Answered step by step

Verified Expert Solution

Question

1 Approved Answer

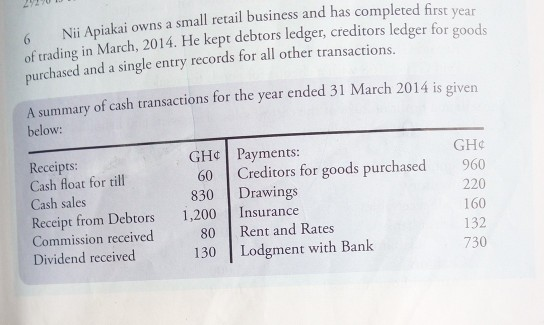

6 Nii Apiakai owns a small retail business and has completed first year of trading in March, 2014. He kept debtors ledger, creditors ledger for

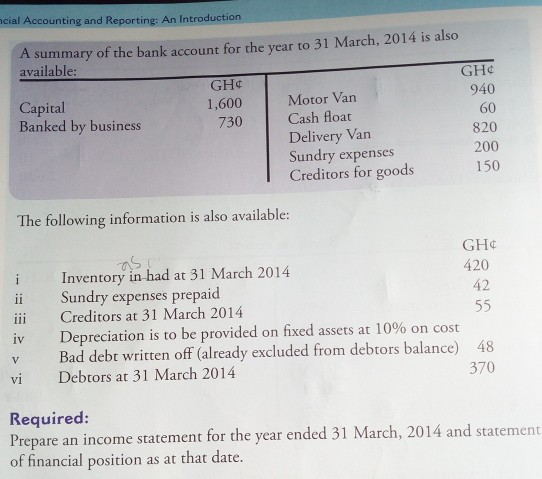

6 Nii Apiakai owns a small retail business and has completed first year of trading in March, 2014. He kept debtors ledger, creditors ledger for goods purchased and a single entry records for all other transactions. A summary of cash transactions for the year ended 31 March 2014 is given below: Receipts: Cash float for till Cash sales Receipt from Debtors Commission received Dividend received GH Payments: 60 Creditors for goods purchased 830 Drawings 1,200 Insurance 80 Rent and Rates 130 Lodgment with Bank GH 960 220 160 132 730 ncial Accounting and Reporting: An Introduction A summary of the bank account for the year to 31 March, 2014 is also available: GH GH Capital 940 1,600 Motor Van Banked by business 60 730 Cash float Delivery Van 820 Sundry expenses 200 Creditors for goods 150 The following information is also available: as ii 111 iv GH 420 Inventory in-had at 31 March 2014 Sundry expenses prepaid 42 Creditors at 31 March 2014 55 Depreciation is to be provided on fixed assets at 10% on cost Bad debt written off (already excluded from debtors balance) 48 Debtors at 31 March 2014 370 V vi Required: Prepare an income statement for the year ended 31 March, 2014 and statement of financial position as at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started