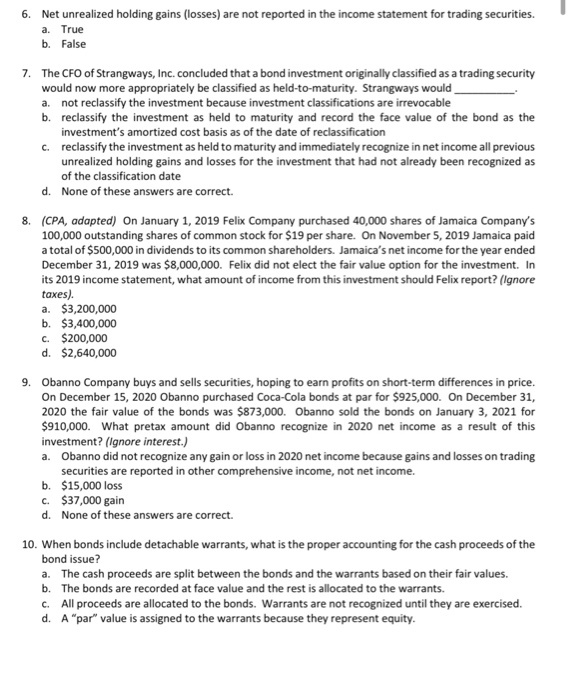

6. Net unrealized holding gains (losses) are not reported in the income statement for trading securities. a. True b. False 7. The CFO of Strangways, Inc. concluded that a bond investment originally classified as a trading security would now more appropriately be classified as held-to-maturity. Strangways would _ a. not reclassify the investment because investment classifications are irrevocable b. reclassify the investment as held to maturity and record the face value of the bond as the investment's amortized cost basis as of the date of reclassification c. reclassify the investment as held to maturity and immediately recognize in net income all previous unrealized holding gains and losses for the investment that had not already been recognized as of the classification date d. None of these answers are correct. 8. (CPA, adapted) On January 1, 2019 Felix Company purchased 40,000 shares of Jamaica Company's 100,000 outstanding shares of common stock for $19 per share. On November 5, 2019 Jamaica paid a total of $500,000 in dividends to its common shareholders. Jamaica's net income for the year ended December 31, 2019 was $8,000,000. Felix did not elect the fair value option for the investment. In its 2019 income statement, what amount of income from this investment should Felix report? (Ignore taxes) a. $3,200,000 b. $3,400,000 c. $200,000 d. $2,640,000 9. Obanno Company buys and sells securities, hoping to earn profits on short-term differences in price. On December 15, 2020 Obanno purchased Coca-Cola bonds at par for $925,000. On December 31, 2020 the fair value of the bonds was $873,000. Obanno sold the bonds on January 3, 2021 for $910,000. What pretax amount did Obanno recognize in 2020 net income as a result of this investment? (ignore interest.) a. Obanno did not recognize any gain or loss in 2020 net income because gains and losses on trading securities are reported in other comprehensive income, not net income. b. $15,000 loss C. $37,000 gain d. None of these answers are correct. 10. When bonds include detachable warrants, what is the proper accounting for the cash proceeds of the bond issue? a. The cash proceeds are split between the bonds and the warrants based on their fair values. b. The bonds are recorded at face value and the rest is allocated to the warrants. C. All proceeds are allocated to the bonds. Warrants are not recognized until they are exercised. d. A "par" value is assigned to the warrants because they represent equity