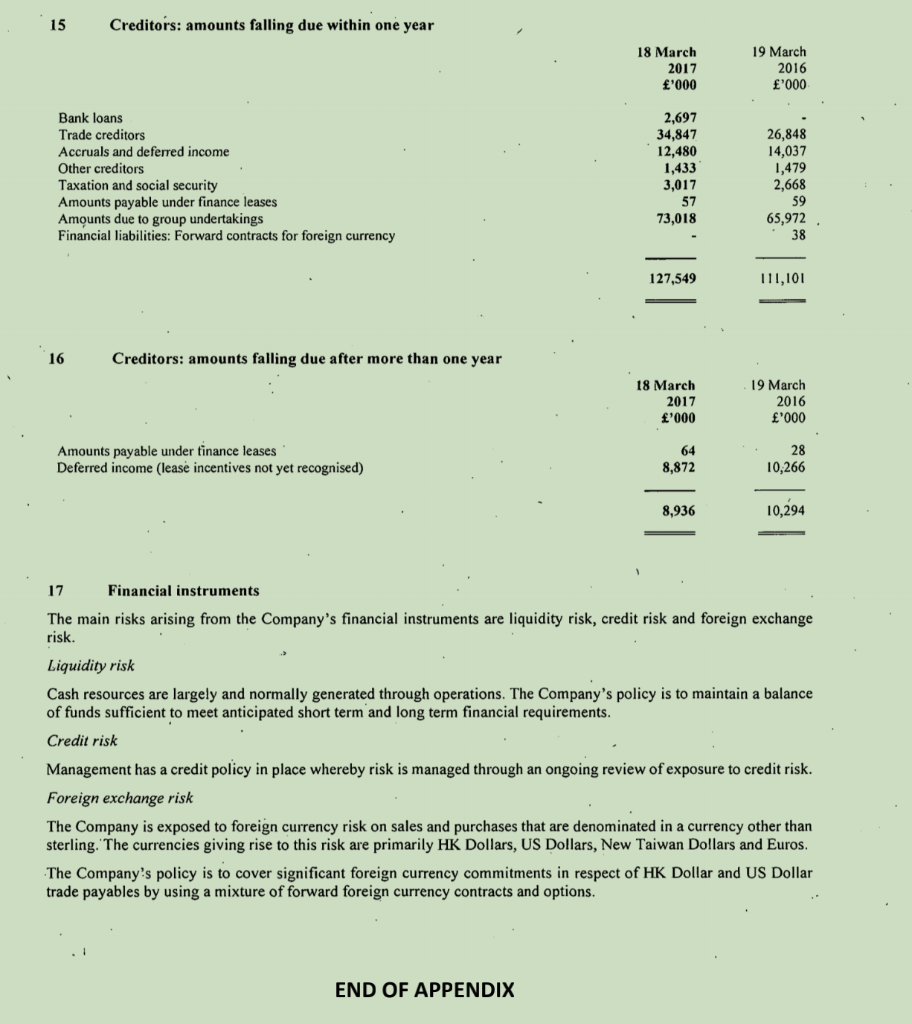

6. Maplin Electronics Limited was a high street retailer selling electronic goods. The company went into administration in March 2018. Appended to this question paper are extracts from the published financial statements of Maplin Electronics Limited for the year ended 18 March 2017 along with comparative figures for the year ended 19 March 2016. Required a) Calculate the following financial ratios for the years ended 18 March 2017 and 19 March 2016 for Maplin Electronics Limited. State clearly the definition you use for each ratio. Use the PRO FORMA supplied separately to answer this part of this question. 1) Return on total assets 2) Total assets turnover 3) Operating profit % 4) Gross margin % Current ratio 6) Liquidity ratio 5) a Page 10 of 17 7) Capital gearing ratio 8) Interest cover 9 Inventory turnover in days (based on closing inventory) 10) Receivables (trade debtor) days (based on closing trade debtors) 11) Payables (trade creditor) days (based on closing trade debtors) (30 marks) b) Evaluate the performance of Maplin Electronics Limited for the financial years ended 18 March 2017 and 19 March 2016 ONLY as evidenced by the ratios you have calculated in a) above. (20 marks) c) In October 2017 a spokesmen for Maplin Electronics Limited is reported as saying 'It is better to be loss making and cash generative than profitable and highly cash negative'. [reported by Paul Kunert, theregister.co.uk, 24 Oct. 2017]. Required Discuss this statement within the context of your analysis in part b) (6 marks) d) Maplin Electronics Limited went into administration at the end of February 2018 after credit insurers reduced or removed trade credit cover. Required Explain briefly i) what going into 'administration' means for a company, and ii) the implications of the removal of trade credit insurance for a company like Maplins. (4 marks) APPENDIX: EXTRACTS FROM THE FINANCIAL STATEMENTS OF MAPLIN ELECTRONICS LIMITED TO BE USED TO ANSWER QUESTION 6 Maplin Electronics Limited Annual report and financial statements 52 weeks ended 18 March 2017 Profit and loss account and other comprehensive income for the 52 weeks ended 18 March 2017 Note 52 weeks ended 18 March 2017 '000 52 weeks ended 19 March 2016 '000 2 . Turnover Cost of sales 235,818 (124,666) 234,550 (124,859) Gross profit 111,152 109,691 Distribution costs Administrative expenses Other operating income (39,473) (69,726) 463 (38,654) (66,787) 340 Operating profit 2,416 4,590 18 Other interest receivable and similar income Interest payable and similar charges Other finance income/costs) 10 (6,467) 183 (6,426) (250) Loss on ordinary activities before taxation Tax on loss on ordinary activities (3,858) 650 (2,068) (933) Loss for the financial period (3,208) (3,001) Other comprehensive income Total comprehensive income for the period (3,208) (3,001) There are no recognised gains and losses other than the loss for the financial period tated above. The loss is derived entirely from continuing operations. There is no difference between the loss on ordinary activities before taxation and the loss for the financial period stated above and their historical cost equivalents. The notes on pages 14 to 33 form part of the financial statements. Balance sheet as at 18 March 2017 18 March 2017 '000 '000 '000 '000 Fixed assets Intangible assets Tangible assets Investments 9,446 21,791 3,744 24,105 17 31,254 27,866 Current assets Stock Debtors Financial assets Cash at bank and in hand 44,683 64,802 50,226 59,862 145 6,357 