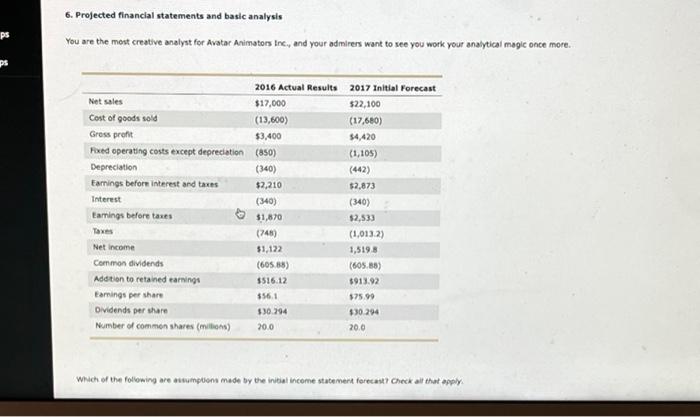

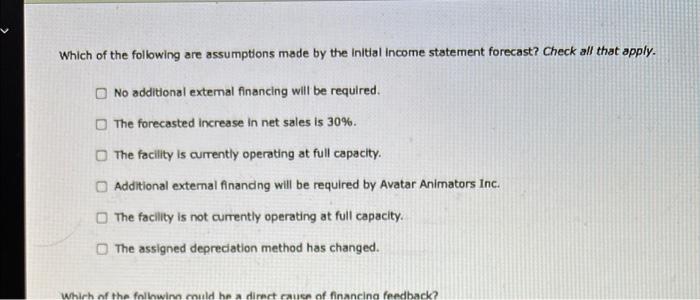

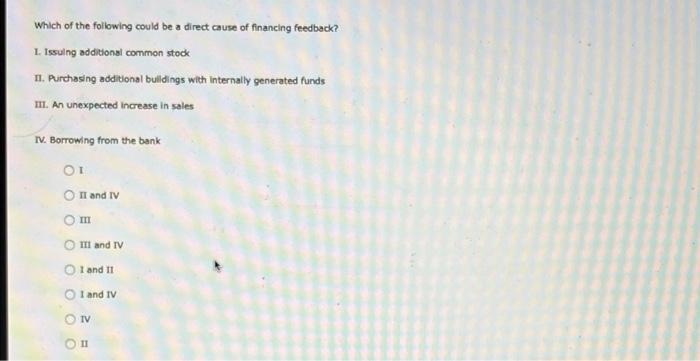

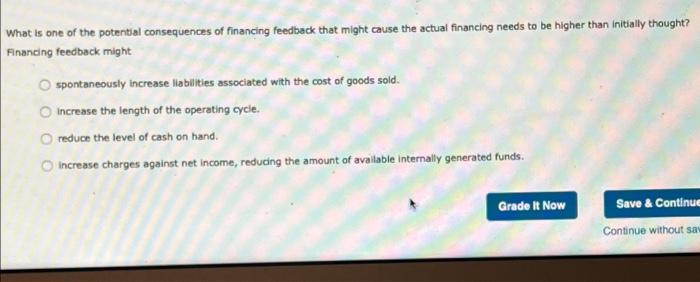

6. Projected financial statements and basic analysis You are the most creative analyst for Avatar Animators Inc., and your admirers want to see you work your analytical magic once more. ps PS 2016 Actual Results 2017 Initial Forecast Net sales $17,000 $22,100 Cost of goods sold (13,600) (17,680) Gross profit $3,400 54,420 Fixed operating costs except depreciation (850) (1,105) Depreciation (340) (442) Earnings before interest and taxes $2,210 $2,873 Interest (340) (340) Eamings before taxes $1,870 $2,533 (748) (1.013.) Net Income $1,122 1,519,8 Common dividends (605.85) (605.85) Addtion to retained earnings 5516.12 $913.92 Earnings per share 56.1 375.99 Dividends per share $30.294 $30.294 Number of common shares (mitm) 20.0 20.0 Which of the following are sumptions made by the initial income statement forecast? Check all that apply Which of the following are assumptions made by the initial income statement forecast? Check all that apply. No additional extemal financing will be required The forecasted increase in net sales is 30%. The facility is currently operating at full capacity. Additional external financing will be required by Avatar Animators Inc. The facility is not currently operating at full capacity The assigned depreciation method has changed. Which of the following could be a direct cause of financina feedback? Which of the following could be a direct cause of financing feedback? 1. Issuing additional common stock 11. Purchasing additional buildings with Internally generated funds I. An unexpected increase in sales IV. Borrowing from the bank OL I and IV E III and TV I and II I and IV TV What is one of the potential consequences of financing feedback that might cause the actual financing needs to be higher than initially thought? Financing feedback might spontaneously increase liabilities associated with the cost of goods sold. Increase the length of the operating cycle. o reduce the level of cash on hand. Increase charges against net income, reducing the amount of available internally generated funds. Grade It Now Save & Continue Continue without say