Answered step by step

Verified Expert Solution

Question

1 Approved Answer

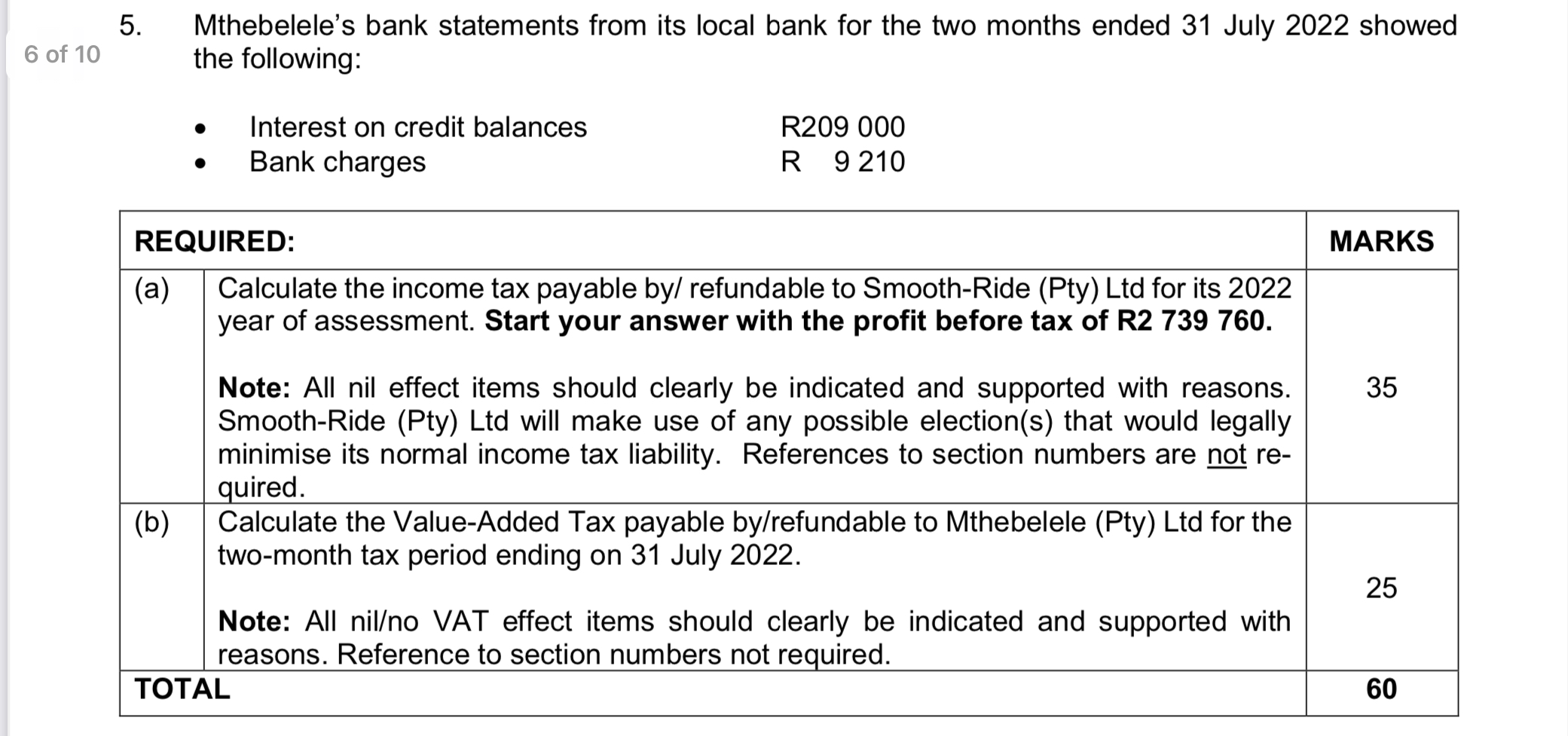

6 of 10 5. (a) Mthebelele's bank statements from its local bank for the two months ended 31 July 2022 showed the following: REQUIRED:

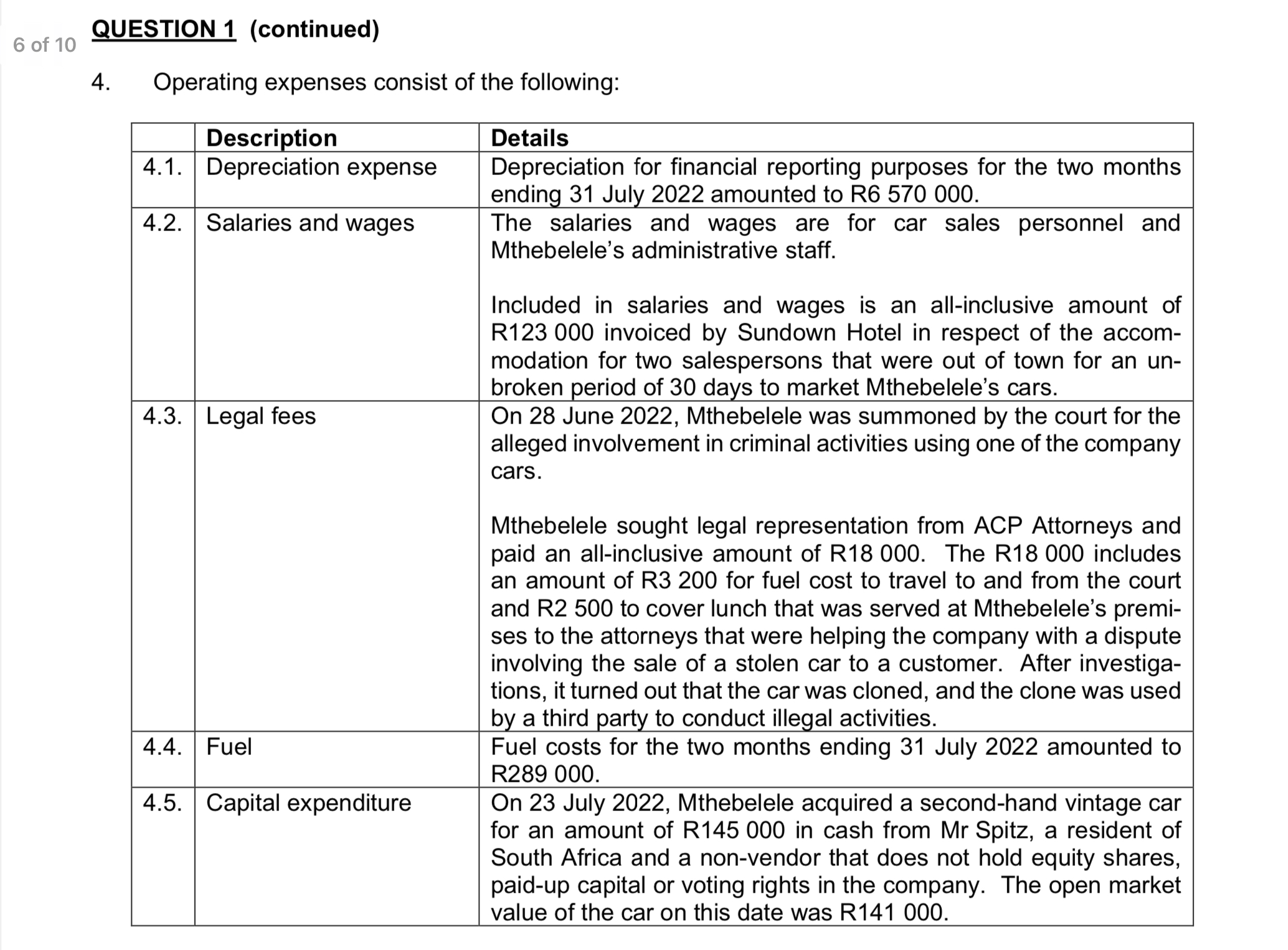

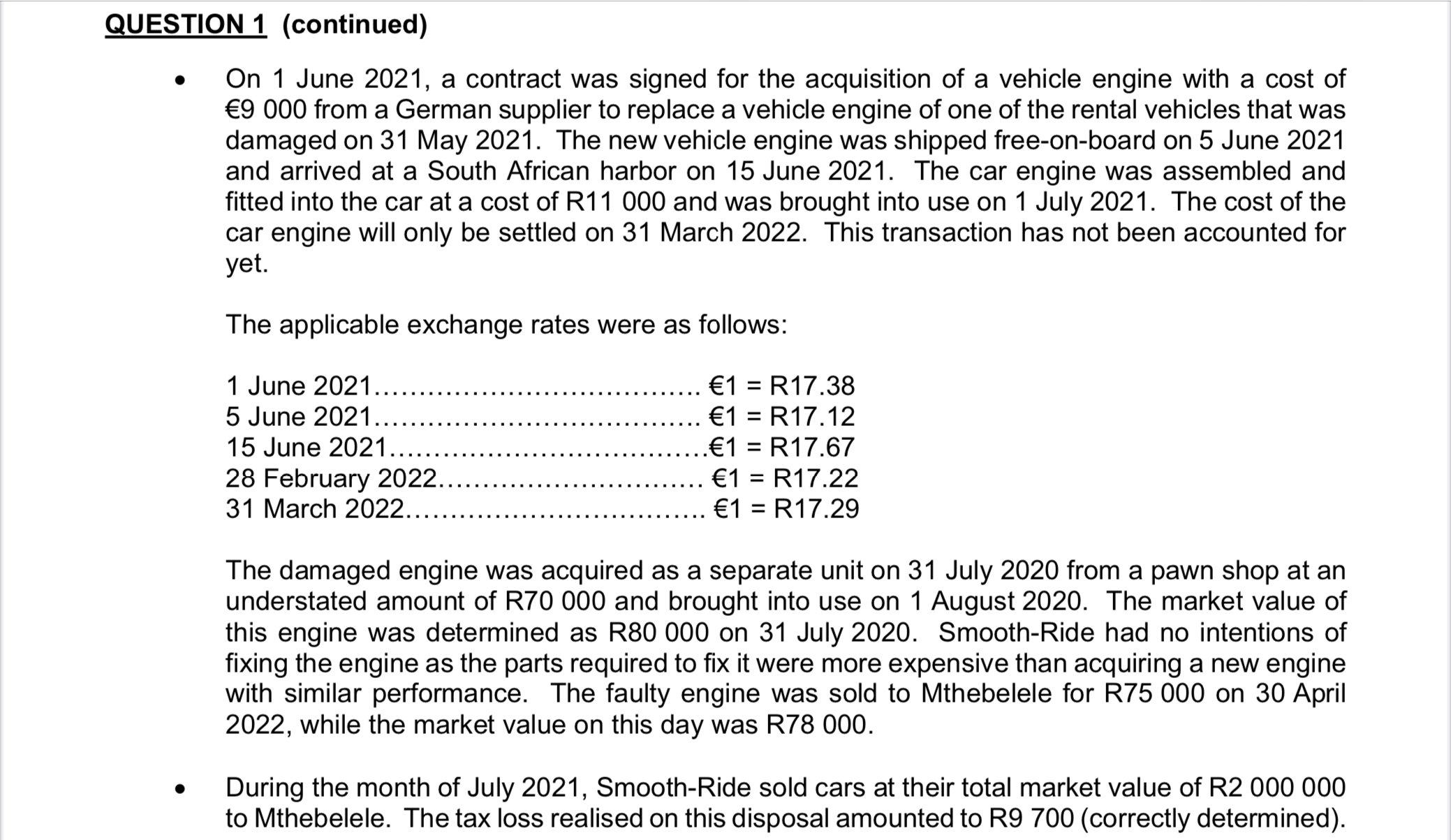

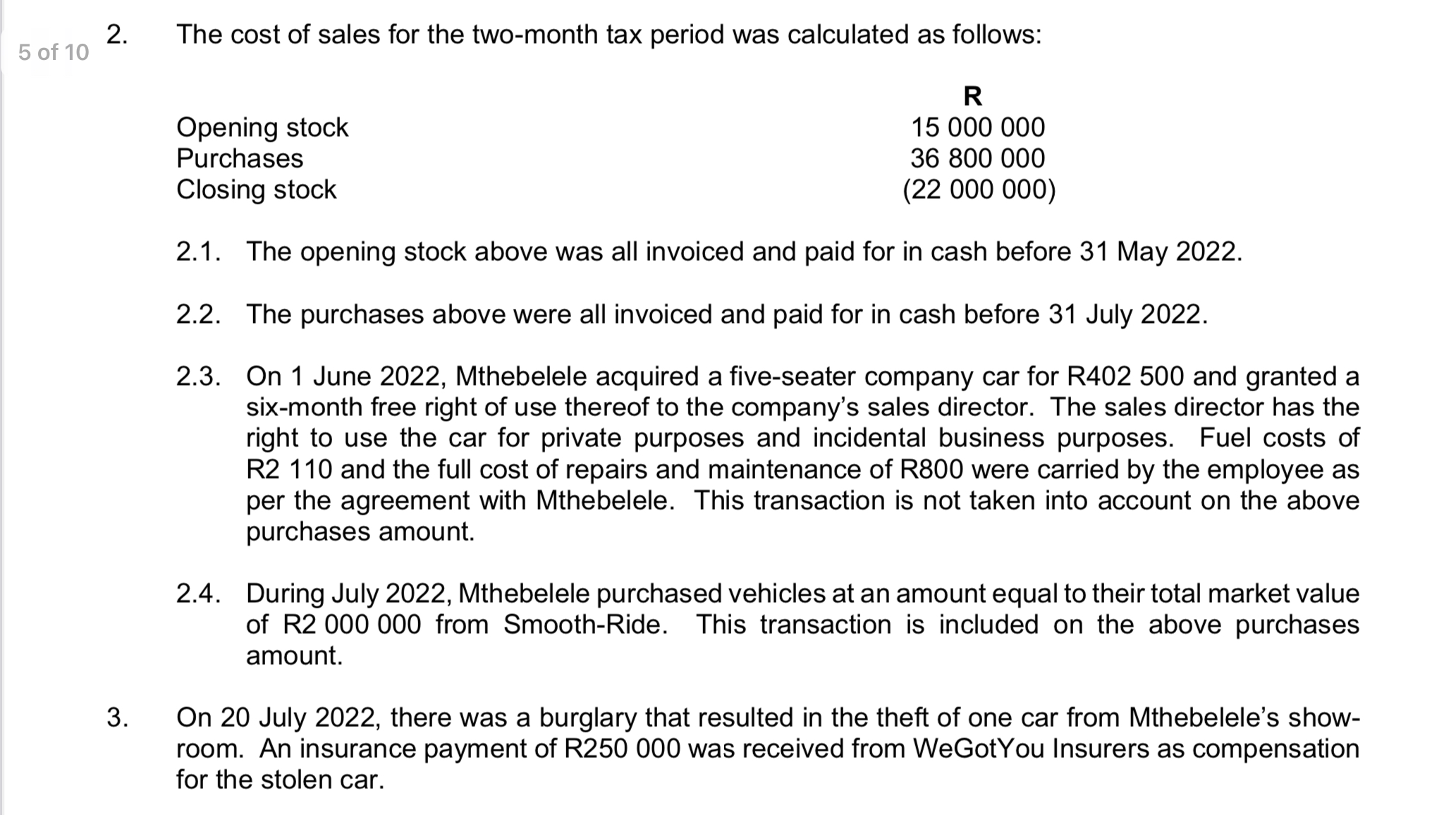

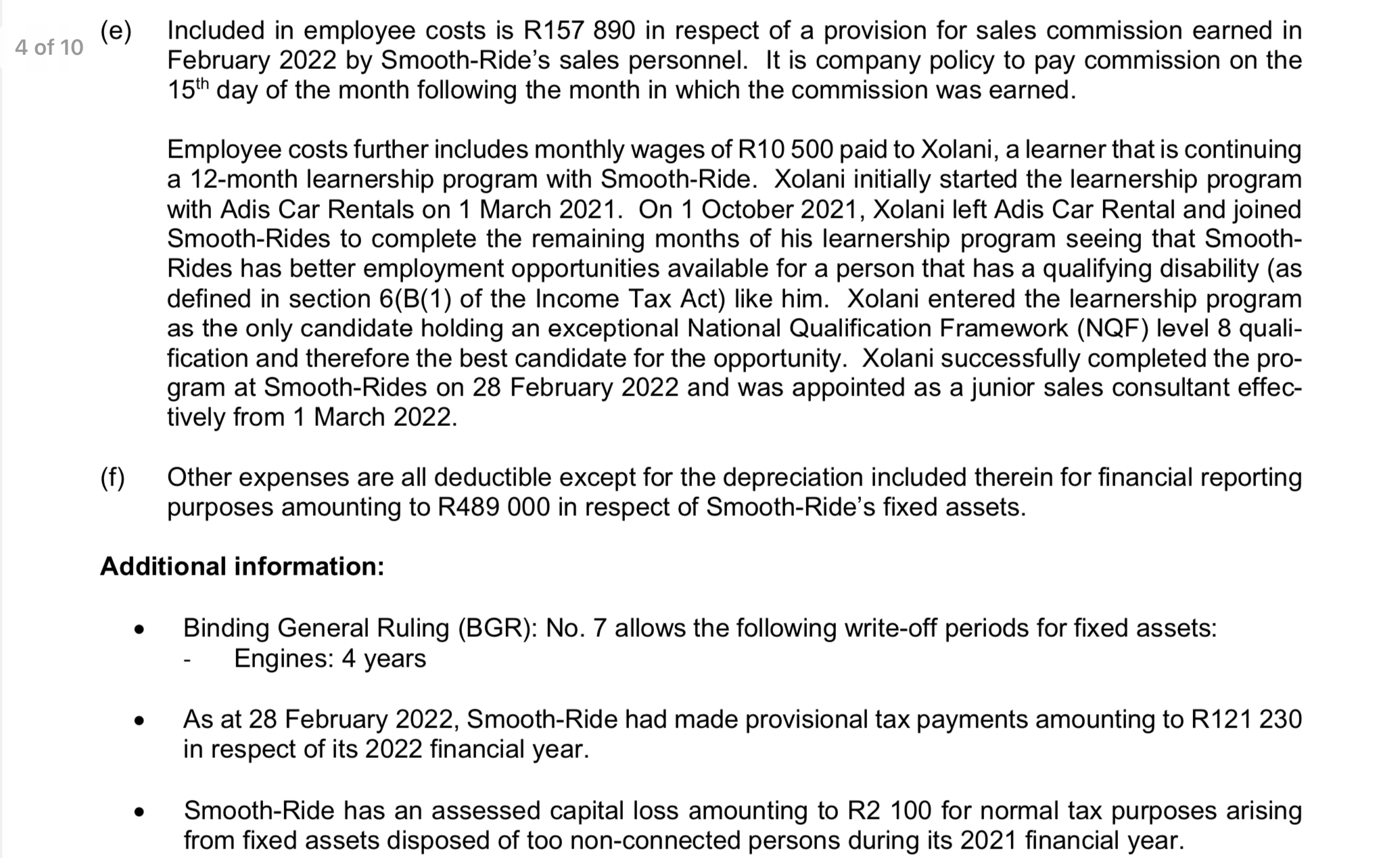

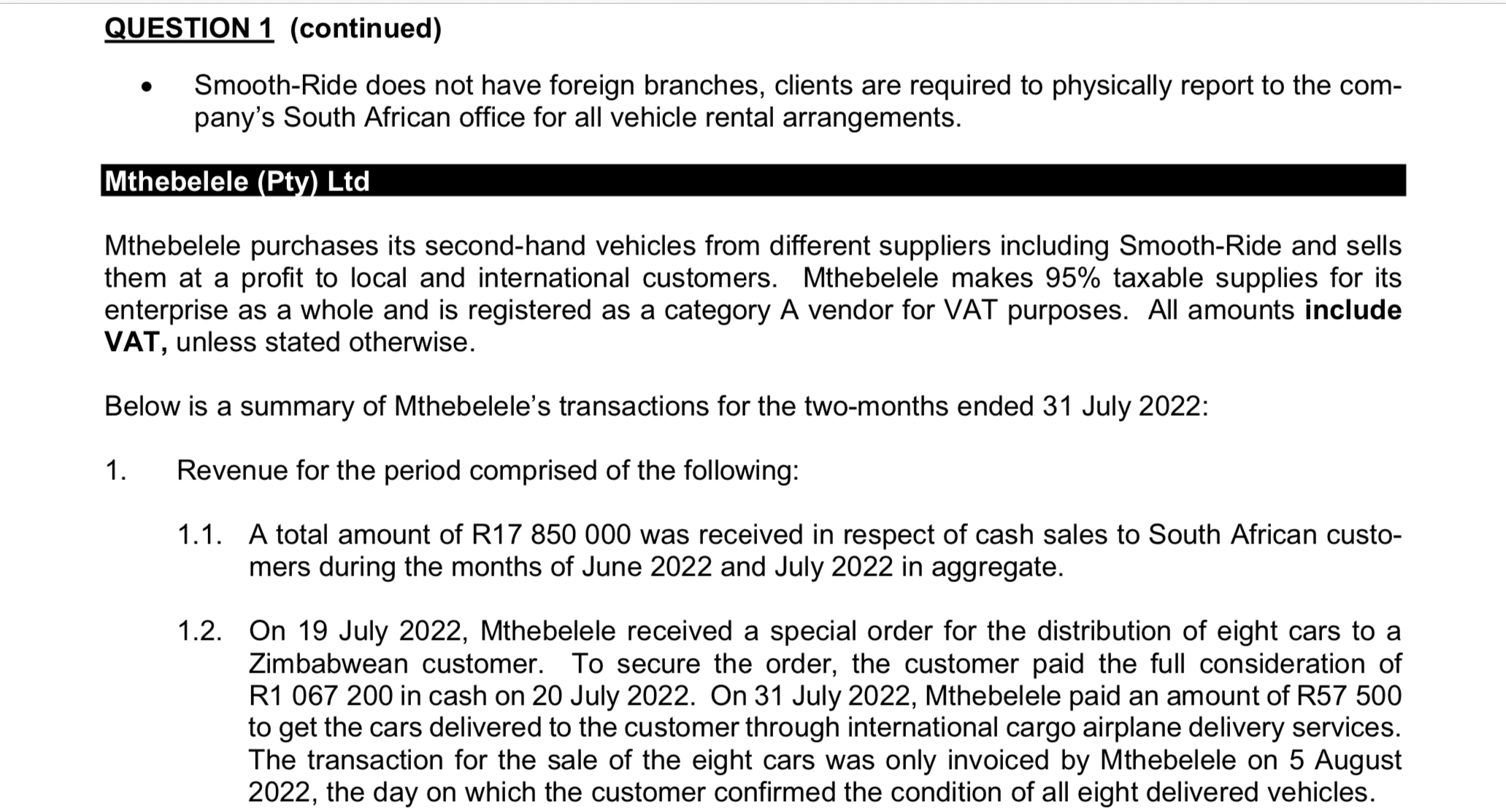

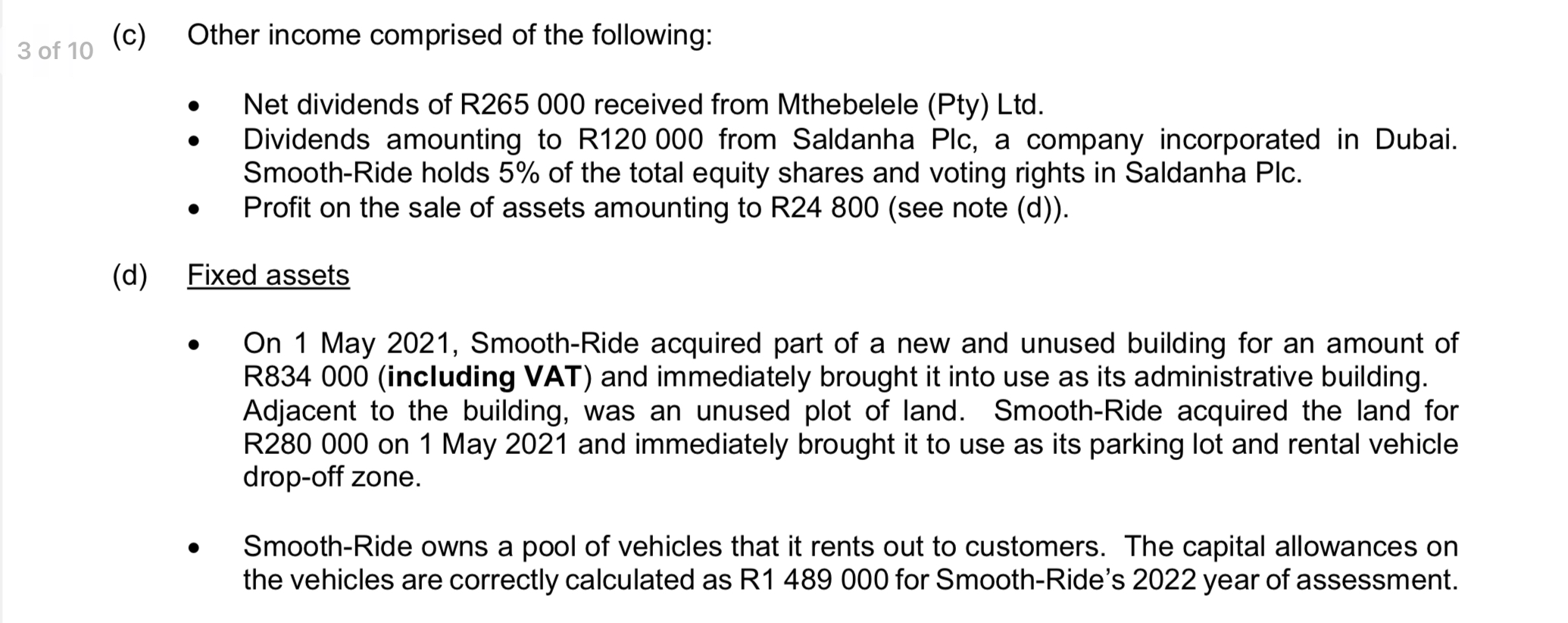

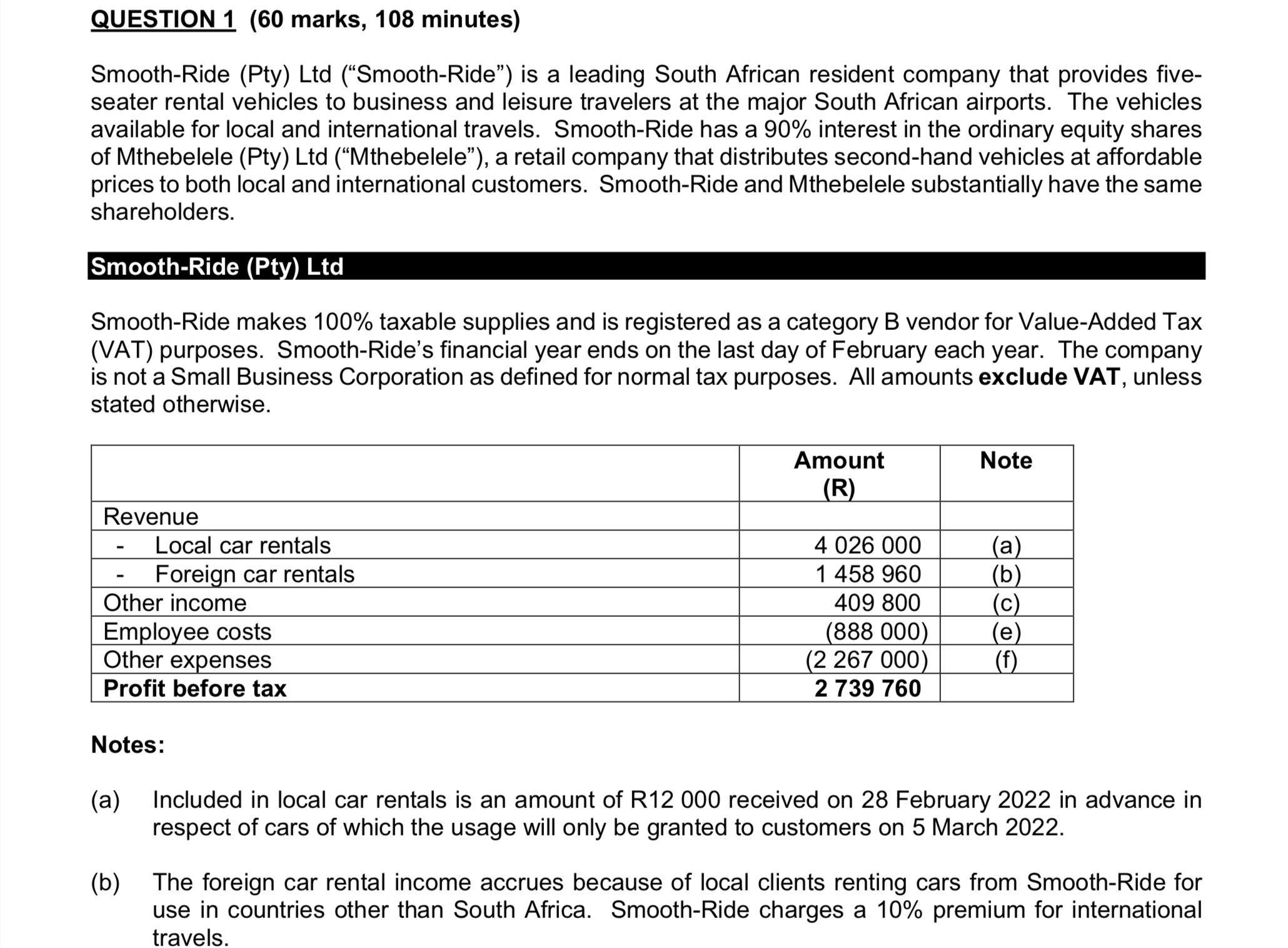

6 of 10 5. (a) Mthebelele's bank statements from its local bank for the two months ended 31 July 2022 showed the following: REQUIRED: (b) Interest on credit balances Bank charges R209 000 R 9 210 Calculate the income tax payable by/ refundable to Smooth-Ride (Pty) Ltd for its 2022 year of assessment. Start your answer with the profit before tax of R2 739 760. Note: All nil effect items should clearly be indicated and supported with reasons. Smooth-Ride (Pty) Ltd will make use of any possible election(s) that would legally minimise its normal income tax liability. References to section numbers are not re- quired. Calculate the Value-Added Tax payable by/refundable to Mthebelele (Pty) Ltd for the two-month tax period ending on 31 July 2022. TOTAL Note: All nil/no VAT effect items should clearly be indicated and supported with reasons. Reference to section numbers not required. MARKS 35 25 60 6 of 