Answered step by step

Verified Expert Solution

Question

1 Approved Answer

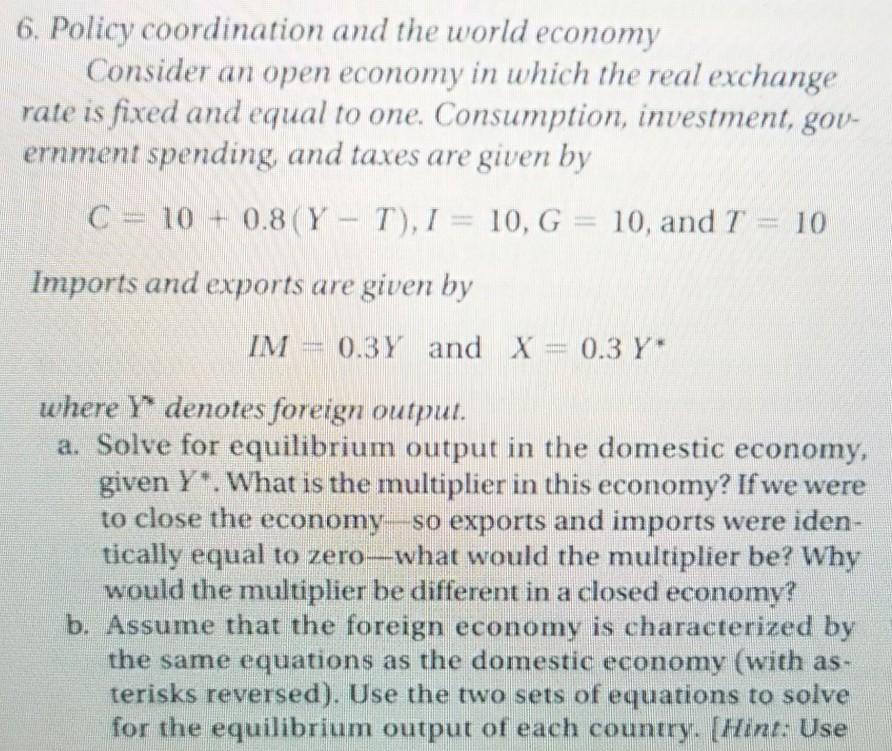

6. Policy coordination and the world economy Consider an open economy in which the real exchange rate is fixed and equal to one. Consumption,

