Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 Part 2 of 3 points Skipped eBook Ask Print References Required information [The following information applies to the questions displayed below.] Sub Station and

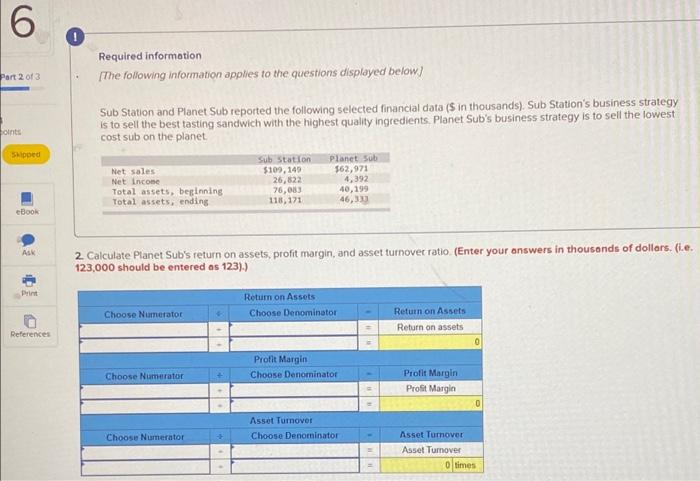

6 Part 2 of 3 points Skipped eBook Ask Print References Required information [The following information applies to the questions displayed below.] Sub Station and Planet Sub reported the following selected financial data ($ in thousands). Sub Station's business strategy is to sell the best tasting sandwich with the highest quality ingredients. Planet Sub's business strategy is to sell the lowest cost sub on the planet. Net sales Net income Total assets, beginning Total assets, ending Choose Numerator Choose Numerator 2. Calculate Planet Sub's return on assets, profit margin, and asset turnover ratio. (Enter your answers in thousands of dollars. (i.e. 123,000 should be entered as 123).) Choose Numerator Sub Station $109, 149 26,822 76,083 118, 171 Planet Sub $62,971 4,392 40,199 46,333 Return on Assets Choose Denominator Profit Margin Choose Denominator Asset Turnover Choose Denominator E 11 11 = Return on Assets Return on assets Profit Margin Profit Margin Asset Turnover Asset Turnover 0 0 0 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started