Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. NTS Inc. is investing in a new project that will generate expected cash flows of $10 starting in one year (t=1), which will

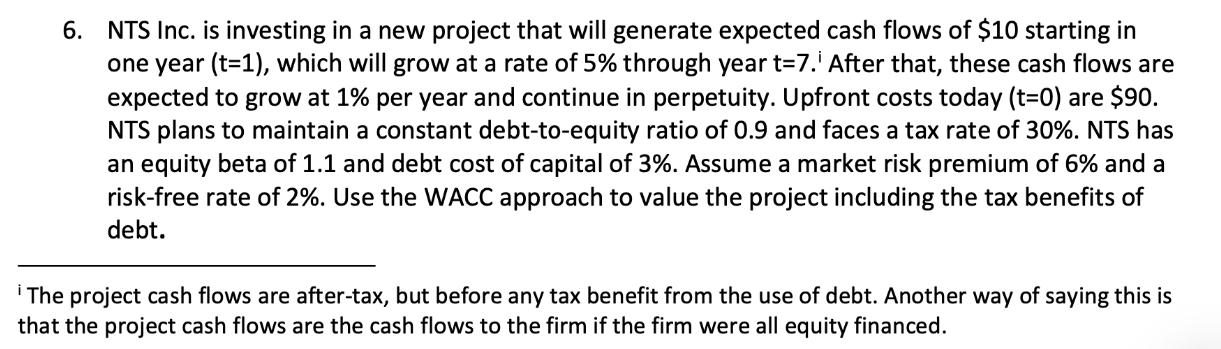

6. NTS Inc. is investing in a new project that will generate expected cash flows of $10 starting in one year (t=1), which will grow at a rate of 5% through year t=7. After that, these cash flows are expected to grow at 1% per year and continue in perpetuity. Upfront costs today (t=0) are $90. NTS plans to maintain a constant debt-to-equity ratio of 0.9 and faces a tax rate of 30%. NTS has an equity beta of 1.1 and debt cost of capital of 3%. Assume a market risk premium of 6% and a risk-free rate of 2%. Use the WACC approach to value the project including the tax benefits of debt. The project cash flows are after-tax, but before any tax benefit from the use of debt. Another way of saying this is that the project cash flows are the cash flows to the firm if the firm were all equity financed.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started