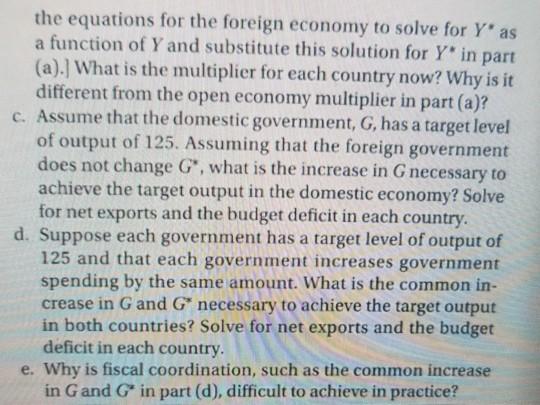

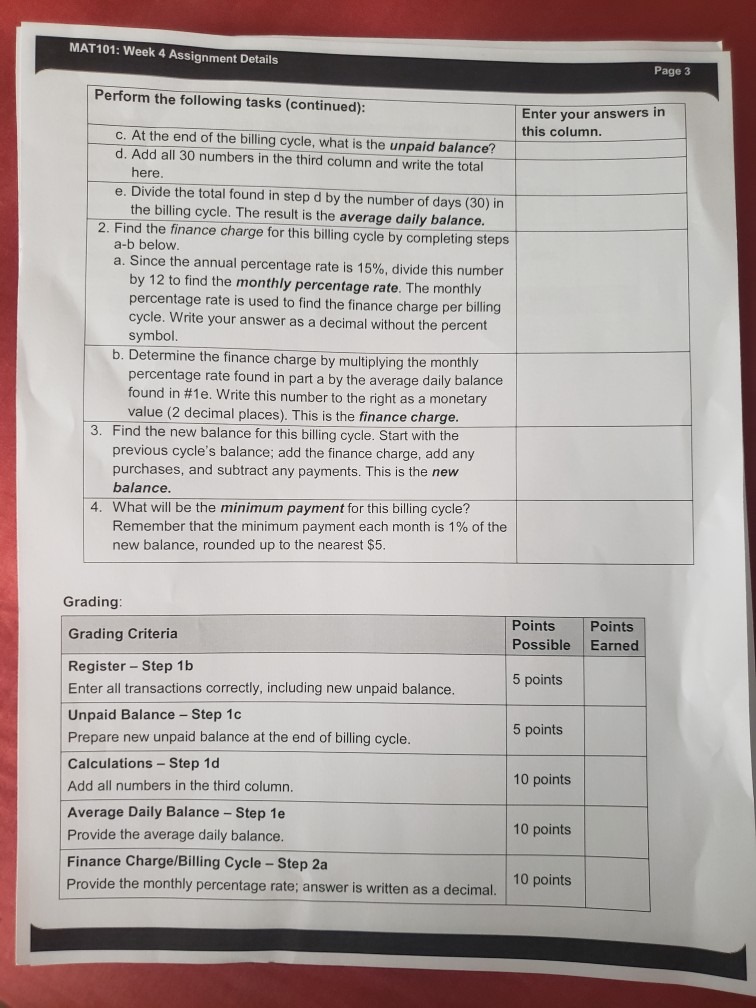

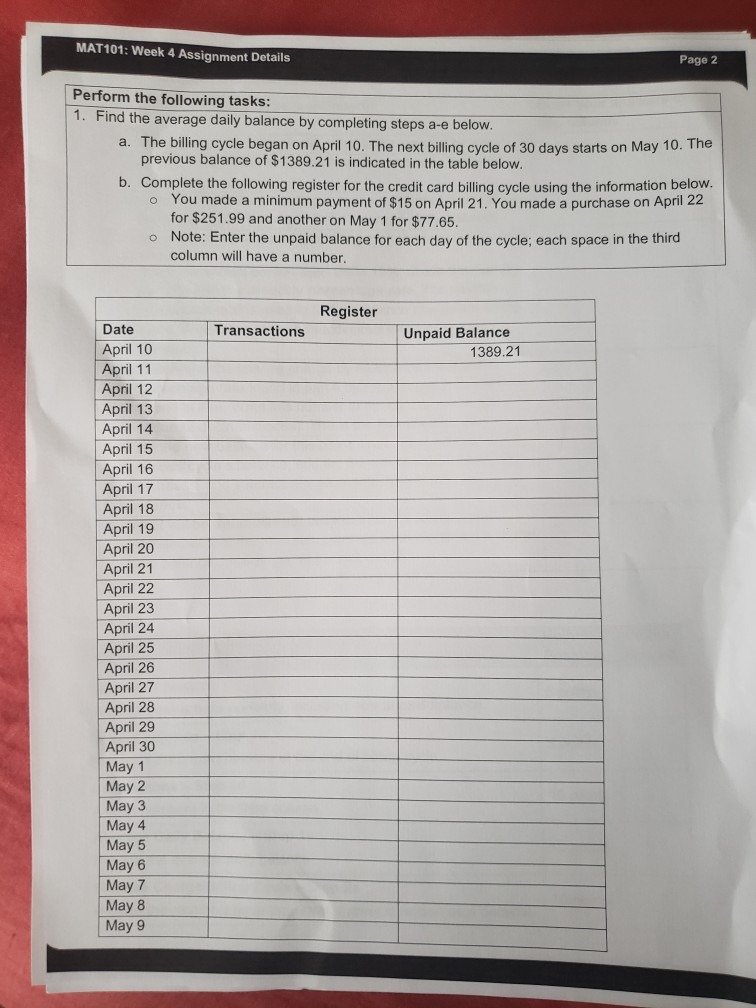

6. Policy coordination and the world economy Consider an open economy in which the real exchange rate is fixed and equal to one. Consumption, investment, gov- ernment spending, and taxes are given by C 10+ 0.8 (YT), I = 10, G = 10, and T = 10 Imports and exports are given by IM 0.3Y and X = 0.3 Y* where Y denotes foreign output. a. Solve for equilibrium output in the domestic economy, given Y. What is the multiplier in this economy? If we were to close the economy- so exports and imports were iden- tically equal to zero-what would the multiplier be? Why would the multiplier be different in a closed economy? b. Assume that the foreign economy is characterized by the same equations as the domestic economy (with as- terisks reversed). Use the two sets of equations to solve for the equilibrium output of each country. [Hint: Use the equations for the foreign economy to solve for Y* as a function of Y and substitute this solution for Y* in part (a).] What is the multiplier for each country now? Why is it different from the open economy multiplier in part (a)? c. Assume that the domestic government, G, has a target level of output of 125. Assuming that the foreign government does not change G", what is the increase in G necessary to achieve the target output in the domestic economy? Solve for net exports and the budget deficit in each country. d. Suppose each government has a target level of output of 125 and that each government increases government spending by the same amount. What is the common in- crease in G and G* necessary to achieve the target output in both countries? Solve for net exports and the budget deficit in each country. e. Why is fiscal coordination, such as the common increase in Gand G' in part (d), difficult to achieve in practice? ( B. All businesses, regardless of their legal form of organization, are taxed under the Business Tax Provisions of the Internal Revenue Code. 32. ( C. Small corporations that qualify under the Tax Code can elect not to pay corporate taxes, but then each stockholder must report his or her pro rata shares of the firm's income as personal income and pay taxes on that income. D. Congress recently changed the tax laws to make dividend income received by individuals exempt from income taxes. Prior to the enactment of that law, corporate income was subject to double taxation, where the firm was first taxed on the corporation's income and stockholders were taxed again on this income when it was paid to them as dividends. E. All corporations other than non-profits are subject to corporate income taxes, which are 15% for the lowest amounts of income and 38% for the highest income amounts. ) (3-2) Balance sheet 33. ( ( 35. Bauer Software's current balance sheet shows total common equity of $5,125,000. The company has 530,000 shares of stock outstanding, and they sell at a price of $27.50 per share. By how much do the firm's market and book values per share differ? A. $17.83 B. $18.72 C. $19.66 D. $20.64. E $21.67 ) (3-3) Income statement Brown Office Supplies recently reported $15,500 of sales, $8,250 of operating costs other than depreciation, and $1,750 of depreciation. It had $9,000 of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's earnings before taxes (EBT)? A. $4,627 B. $4,870 C. $5,114 D. $5.369 E. $5,638 )(3-8) MVA Hayes Corporation has $300 million of common equity, with 6 million shares of common stock