10 QUESTION 1 (continued) 4. Operating expenses consist of the following: Description 4.1. Depreciation expense 4.2. Salaries and wages 4.3. Legal fees 4.4. Fuel 4.5. Capital expenditure Details Depreciation for financial reporting purposes for the two months ending 31 July 2022 amounted to R6 570 000. The salaries and wages are for car sales personnel and Mthebelele's administrative staff. Included in salaries and wages is an all-inclusive amount of R123 000 invoiced by Sundown Hotel in respect of the accom- modation for two salespersons that were out of town for an un- broken period of 30 days to market Mthebelele's cars. On 28 June 2022, Mthebelele was summoned by the court for the alleged involvement in criminal activities using one of the company cars. Mthebelele sought legal representation from ACP Attorneys and paid an all-inclusive amount of R18 000. The R18 000 includes an amount of R3 200 for fuel cost to travel to and from the court and R2 500 to cover lunch that was served at Mthebelele's premi- ses to the attorneys that were helping the company with a dispute involving the sale of a stolen car to a customer. After investiga- tions, it turned out that the car was cloned, and the clone was used by a third party to conduct illegal activities. Fuel costs for the two months ending 31 July 2022 amounted to R289 000. On 23 July 2022, Mthebelele acquired a second-hand vintage car for an amount of R145 000 in cash from Mr