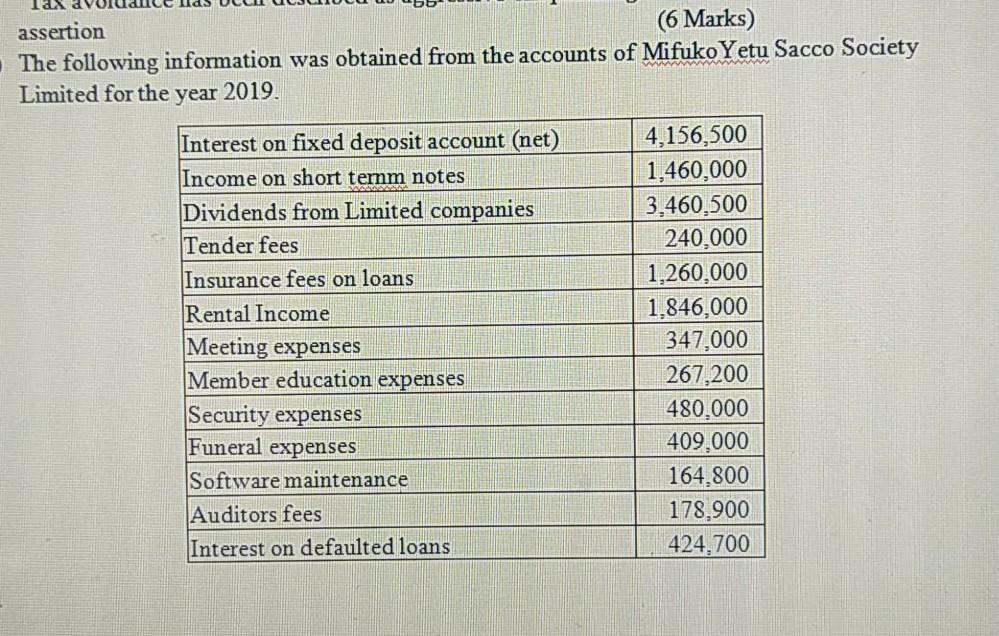

Question: assertion (6 Marks) The following information was obtained from the accounts of Mifuko Yetu Sacco Society Limited for the year 2019. Interest on fixed

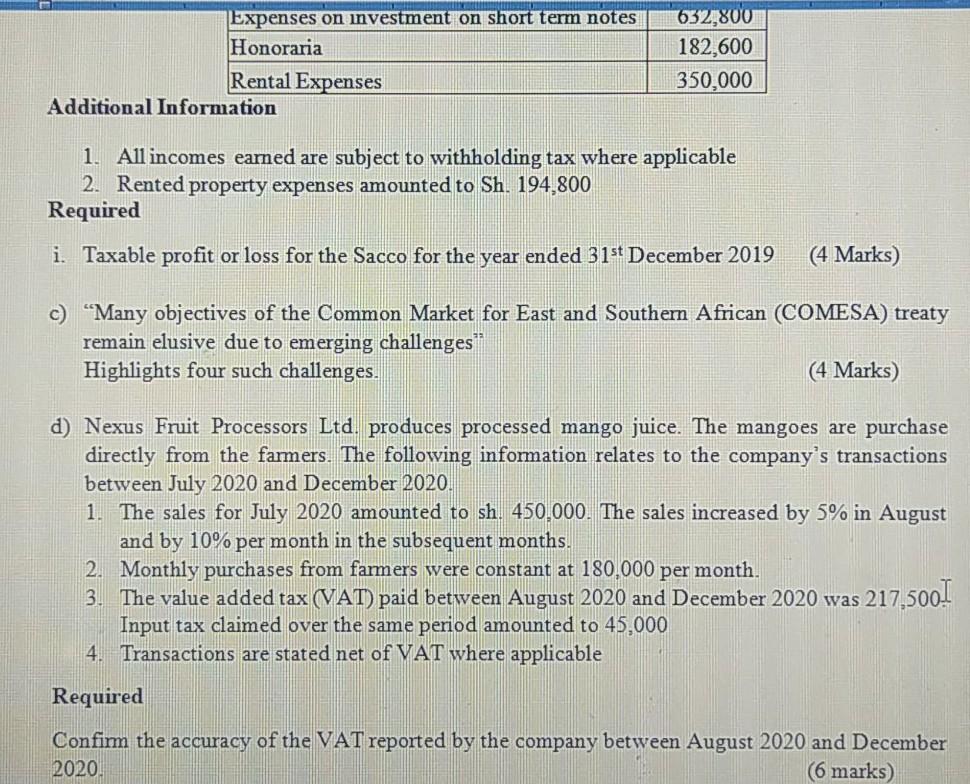

assertion (6 Marks) The following information was obtained from the accounts of Mifuko Yetu Sacco Society Limited for the year 2019. Interest on fixed deposit account (net) Income on short term notes Dividends from Limited companies Tender fees Insurance fees on loans Rental Income Meeting expenses Member education expenses Security expenses Funeral expenses Software maintenance Auditors fees Interest on defaulted loans 4,156,500 1,460,000 3,460,500 240,000 1,260,000 1,846,000 347,000 267,200 480,000 409,000 164,800 178,900 424,700 Expenses on investment on short term notes Honoraria Rental Expenses Additional Information 632,800 182,600 350,000 1. All incomes earned are subject to withholding tax where applicable 2. Rented property expenses amounted to Sh. 194,800 Required i. Taxable profit or loss for the Sacco for the year ended 31st December 2019 (4 Marks) c) "Many objectives of the Common Market for East and Southern African (COMESA) treaty remain elusive due to emerging challenges" Highlights four such challenges. (4 Marks) d) Nexus Fruit Processors Ltd. produces processed mango juice. The mangoes are purchase directly from the farmers. The following information relates to the company's transactions between July 2020 and December 2020. 1. The sales for July 2020 amounted to sh. 450,000. The sales increased by 5% in August and by 10% per month in the subsequent months. 2. Monthly purchases from farmers were constant at 180,000 per month. 3. The value added tax (VAT) paid between August 2020 and December 2020 was 217,500 Input tax claimed over the same period amounted to 45,000 4. Transactions are stated net of VAT where applicable Required Confirm the accuracy of the VAT reported by the company between August 2020 and December 2020. (6 marks)

Step by Step Solution

3.36 Rating (177 Votes )

There are 3 Steps involved in it

i Taxable profit or loss for the Sacco for the year ended 31st December 2019 Total Income Total Expe... View full answer

Get step-by-step solutions from verified subject matter experts