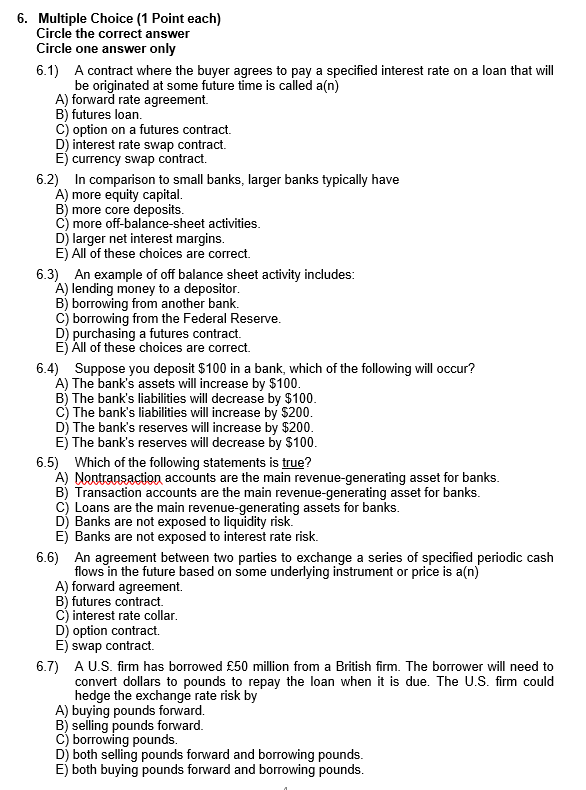

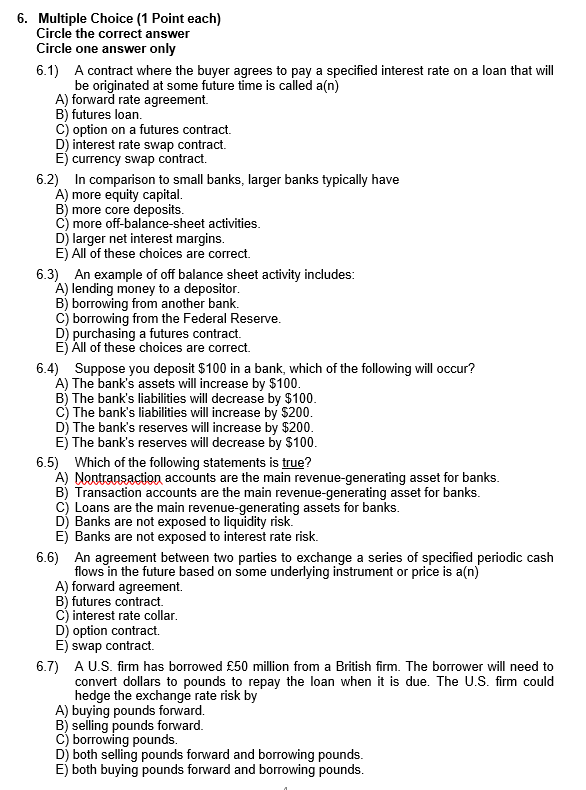

6. Multiple Choice (1 Point each) Circle the correct answer Circle one answer only 6.1) A contract where the buyer agrees to pay a specified interest rate on a loan that will be originated at some future time is called an) A) forward rate agreement. B) futures loan. C) option on a futures contract. D) interest rate swap contract. E) currency swap contract. 6.2) In comparison to small banks, larger banks typically have A) more equity capital. B) more core deposits. C) more off-balance-sheet activities. D) larger net interest margins. E) All of these choices are correct. 6.3) An example of off balance sheet activity includes: A) lending money to a depositor. B) borrowing from another bank. C) borrowing from the Federal Reserve. D) purchasing a futures contract. E) All of these choices are correct. 6.4) Suppose you deposit $100 in a bank, which of the following will occur? A) The bank's assets will increase by $100. B) The bank's liabilities will decrease by $100. C) The bank's liabilities will increase by $200. D) The bank's reserves will increase by $200. E) The bank's reserves will decrease by $100. 6.5) Which of the following statements is true? A) Nontransaction accounts are the main revenue-generating asset for banks. B) Transaction accounts are the main revenue-generating asset for banks. C) Loans are the main revenue-generating assets for banks. D) Banks are not exposed to liquidity risk. E) Banks are not exposed to interest rate risk. 6.6) An agreement between two parties to exchange a series of specified periodic cash flows in the future based on some underlying instrument or price is a(n) A) forward agreement. B) futures contract. C) interest rate collar. D) option contract. E) swap contract. 6.7) A U.S. firm has borrowed 50 million from a British firm. The borrower will need to convert dollars to pounds to repay the loan when it is due. The U.S. firm could hedge the exchange rate risk by A) buying pounds forward. B) selling pounds forward. C) borrowing pounds. D) both selling pounds forward and borrowing pounds. E) both buying pounds forward and borrowing pounds