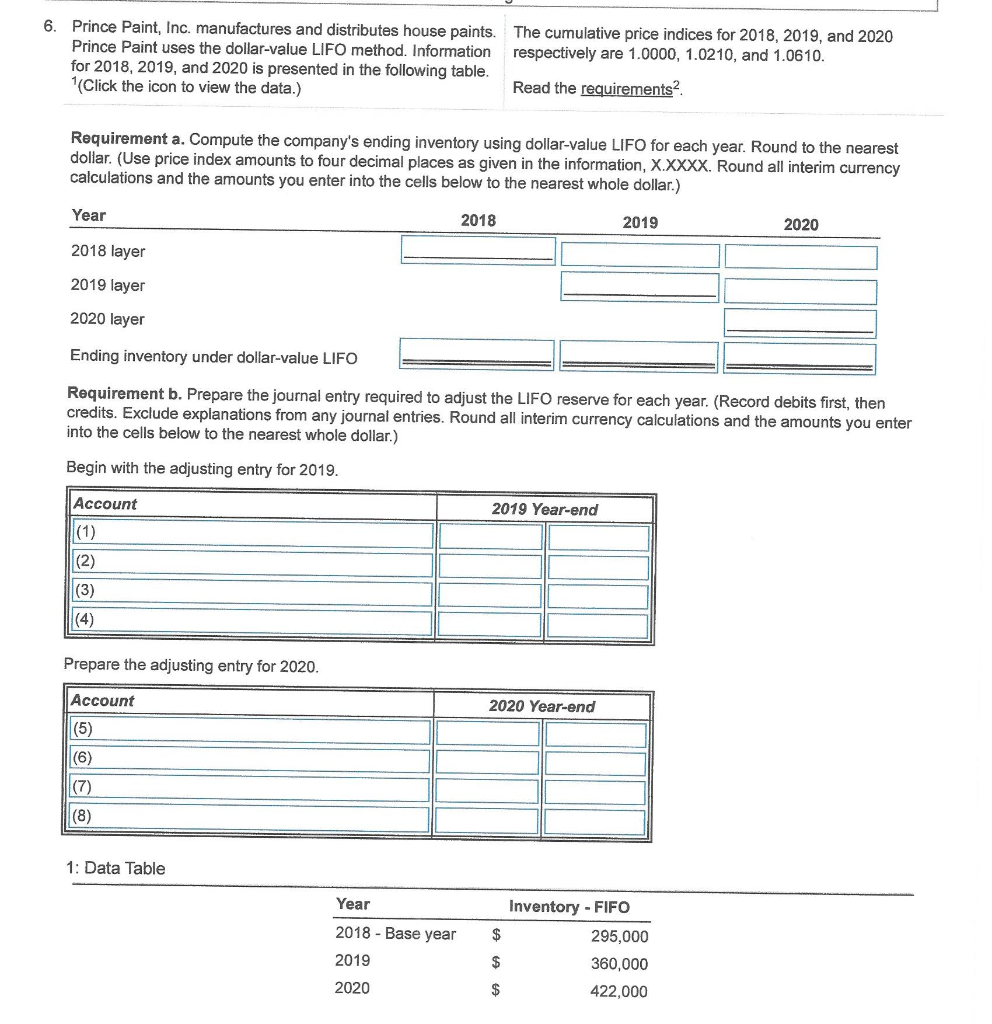

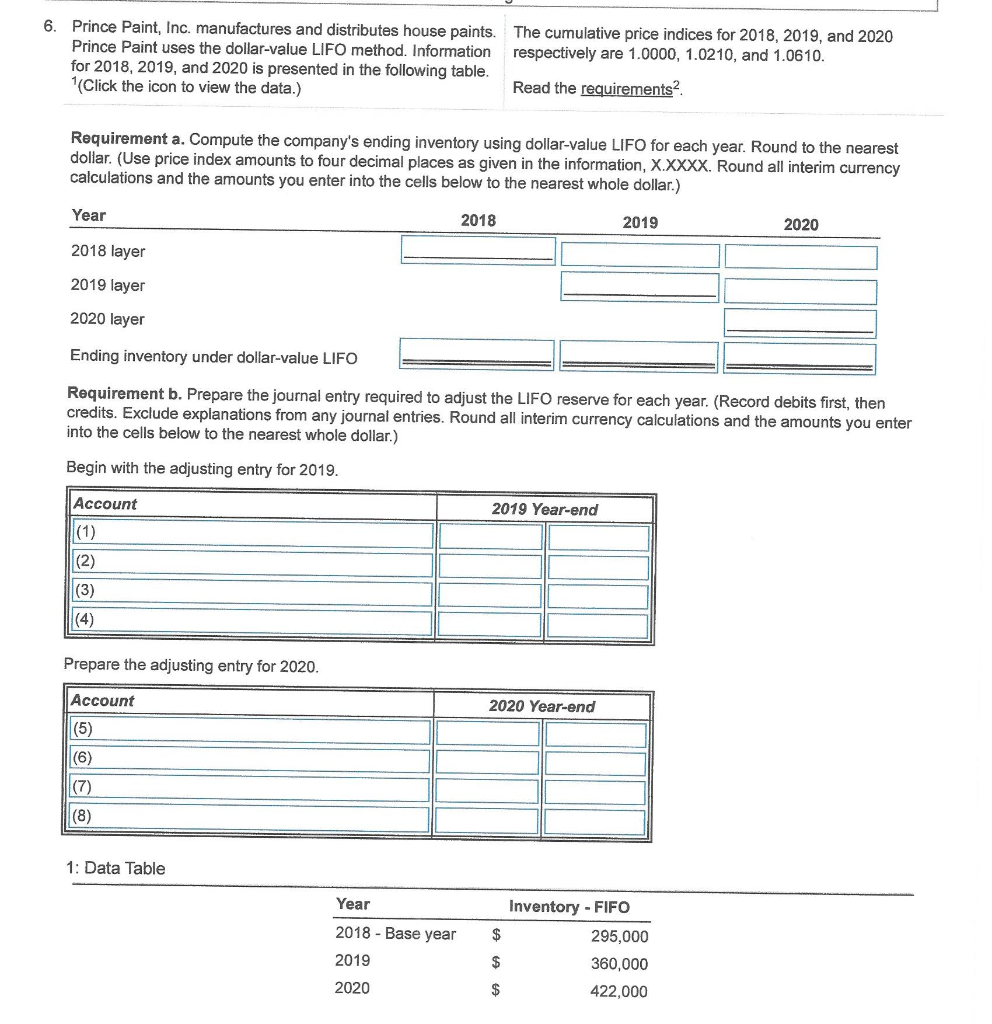

6. Prince Paint, Inc. manufactures and distributes house paints. Prince Paint uses the dollar-value LIFO method. Information for 2018, 2019, and 2020 is presented in the following table. 1(Click the icon to view the data.) The cumulative price indices for 2018, 2019, and 2020 respectively are 1.0000, 1.0210, and 1.0610. Read the requirements Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Round to the nearest dollar. (Use price index amounts to four decimal places as given in the information, X.XXXX. Round all interim currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Year 2018 2019 2020 2018 layer 2019 layer 2020 layer Ending inventory under dollar-value LIFO Requirement b. Prepare the journal entry required to adjust the LIFO reserve for each year. (Record debits first, then credits. Exclude explanations from any journal entries. Round all interim currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Begin with the adjusting entry for 2019. Account 2019 Year-end (1) (2) (4) Prepare the adjusting entry for 2020. Account 2020 Year-end (5) (6) (7) (8) 1: Data Table Year Inventory FIFO 2018-Base year 295,000 2019 360,000 2020 $ 422.000 6. Prince Paint, Inc. manufactures and distributes house paints. Prince Paint uses the dollar-value LIFO method. Information for 2018, 2019, and 2020 is presented in the following table. 1(Click the icon to view the data.) The cumulative price indices for 2018, 2019, and 2020 respectively are 1.0000, 1.0210, and 1.0610. Read the requirements Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Round to the nearest dollar. (Use price index amounts to four decimal places as given in the information, X.XXXX. Round all interim currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Year 2018 2019 2020 2018 layer 2019 layer 2020 layer Ending inventory under dollar-value LIFO Requirement b. Prepare the journal entry required to adjust the LIFO reserve for each year. (Record debits first, then credits. Exclude explanations from any journal entries. Round all interim currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Begin with the adjusting entry for 2019. Account 2019 Year-end (1) (2) (4) Prepare the adjusting entry for 2020. Account 2020 Year-end (5) (6) (7) (8) 1: Data Table Year Inventory FIFO 2018-Base year 295,000 2019 360,000 2020 $ 422.000