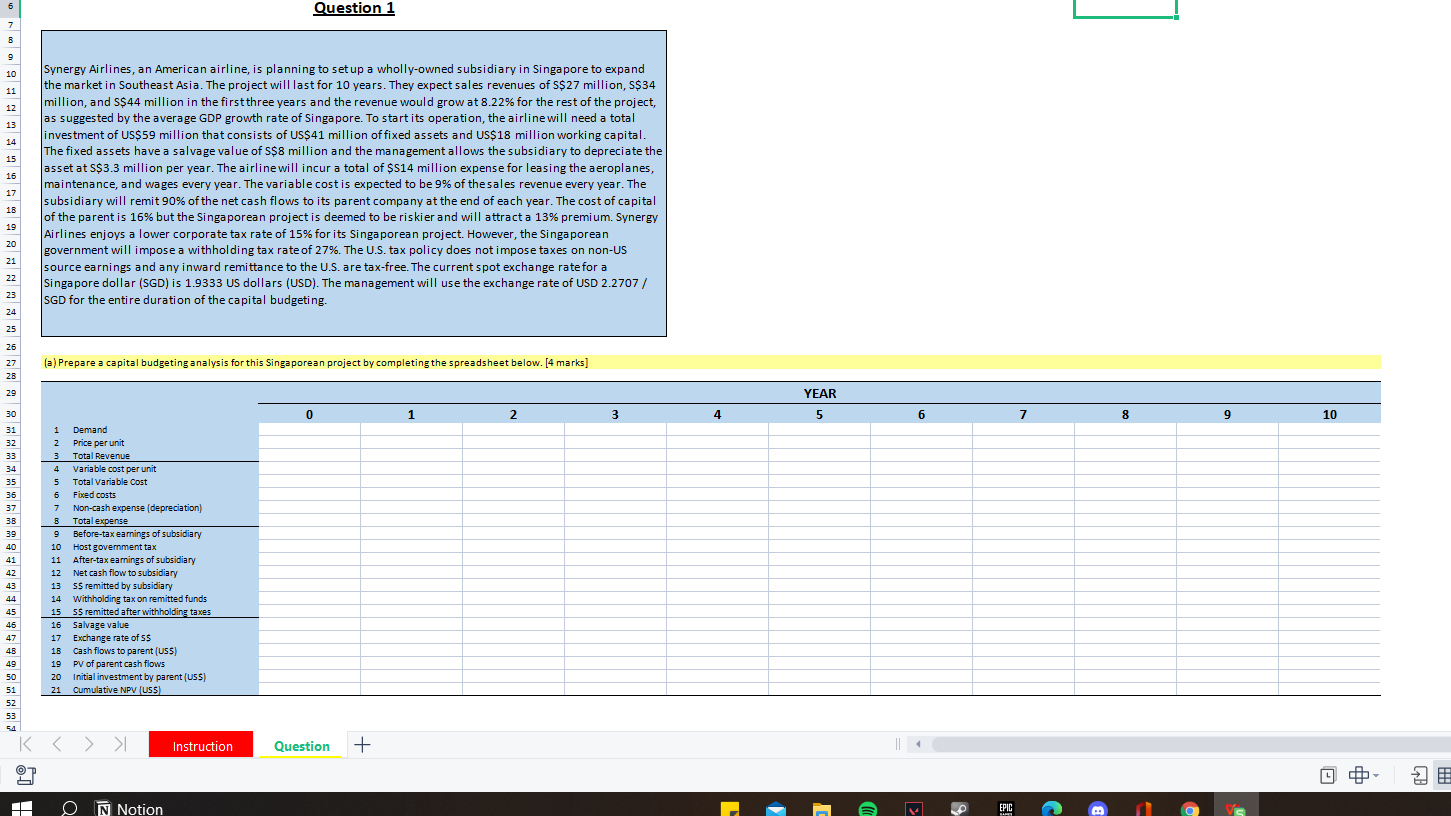

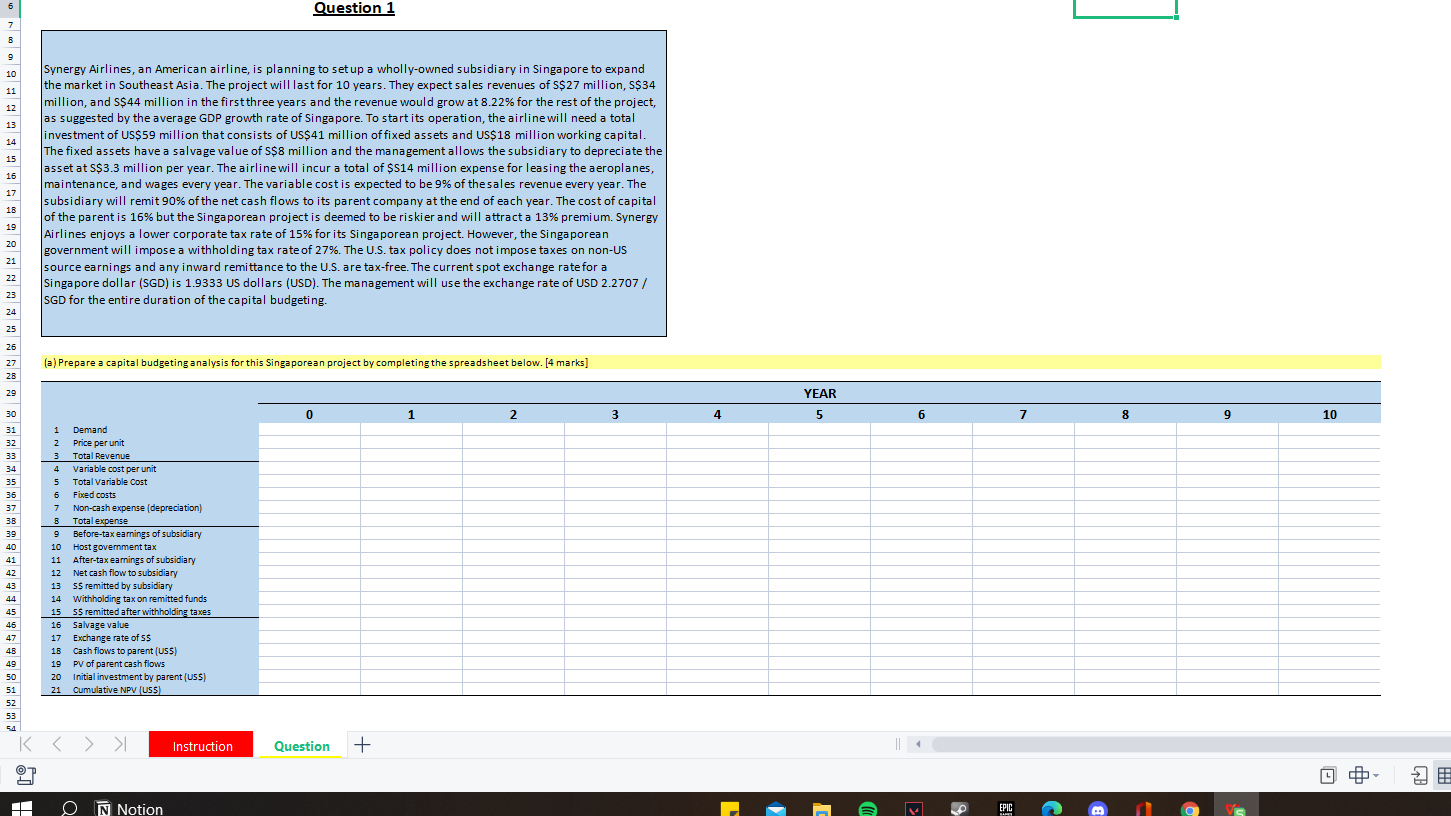

6 Question 1 7 B 9 10 11 12 13 14 15 16 17 Synergy Airlines, an American airline, is planning to set up a wholly-owned subsidiary in Singapore to expand the market in Southeast Asia. The project will last for 10 years. They expect sales revenues of S$27 million, S$34 million, and S$44 million in the first three years and the revenue would grow at 8.22% for the rest of the project, as suggested by the average GDP growth rate of Singapore. To start its operation, the airline will need a total investment of US$59 million that consists of US$41 million offixed assets and US$18 million working capital. The fixed assets have a salvage value of S$8 million and the management allows the subsidiary to depreciate the asset at S$3.3 million per year. The airline will incur a total of $514 million expense for leasing the aeroplanes, maintenance, and wages every year. The variable cost is expected to be 9% of the sales revenue every year. The subsidiary will remit 90% of the net cash flows to its parent company at the end of each year. The cost of capital of the parent is 16% but the Singaporean project is deemed to be riskier and will attract a 13% premium. Synergy Airlines enjoys a lower corporate