Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Mr. Lai runs a frozen seafood trading company in Tai Po. The financial year ends on 31 December. Because of the failure of

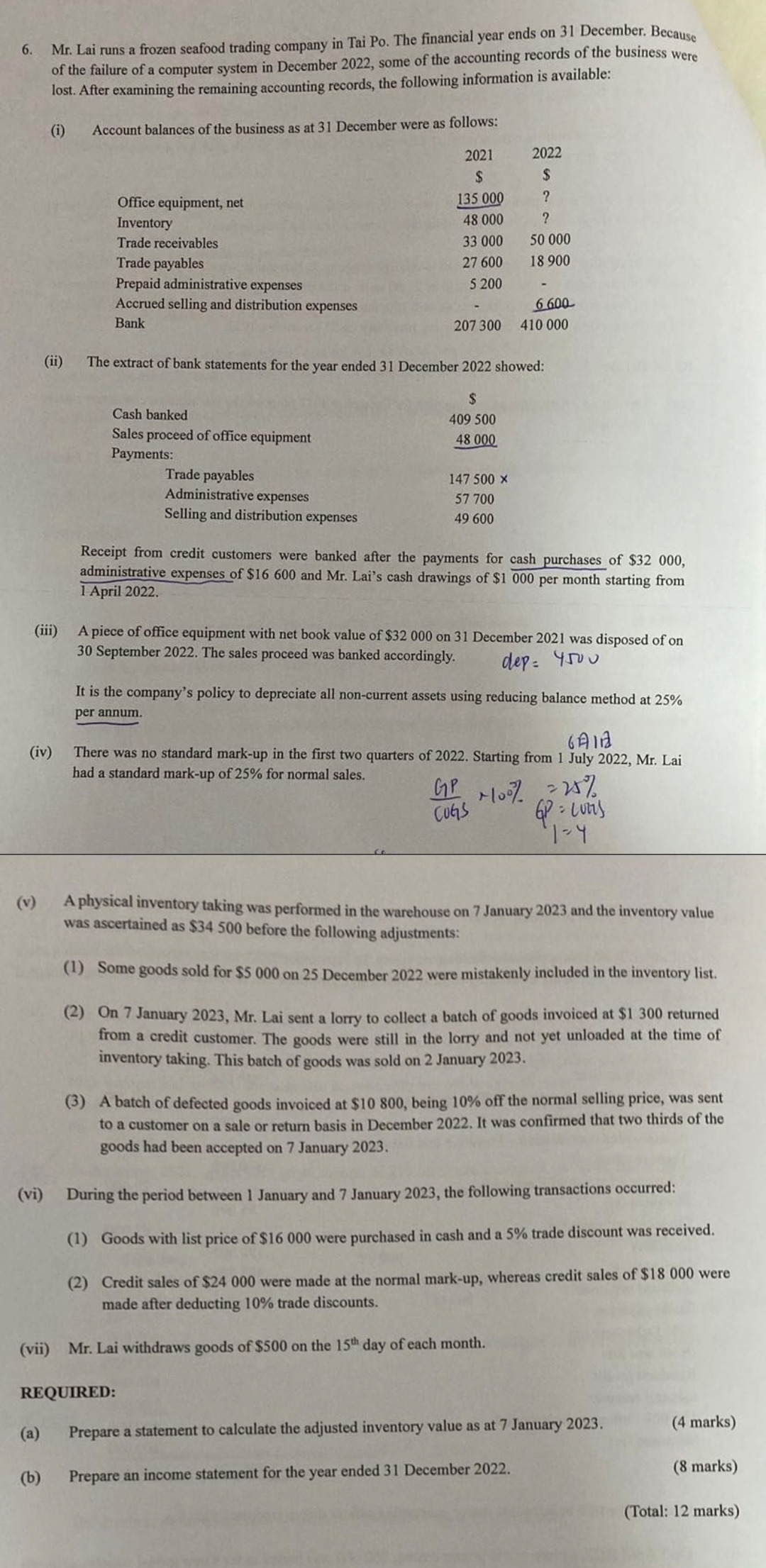

6. Mr. Lai runs a frozen seafood trading company in Tai Po. The financial year ends on 31 December. Because of the failure of a computer system in December 2022, some of the accounting records of the business were lost. After examining the remaining accounting records, the following information is available: (i) (iv) Account balances of the business as at 31 December were as follows: 2021 $ (a) (b) Office equipment, net Inventory Trade receivables Trade payables Prepaid administrative expenses Accrued selling and distribution expenses Bank Cash banked Sales proceed of office equipment Payments: 135 000 48 000 33 000 27 600 5 200 Trade payables Administrative expenses Selling and distribution expenses The extract of bank statements for the year ended 31 December 2022 showed: $ 409 500 48 000 2022 $ ? ? 6600 207 300 410 000 147 500 X 57 700 49 600 (iii) A piece of office equipment with net book value of $32 000 on 31 December 2021 was disposed of on 30 September 2022. The sales proceed was banked accordingly. dep= Y5uU REQUIRED: 50 000 18 900 Receipt from credit customers were banked after the payments for cash purchases of $32 000, administrative expenses of $16 600 and Mr. Lai's cash drawings of $1 000 per month starting from 1 April 2022. It is the company's policy to depreciate all non-current assets using reducing balance method at 25% per annum. There was no standard mark-up in the first two quarters of 2022. Starting from 1 July 2022, Mr. Lai had a standard mark-up of 25% for normal sales. 61 M007 GP COGS = 28% 2 GP = Luris 1-4 A physical inventory taking was performed in the warehouse on 7 January 2023 and the inventory value was ascertained as $34 500 before the following adjustments: (3) A batch of defected goods invoiced at $10 800, being 10% off the normal selling price, was sent to a customer on a sale or return basis in December 2022. It was confirmed that two thirds of the goods had been accepted on 7 January 2023. (vi) During the period between 1 January and 7 January 2023, the following transactions occurred: (1) Goods with list price of $16 000 were purchased in cash and a 5% trade discount was received. (2) Credit sales of $24 000 were made at the normal mark-up, whereas credit sales of $18 000 were made after deducting 10% trade discounts. (vii) Mr. Lai withdraws goods of $500 on the 15th day of each month. (1) Some goods sold for $5 000 on 25 December 2022 were mistakenly included in the inventory list. (2) On 7 January 2023, Mr. Lai sent a lorry to collect a batch of goods invoiced at $1 300 returned from a credit customer. The goods were still in the lorry and not yet unloaded at the time of inventory taking. This batch of goods was sold on 2 January 2023. Prepare a statement to calculate the adjusted inventory value as at 7 January 2023. Prepare an income statement for the year ended 31 December 2022. (4 marks) (8 marks) (Total: 12 marks)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Adjusted Inventory Value as at 7 January 2023 Physical Inventory Value before adjustments 34500 De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started