outstanding. If Hayes' Market Value Added (MVA) is $162 million, what is the company's stock price? A. $66.02 B. $69.49 C. $73.15 D. $77.00 ) (3-9) Corporate taxes Your corporation has the following cash flows: Operating income Interest received Interest paid Dividends received Dividends paid E. $80.85 $250,000 $ 10,000 $ 45,000 $ 20,000 $ 50,000 If the applicable income tax rate is 40% (federal and state combined), and if 70% of dividends received are exempt from taxes, what is the corporation's tax liability? A. $ 83,980 B. $ 88,400 C.$ 92,820 D. $97,461 E. $102,334. ) (3-9) Carry-back, carry-forward MAT101: Week 4 Assignment Details Perform the following tasks (continued): c. At the end of the billing cycle, what is the unpaid balance? d. Add all 30 numbers in the third column and write the total here. e. Divide the total found in step d by the number of days (30) in the billing cycle. The result is the average daily balance. 2. Find the finance charge for this billing cycle by completing steps a-b below. a. Since the annual percentage rate is 15%, divide this number by 12 to find the monthly percentage rate. The monthly percentage rate is used to find the finance charge per billing cycle. Write your answer as a decimal without the percent symbol. b. Determine the finance charge by multiplying the monthly percentage rate found in part a by the average daily balance found in #1e. Write this number to the right as a monetary value (2 decimal places). This is the finance charge. 3. Find the new balance for this billing cycle. Start with the previous cycle's balance; add the finance charge, add any purchases, and subtract any payments. This is the new balance. 4. What will be the minimum payment for this billing cycle? Remember that the minimum payment each month is 1% of the new balance, rounded up to the nearest $5. Grading: Grading Criteria Register - Step 1b Enter all transactions correctly, including new unpaid balance. Unpaid Balance - Step 1c Prepare new unpaid balance at the end of billing cycle. Calculations - Step 1d Add all numbers in the third column. Average Daily Balance - Step 1e Provide the average daily balance. Finance Charge/Billing Cycle - Step 2a Provide the monthly percentage rate; answer is written as a decimal. Enter your answers in this column. Points Possible 5 points 5 points 10 points 10 points 10 points Page 3 Points Earned MAT101: Week 4 Assignment Details Perform the following tasks: 1. Find the average daily balance by completing steps a-e below. a. The billing cycle began on April 10. The next billing cycle of 30 days starts on May 10. The previous balance of $1389.21 is indicated in the table below. b. Complete the following register for the credit card billing cycle using the information below. o You made a minimum payment of $15 on April 21. You made a purchase on April 22 for $251.99 and another on May 1 for $77.65. o Note: Enter the unpaid balance for each day of the cycle; each space in the third column will have a number. Date April 10 April 11 April 12 April 13 April 14 April 15 April 16 April 17 April 18 April 19 April 20 April 21 April 22 April 23 April 24 April 25 April 26 April 27 April 28 April 29 April 30 May 1 May 2 May 3 May 4 May 5 May 6 May 7 May 8 May 9 Transactions Page 2 Register Unpaid Balance 1389.21

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the corporate tax questions with explanations and calculations where needed 35 Your corporation has the following cash flows O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started