tax rate of 15% for its Singaporean project. However, the Singaporean government will impose a withholding tax rate of 27%. The U.S. tax policy does not impose taxes on non-us source earnings and any inward remittance to the U.S. are tax-free. The current spot exchange rate for a Singapore dollar (SGD) is 1.9333 US dollars (USD). The management will use the exchange rate of USD 2.2707 / SGD for the entire duration of the capital budgeting. 1B 19 20 21 22 23 24 25 25 27 28 (a) Prepare a capital budgeting analysis for this Singaporean project by completing the spreadsheet below. marks] 29 YEAR 30 0 1 1 2 3 4 5 6 7 8 9 10 31 32 33 34 35 36 37 3B 39 40 41 42 43 44 HEEGELDEEvo un 1 1 Demand 2 Price per unit Total Revenue Variable cost per unit Total Variable Cost Fixed costs Non-cash expense depreciation) 8 Total expense 9 Before-tax earnings of subsidiary 10 Host government tax 11 After-tax earnings of subsidiary 12 Net cash flow to subsidiary 13 55 remitted by subsidiary 14 withholding tax on remitted funds SS remitted after withholding taxes 16 Salvage value 17 Exchange rate of SS 18 Cash flows to parent (USS) 19 PV of parent cash flows 20 Initial investment by parent (USS) ) 21 Cumulative NPV (USS) 45 46 47 4B 49 50 51 52 53 54 K > Instruction Question + 1 ON Notion EPIC BAI