8,357 116,590 117,842 Creditors: amounts falling due within one year 15 0127.549) (111,101) Net current liabilities (10.959) 6,741 Total assets less current liabilities 20,295 34,607 16 (8,936) (10,294) Creditors: amounts falling due after more than one year Provisions for liabilities and charges Deferred tax liability Other provisions (350) (3,879) (3,983) (3,983) (4,229) Net assets 7,376 20,084 Capital and reserves Called up share capital Share premium Profit and loss account 420 429 6,527 420 429 19,235 Equity shareholders' funds 7,376 20,084 Notes (continued) 12 Investments Shares in group undertaking '000 At 18 March 2017 and 19 March 2016 17 The Company has the following investments in subsidiaries: Country of incorporation Principal activity Class and percentage of shares held Subsidiary undertaking Maplin Electronics (HK) Limited* Hong Kong 100% Ordinary shares Buying, sourcing quality control and shipping of products. * Registered office address: Room 9B, 9th Floor, KOHO, No. 73-75 Hung To Road, Kwun Tong, Kowloon, Hong Kong 13 Stock 18 March 2017 '000 19 March 2016 '000 . Finished goods and goods held for resale 50,226 44,683 Raw materials, consumables and changes in finished goods and work in progress recognised as cost of sales in the year amounted to 123,058,000 (2016: 124,021,000). The write-down of stocks to net realisable value amounted to 458,000 (2016: 3,238,000). The reversal of write-downs amounted to 156,000 as discussed below (2016: 111,000). The write-down and reversal are included in cost of sales. The reversal of write downs occurred in the year. The total carrying amount of stocks pledged as security for liabilities in the year amounted to 30,464,000 (2016: 36,048,000) Debtors 18 March 2017 '000 19 March 2016 '000 Trade debtors Amounts due from group undertakings Other debtors Prepayments and accrued income Corporation tax 1,721 48,776 92 9,119 154 1,696 53,525 479 7,606 1,496 : 59,862 64,802 15 Creditors: amounts falling due within one year 18 March 2017 '000 19 March 2016 '000 Bank loans Trade creditors Accruals and deferred income Other creditors Taxation and social security Amounts payable under finance leases Amounts due to group undertakings Financial liabilities: Forward contracts for foreign currency 2,697 34,847 12,480 1,433 3,017 26,848 14,037 1,479 2,668 59 65,972 38 57 73,018 127,549 111,101 Creditors: amounts falling due after more than one year 18 March 2017 '000 . 19 March 2016 '000 64 Amounts payable under tinance leases Deferred income (lease incentives not yet recognised) 28 10,266 8,872 8,936 10,294 17 Financial instruments The main risks arising from the Company's financial instruments are liquidity risk, credit risk and foreign exchange risk. Liquidity risk Cash resources are largely and normally generated through operations. The Company's policy is to maintain a balance of funds sufficient to meet anticipated short term and long term financial requirements. Credit risk Management has a credit policy in place whereby risk is managed through an ongoing review of exposure to credit risk. Foreign exchange risk The Company is exposed to foreign currency risk on sales and purchases that are denominated in a currency other than sterling. The currencies giving rise to this risk are primarily HK Dollars, US Dollars, New Taiwan Dollars and Euros. The Company's policy is to cover significant foreign currency commitments in respect of HK Dollar and US Dollar trade payables by using a mixture of forward foreign currency contracts and options. END OF APPENDIX