Question

6. One goal of the proposal is to generate excess cash now that could potentially be used in the future for acquistions. What are the

6. One goal of the proposal is to generate excess cash now that could potentially be used in the future for acquistions. What are the pros and cons of raising the fund now rather than when needed?

7. Now consider the junk bond financing alternative.

a. Construct pro forma income statements for 1993 for the tow financing alternatives.

b. What are the times-interest-earned, fixed charge coverage, and cash flow coverage ratios under each alternative.

8. What should Rodriguez and Fulton's final decision be ? Fully support your answer. Are there any other financing alternatives that should be considered?

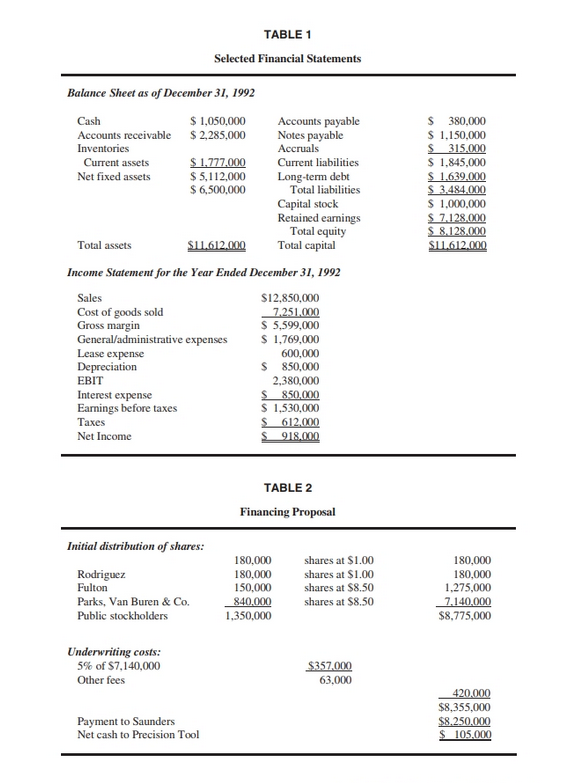

TABLE 1 Selected Financial Statements $ 380,000 $ 1.150.000 S 315.000 $ 1,845,000 $ 1,639.000 $ 3.484.000 $ 1,000,000 $ 7.128.000 $ 8.128.000 $11.612.000 Balance Sheet as of December 31, 1992 Cash $ 1,050,000 Accounts payable Accounts receivable $2,285,000 Notes payable Inventories Accruals Current assets $ 1.777.000 Current liabilities Net fixed assets $5,112,000 Long-term debt $6,500,000 Total liabilities Capital stock Retained earnings Total equity Total assets $11.612.000 Total capital Income Statement for the Year Ended December 31, 1992 Sales $12.850,000 Cost of goods sold 7.251.000 Gross margin $ 5,599,000 General/administrative expenses $ 1,769,000 Lease expense 600,000 Depreciation $ 850,000 EBIT 2,380,000 Interest expense S850,000 Earnings before taxes $ 1,530,000 Taxes 612.000 Net Income 918.000 TABLE 2 Financing Proposal Initial distribution of shares: Rodriguez Fulton Parks, Van Buren & Co. Public stockholders 180,000 180,000 150,000 840,000 1,350,000 shares at $1.00 shares at $1.00 shares at $8.50 shares at $8.50 180,000 180,000 1.275,000 7.140,000 $8,775,000 Underwriting costs: 5% of S7,140,000 Other fees S357.000 63.000 Payment to Saunders Net cash to Precision Tool 420.000 $8.355,000 $8,250,000 $ 105,000 TABLE 1 Selected Financial Statements $ 380,000 $ 1.150.000 S 315.000 $ 1,845,000 $ 1,639.000 $ 3.484.000 $ 1,000,000 $ 7.128.000 $ 8.128.000 $11.612.000 Balance Sheet as of December 31, 1992 Cash $ 1,050,000 Accounts payable Accounts receivable $2,285,000 Notes payable Inventories Accruals Current assets $ 1.777.000 Current liabilities Net fixed assets $5,112,000 Long-term debt $6,500,000 Total liabilities Capital stock Retained earnings Total equity Total assets $11.612.000 Total capital Income Statement for the Year Ended December 31, 1992 Sales $12.850,000 Cost of goods sold 7.251.000 Gross margin $ 5,599,000 General/administrative expenses $ 1,769,000 Lease expense 600,000 Depreciation $ 850,000 EBIT 2,380,000 Interest expense S850,000 Earnings before taxes $ 1,530,000 Taxes 612.000 Net Income 918.000 TABLE 2 Financing Proposal Initial distribution of shares: Rodriguez Fulton Parks, Van Buren & Co. Public stockholders 180,000 180,000 150,000 840,000 1,350,000 shares at $1.00 shares at $1.00 shares at $8.50 shares at $8.50 180,000 180,000 1.275,000 7.140,000 $8,775,000 Underwriting costs: 5% of S7,140,000 Other fees S357.000 63.000 Payment to Saunders Net cash to Precision Tool 420.000 $8.355,000 $8,250,000 $ 105,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started