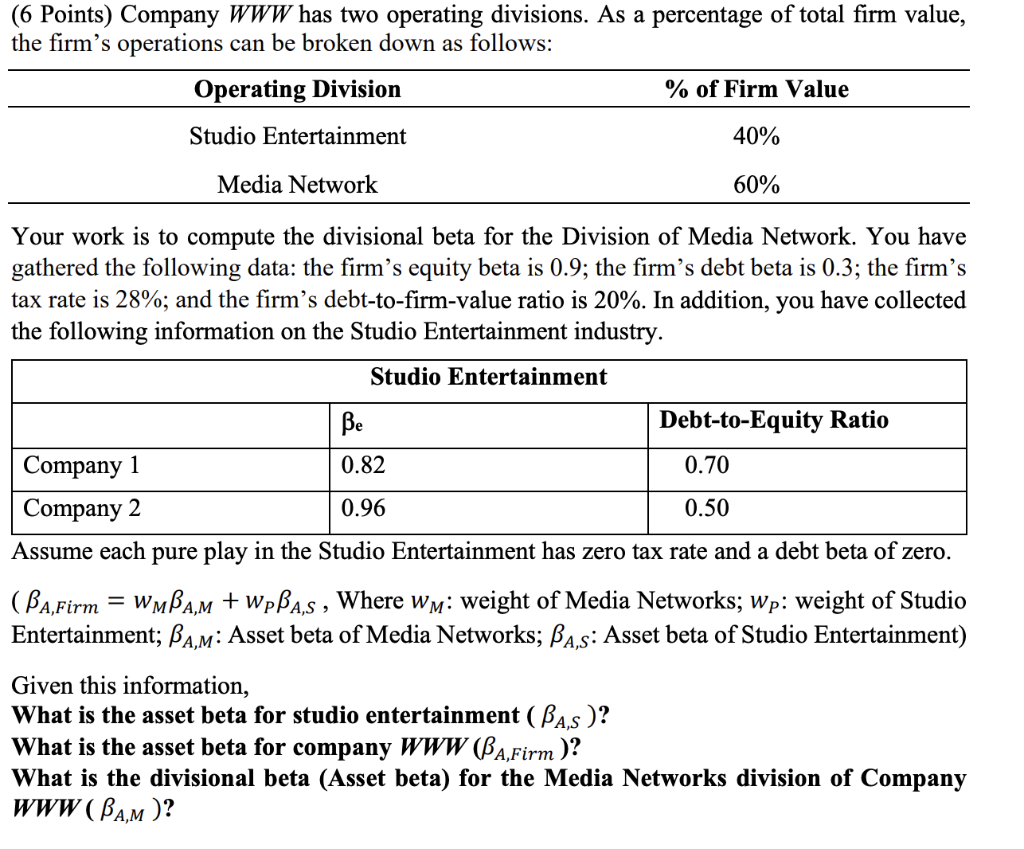

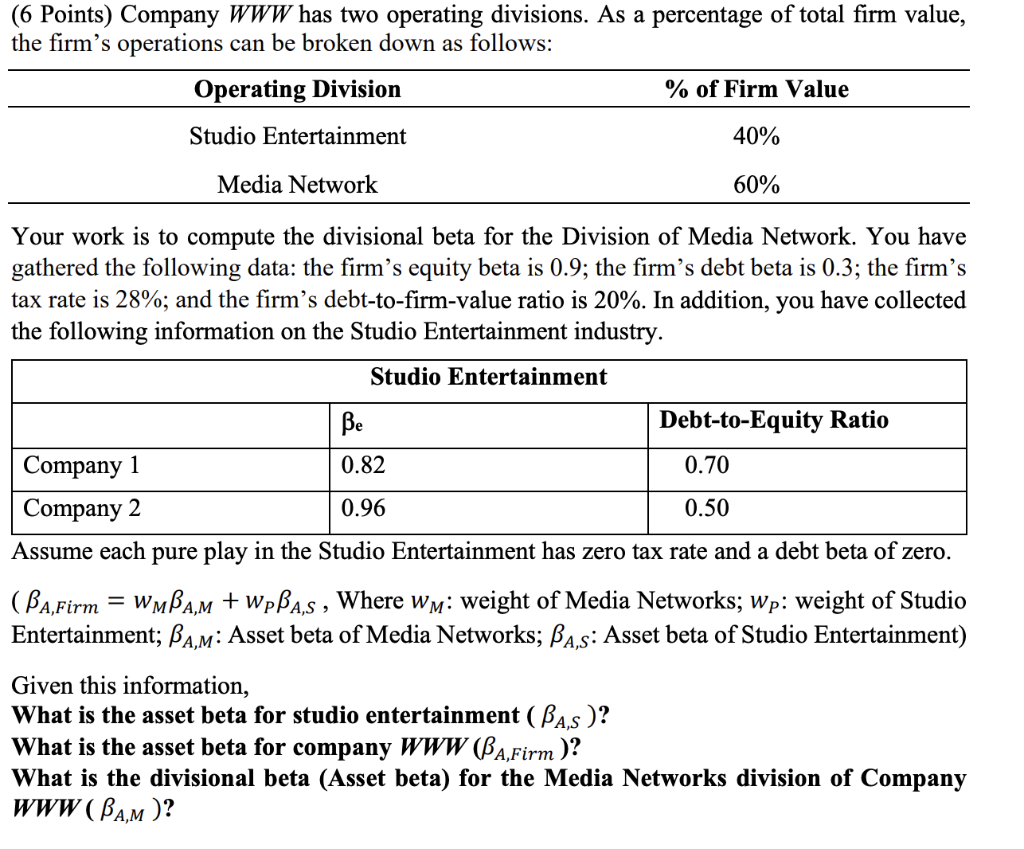

(6 Points) Company WWW has two operating divisions. As a percentage of total firm value, the firm's operations can be broken down as follows: Operating Division % of Firm Value Studio Entertainment 40% Media Network 60% Your work is to compute the divisional beta for the Division of Media Network. You have gathered the following data: the firm's equity beta is 0.9; the firm's debt beta is 0.3; the firm's tax rate is 28%; and the firm's debt-to-firm-value ratio is 20%. In addition, you have collected the following information on the Studio Entertainment industry. Studio Entertainment e Debt-to-Equity Ratio Company 1 0.82 0.70 Company 2 0.96 0.50 Assume each pure play in the Studio Entertainment has zero tax rate and a debt beta of zero. (BA,Firm = WMBA,M + wpa,s , Where Wm: weight of Media Networks; Wp: weight of Studio Entertainment; Ba,m: Asset beta of Media Networks; BA,s: Asset beta of Studio Entertainment) Given this information, What is the asset beta for studio entertainment (BA,s )? What is the asset beta for company WWW (PA,Firm )? What is the divisional beta (Asset beta) for the Media Networks division of Company WWW (BAM)? (6 Points) Company WWW has two operating divisions. As a percentage of total firm value, the firm's operations can be broken down as follows: Operating Division % of Firm Value Studio Entertainment 40% Media Network 60% Your work is to compute the divisional beta for the Division of Media Network. You have gathered the following data: the firm's equity beta is 0.9; the firm's debt beta is 0.3; the firm's tax rate is 28%; and the firm's debt-to-firm-value ratio is 20%. In addition, you have collected the following information on the Studio Entertainment industry. Studio Entertainment e Debt-to-Equity Ratio Company 1 0.82 0.70 Company 2 0.96 0.50 Assume each pure play in the Studio Entertainment has zero tax rate and a debt beta of zero. (BA,Firm = WMBA,M + wpa,s , Where Wm: weight of Media Networks; Wp: weight of Studio Entertainment; Ba,m: Asset beta of Media Networks; BA,s: Asset beta of Studio Entertainment) Given this information, What is the asset beta for studio entertainment (BA,s )? What is the asset beta for company WWW (PA,Firm )? What is the divisional beta (Asset beta) for the Media Networks division of Company WWW (BAM)