Spitz, a resident of South Africa and a non-vendor that does not hold equity shares, paid-up capital or voting rights in the company. The open market value of the car on this date was R141 000. QUESTION 1 (continued) On 1 June 2021, a contract was signed for the acquisition of a vehicle engine with a cost of 9 000 from a German supplier to replace a vehicle engine of one of the rental vehicles that was damaged on 31 May 2021. The new vehicle engine was shipped free-on-board on 5 June 2021 and arrived at a South African harbor on 15 June 2021. The car engine was assembled and fitted into the car at a cost of R11 000 and was brought into use on 1 July 2021. The cost of the car engine will only be settled on 31 March 2022. This transaction has not been accounted for yet. The applicable exchange rates were as follows: 1 June 2021. 5 June 2021. 15 June 2021.. 28 February 2022. 31 March 2022... 1 = R17.38 1 = R17.12 .1 = R17.67 1 = R17.22 1 = R17.29 The damaged engine was acquired as a separate unit on 31 July 2020 from a pawn shop at an understated amount of R70 000 and brought into use on 1 August 2020. The market value of this engine was determined as R80 000 on 31 July 2020. Smooth-Ride had no intentions of fixing the engine as the parts required to fix it were more expensive than acquiring a new engine with similar performance. The faulty engine was sold to Mthebelele for R75 000 on 30 April 2022, while the market value on this day was R78 000. During the month of July 2021, Smooth-Ride sold cars at their total market value of R2 000 000 to Mthebelele. The tax loss realised on this disposal amounted to R9 700 (correctly determined). 