Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 Palak has reviewed his policy for the depreciation of computers. He has decided to change from the straight line method to the reducing balance

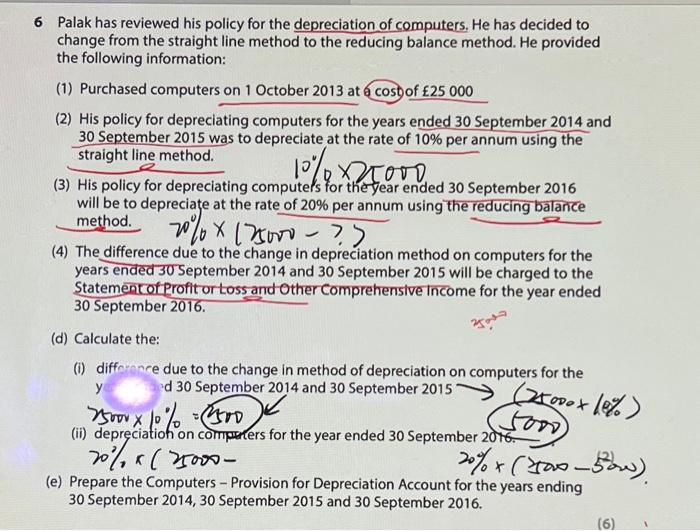

6 Palak has reviewed his policy for the depreciation of computers. He has decided to change from the straight line method to the reducing balance method. He provided the following information: (1) Purchased computers on 1 October 2013 at a cost of 25 000 (2) His policy for depreciating computers for the years ended 30 September 2014 and 30 September 2015 was to depreciate at the rate of 10% per annum using the straight line method. 10% (3) His policy for depreciating computers for the year ended 30 September 2016 will be to depreciate at the rate of 20% per annum using the reducing balance method. 70 % x 125000 - ?) ?> (4) The difference due to the change in depreciation method on computers for the years ended 30 September 2014 and 30 September 2015 will be charged to the Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2016. (d) Calculate the: (i) difference due to the change in method of depreciation on computers for the (2000x Joo 2 y 25000 x 10% = 1500 d 30 September 2014 and 30 September 2015 (0%) -Todo (ii) depreciation on computers for the year ended 30 September 2016. 20% x(25000- 20% x (Hox-50w) (e) Prepare the Computers - Provision for Depreciation Account for the years ending 30 September 2014, 30 September 2015 and 30 September 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started