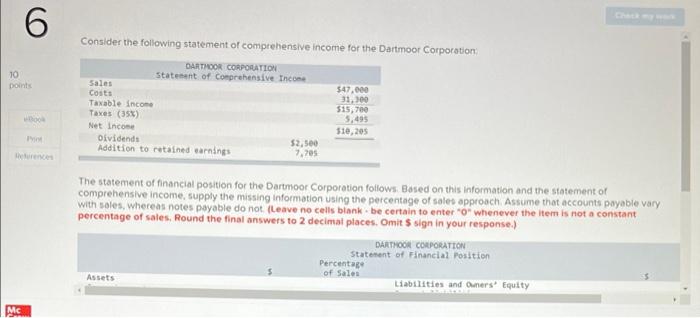

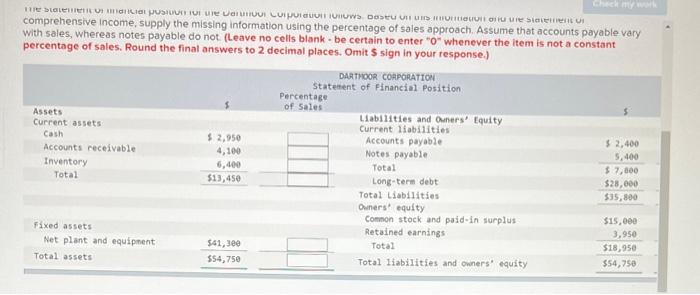

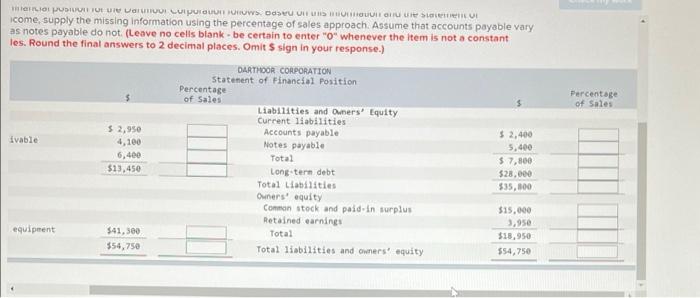

6 Mc 10 points Consider the following statement of comprehensive income for the Dartmoor Corporation: DARTMOOR CORPORATION Statement of Comprehensive Income Sales Costs $47,000 31,300 Taxable income $15,700 Taxes (35%) 5,495 Net Income $10,205 Dividends Pyjnt Addition to retained earnings $2,500 7,705 The statement of financial position for the Dartmoor Corporation follows. Based on this information and the statement of comprehensive income, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not (Leave no cells blank be certain to enter "0" whenever the item is not a constant percentage of sales. Round the final answers to 2 decimal places. Omit $ sign in your response.) DARTHOOR CORPORATION Statement of Financial Position Percentage of Sales Assets Liabilities and Owners' Equity The statement on marcial pusin e Diui Cupra Dastu un uns vieun ou une statement comprehensive income, supply the missing information using the percentage of sales approach. Assume that accounts payable vary with sales, whereas notes payable do not (Leave no cells blank - be certain to enter "0" whenever the item is not a constant percentage of sales. Round the final answers to 2 decimal places. Omit $ sign in your response.) DARTHOOR CORPORATION Statement of Financial Position Percentage of Sales Assets Current assets Liabilities and Ouners' Equity Current liabilities Cash $ 2,950 Accounts payable Accounts receivable $2,400 5,400 4,100 Notes payable Inventory 6,400 Total $7,000 Total $13,450 Long-term debt $28,000 Total Liabilities $35,800 Owners equity Common stock and paid-in surplus $15,000 Fixed assets Retained earnings 3,950 Net plant and equipment $41,300 Total $18,950 Total assets $54,750 Total liabilities and owners' equity $54,750 ou au ue siemen OU e puso e Darum Cupuras. De come, supply the missing information using the percentage of sales approach. Assume that accounts payable vary as notes payable do not. (Leave no cells blank - be certain to enter "0" whenever the item is not a constant les. Round the final answers to 2 decimal places. Omit $ sign in your response.) DARTMOOR CORPORATION Statement of Financial Position Percentage of Sales Liabilities and Owners' Equity Current liabilities Accounts payable $ 2,950 ivable $2,400 5,400 4,100 Notes payable 6,400 Total $7,800 $13,450 Long-term debt $28,000 Total Liabilities $35,800 Owners' equity Common stock and paid-in surplus $15,000 Retained earnings 3,950 equipment $41,300 Total $18,950 $54,750 Total liabilities and owners' equity $54,750 Percentage of Sales