5 of 10 2. 3. The cost of sales for the two-month tax period was calculated as follows: R 15 000 000 Opening stock Purchases Closing stock 36 800 000 (22 000 000) 2.1. The opening stock above was all invoiced and paid for in cash before 31 May 2022. 2.2. The purchases above were all invoiced and paid for in cash before 31 July 2022. 2.3. On 1 June 2022, Mthebelele acquired a five-seater company car for R402 500 and granted a six-month free right of use thereof to the company's sales director. The sales director has the right to use the car for private purposes and incidental business purposes. Fuel costs of R2 110 and the full cost of repairs and maintenance of R800 were carried by the employee as per the agreement with Mthebelele. This transaction is not taken into account on the above purchases amount. 2.4. During July 2022, Mthebelele purchased vehicles at an amount equal to their total market value of R2 000 000 from Smooth-Ride. This transaction is included on the above purchases amount. On 20 July 2022, there was a burglary that resulted in the theft of one car from Mthebelele's show- room. An insurance payment of R250 000 was received from WeGot You Insurers as compensation for the stolen car. 4 of 10 (e) (f) Included in employee costs is R157 890 in respect of a provision for sales commission earned in February 2022 by Smooth-Ride's sales personnel. It is company policy to pay commission on the 15th day of the month following the month in which the commission was earned. Employee costs further includes monthly wages of R10 500 paid to Xolani, a learner that is continuing a 12-month learnership program with Smooth-Ride. Xolani initially started the learnership program with Adis Car Rentals on 1 March 2021. On 1 October 2021, Xolani left Adis Car Rental and joined Smooth-Rides to complete the remaining months of his learnership program seeing that Smooth- Rides has better employment opportunities available for a person that has a qualifying disability (as defined in section 6(B(1) of the Income Tax Act) like him. Xolani entered the learnership program as the only candidate holding an exceptional National Qualification Framework (NQF) level 8 quali- fication and therefore the best candidate for the opportunity. Xolani successfully completed the pro- gram at Smooth-Rides on 28 February 2022 and was appointed as a junior sales consultant effec- tively from 1 March 2022. Other expenses are all deductible except for the depreciation included therein for financial reporting purposes amounting to R489 000 in respect of Smooth-Ride's fixed assets. Additional information: Binding General Ruling (BGR): No. 7 allows the following write-off periods for fixed assets: