Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Marguerite Guron operators a JUTA Tours business in Portland. The following data was obtained for the year 2013: Non-current assets Office equipment at book

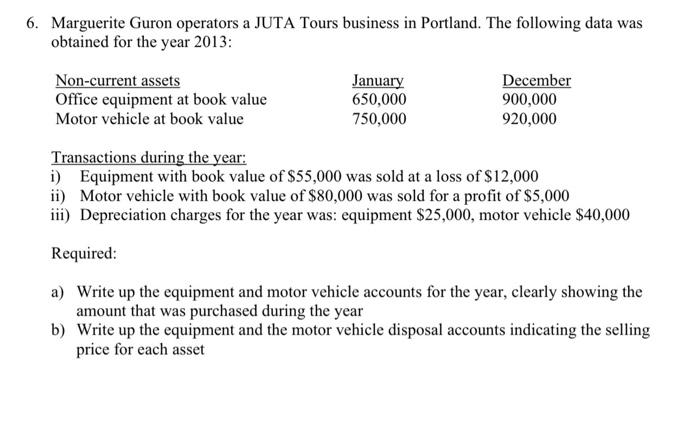

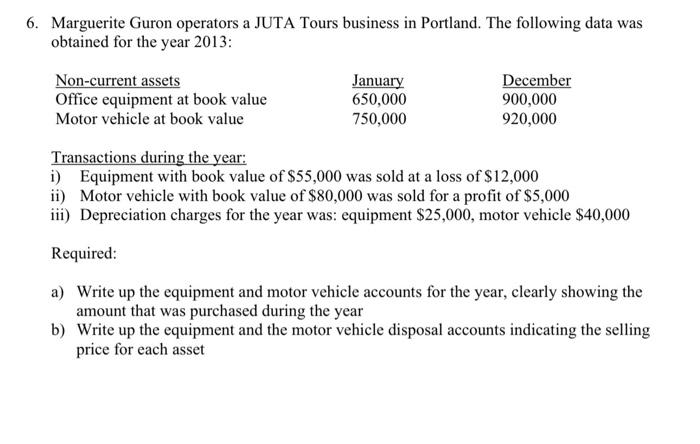

6. Marguerite Guron operators a JUTA Tours business in Portland. The following data was obtained for the year 2013: Non-current assets Office equipment at book value Motor vehicle at book value January 650,000 750,000 December 900,000 920,000 Transactions during the year: i) Equipment with book value of $55,000 was sold at a loss of $12,000 ii) Motor vehicle with book value of $80,000 was sold for a profit of $5,000 iii) Depreciation charges for the year was: equipment $25,000, motor vehicle $40,000 Required: a) Write up the equipment and motor vehicle accounts for the year, clearly showing the amount that was purchased during the year b) Write up the equipment and the motor vehicle disposal accounts indicating the selling price for each asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started