Question

Fiduciary Liability: Thole vs. U.S. Bank I came across this Supreme Court decision and thought it might make for a good class discussion topic that

| Fiduciary Liability: Thole vs. U.S. Bank |

I came across this Supreme Court decision and thought it might make for a good class discussion topic that touches on defined benefit plans and fiduciary liability. This discussion is asking you to consider the case Thole vs U.S. Bank and see in you can identify possible breaches in fiduciary duty to the U.S. Bank defined benefit pension plan.

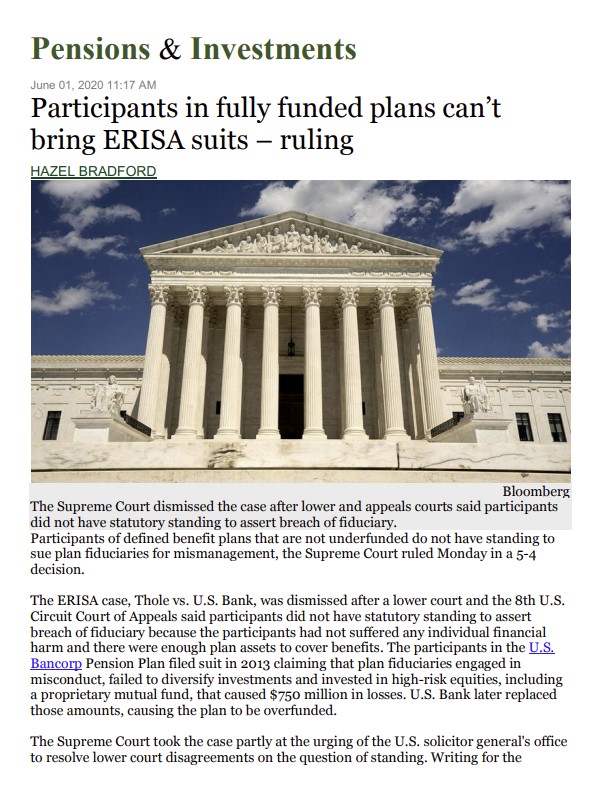

Paraphrased from the Cornell Law School Library website: Case Facts:Plaintiff James Thole and others brought a class action lawsuit against U.S. Bank and others over alleged mismanagement of a defined benefit pension plan between 2007 and 2010. The plaintiffs alleged that the defendants violated the Employee Retirement Income Security Act of 1974 (ERISA) by breaching their fiduciary duties and causing the plan to engage in prohibited transactions with a subsidiary company of U.S. Bank. Specifically, they claim that U.S. Bank usedits subsidiary to invest plan assets and thereby violated ERISA's duties of loyalty and prudence by self-dealing and making poor investment decisions ofthe plan assets.The plaintiffs argued that as a result of these prohibited transactions, the plan suffered significant losses and became underfunded in 2008 by $750 million. The defendants filed a motion to dismiss the complaint, which the district court granted in part. However, the court permitted the plaintiffs to proceed with their claim that the defendants engaged in a prohibited transaction by investing plan money usinga subsidiary. In 2014, with the parties still in litigation, the plan became overfunded; that is, it contained more money than was needed to meet its obligations. The defendants raised the argument that the plaintiffs had not suffered any financial lossand moved to dismiss the remainder of the action. Conclusion: 5 - 4 Decision for U.S. Bank Majority: Roberts, Thomas, Alito, Gorsuch and Kavanaugh Minority: Ginsburg, Breyer, Sotomayor and Kagan Article from Pension & Investments on the Thole vs. U.S. Bank decision - Pension & Investments: Participants in Fully Funded Plans Can't Bring ERISA Suits

Question:The Supreme Court's decision addressed the question of standing, not fiduciary liability . For this discussion, let's forget the standing consideration and focus on whether there was a fiduciary breach. Do you believe there was a fiduciary breach of duty on the part of the defendants? If so, identify the breach or breaches. If you believe there was no breach of fiduciary liability, what was the flaw in the plaintiffs argument? |

PermalinkReply

majority, Associate Justice Brett Kavanaugh said that because the plaintiffs "have no concrete stake in the lawsuit, they lack Article III standing... Win or lose, they would still receive the exact same monthly benefits they are already entitled to receive." Mr. Kavanaugh also said that "courts sometimes make standing law more complicated than it needs to be." Writing the dissent, Associate Justice Sonia Sotomayor said: "The Court holds that the Constitution prevents millions of pensioners from enforcing their rights to prudent and loyal management of their retirement trusts. Indeed, the Court determines that pensioners may not bring a federal lawsuit to stop or cure retirement-plan mismanagement until their pensions are on the verge of default. This conclusion conflicts with common sense and longstanding precedent." The decision was "surprising," since the Supreme Court typically rules "on the narrowest grounds possible," said Nancy Hendrickson, a partner with Kaufman Dolowich & Voluck LLPC. By ruling out standing in such cases, "participants in defined benefit plans are essentially left with no way to challenge or seek redress for improper actions taken by plan fiduciaries and could also have implications for other types of class actions, Ms. Hendrickson said in a statement. The ruling may limit participants' ability to sue fiduciaries before benefits are directly impacted, but investment decisions are still subject to legal action by the Department of Labor and fiduciaries are still bound by ERISA rules on prudence and diversification, said Adam Cohen, a partner with Eversheds Sutherland. "The ruling leaves the door open a small crack to participants who can plausibly allege that the mismanagement of the plan substantially increased the risk that future benefits would not be paid, "Mr. Cohen said in a separate statement. "This appears to be a high bar, but for employers with chronically underfunded plans, it could be a relevant consideration."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In examining the Thole vs US Bank case and considering fiduciary duty under ERISA its important to focus on whether there was indeed a breach of fiduc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started