Engines: 4 years As at 28 February 2022, Smooth-Ride had made provisional tax payments amounting to R121 230 in respect of its 2022 financial year. Smooth-Ride has an assessed capital loss amounting to R2 100 for normal tax purposes arising from fixed assets disposed of too non-connected persons during its 2021 financial year. QUESTION 1 (continued) Smooth-Ride does not have foreign branches, clients are required to physically report to the com- pany's South African office for all vehicle rental arrangements. Mthebelele (Pty) Ltd Mthebelele purchases its second-hand vehicles from different suppliers including Smooth-Ride and sells them at a profit to local and international customers. Mthebelele makes 95% taxable supplies for its enterprise as a whole and is registered as a category A vendor for VAT purposes. All amounts include VAT, unless stated otherwise. Below is a summary of Mthebelele's transactions for the two-months ended 31 July 2022: Revenue for the period comprised of the following: 1.1. A total amount of R17 850 000 was received in respect of cash sales to South African custo- mers during the months of June 2022 and July 2022 in aggregate. 1. 1.2. On 19 July 2022, Mthebelele received a special order for the distribution of eight cars to a Zimbabwean customer. To secure the order, the customer paid the full consideration of R1 067 200 in cash on 20 July 2022. On 31 July 2022, Mthebelele paid an amount of R57 500 to get the cars delivered to the customer through international cargo airplane delivery services. The transaction for the sale of the eight cars was only invoiced by Mthebelele on 5 August 2022, the day on which the customer confirmed the condition of all eight delivered vehicles. 3 of 10 (c) (d) Other income comprised of the following: Net dividends of R265 000 received from Mthebelele (Pty) Ltd. Dividends amounting to R120 000 from Saldanha Plc, a company incorporated in Dubai. Smooth-Ride holds 5% of the total equity shares and voting rights in Saldanha Plc. Profit on the sale of assets amounting to R24 800 (see note (d)). Fixed assets On 1 May 2021, Smooth-Ride acquired part of a new and unused building for an amount of R834 000 (including VAT) and immediately brought it into use as its administrative building. Adjacent to the building, was an unused plot of land. Smooth-Ride acquired the land for R280 000 on 1 May 2021 and immediately brought it to use as its parking lot and rental vehicle drop-off zone. Smooth-Ride owns a pool of vehicles that it rents out to customers. The capital allowances on the vehicles are correctly calculated as R1 489 000 for Smooth-Ride's 2022 year of assessment. QUESTION 1 (60 marks, 108 minutes) Smooth-Ride (Pty) Ltd ("Smooth-Ride") is a leading South African resident company that provides five- seater rental vehicles to business and leisure travelers at the major South African airports. The vehicles available for local and international travels. Smooth-Ride has a 90% interest in the ordinary equity shares of Mthebelele (Pty) Ltd ("Mthebelele"), a retail company that distributes second-hand vehicles at affordable prices to both local and international customers. Smooth-Ride and Mthebelele substantially have the same shareholders. Smooth-Ride (Pty) Ltd Smooth-Ride makes 100% taxable supplies and is registered as a category B vendor for Value-Added Tax (VAT) purposes. Smooth-Ride's financial year ends on the last day of February each year. The company is not a Small Business Corporation as defined for normal tax purposes. All amounts exclude VAT, unless stated otherwise. Revenue - Local car rentals Foreign car rentals Other income Employee costs Other expenses Profit before tax Notes: (a) Amount (R) 4 026 000 1 458 960 409 800 (888 000) (2 267 000) 2 739 760 Note (a) (b) (c) (e) (f) Included in local car rentals is an amount of R12 000 received on 28 February 2022 in advance in respect of cars of which the usage will only be granted to customers on 5 March 2022. (b) The foreign car rental income accrues because of local clients renting cars from Smooth-Ride for use in countries other than South Africa. Smooth-Ride charges a 10% premium for international travels.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Income tax calculation Profit before tax R2739760 Add back Depreciat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started