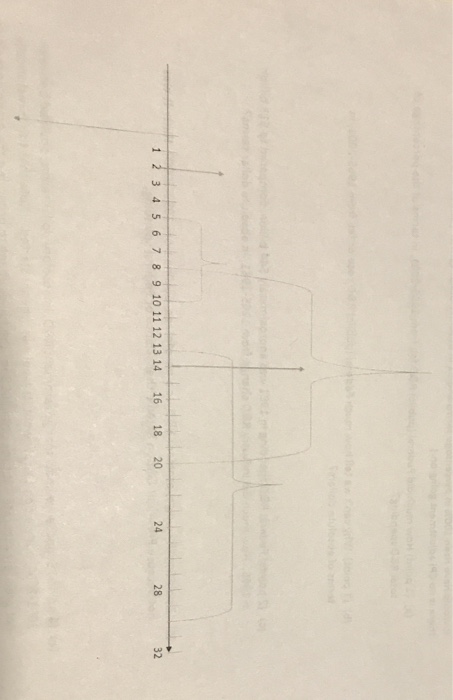

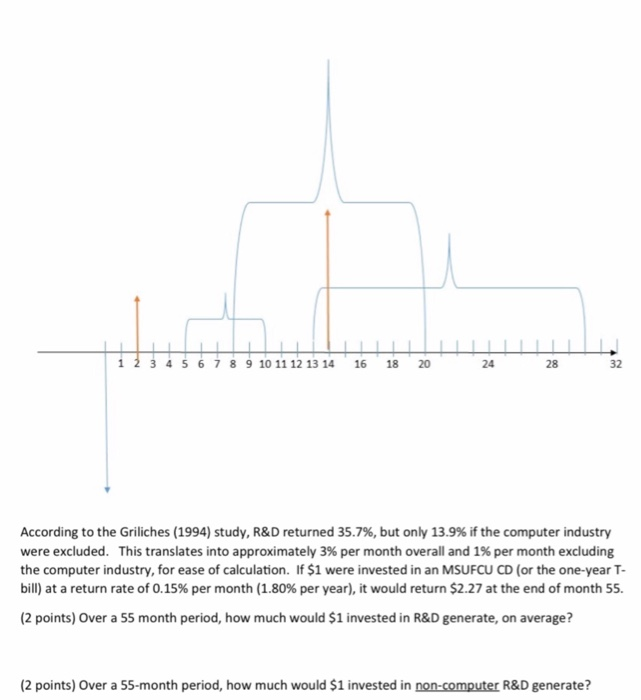

6. Rate of return on innovations in general (and process vs. product) (6 points) Label the key features on the (updated and truncated to 32 periods) returns to R&D. You should make sure to label all three arrows and all three time brackets. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 18 20 24 28 According to the Griliches (1994) study, R&D returned 35.7%, but only 13.9% if the computer industry were excluded. This translates into approximately 3% per month overall and 19 per month excluding the computer industry, for ease of calculation. If $1 were invested in an MSUFCU CD (or the one-year T- bill) at a return rate of 0.15% per month (1.80% per year), it would return $2.27 at the end of month 55. (2 points) Over a 55 month period, how much would $1 invested in R&D generate, on average? (2 points) Over a 55-month period, how much would $1 invested in non-computer R&D generate? 6. Rate of return on innovations in general and process vs. product) (6 points) Label the key features on the (updated and truncated to 32 periods) returns to R&D. You should make sure to label all three arrows and all three time brackets. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 18 20 24 28 32 According to the Griliches (1994) study, R&D returned 35.7%, but only 13.9% if the computer industry were excluded. This translates into approximately 3% per month overall and 1% per month excluding the computer industry, for ease of calculation. If $1 were invested in an MSUFCU CD (or the one-year T- bill) at a return rate of 0.15% per month (1.80% per year), it would return $2.27 at the end of month 55. (2 points) Over a 55 month period, how much would $1 invested in R&D generate, on average? (2 points) Over a 55-month period, how much would $1 invested in non-computer R&D generate? 6. Rate of return on innovations in general (and process vs. product) (6 points) Label the key features on the (updated and truncated to 32 periods) returns to R&D. You should make sure to label all three arrows and all three time brackets. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 18 20 24 28 According to the Griliches (1994) study, R&D returned 35.7%, but only 13.9% if the computer industry were excluded. This translates into approximately 3% per month overall and 19 per month excluding the computer industry, for ease of calculation. If $1 were invested in an MSUFCU CD (or the one-year T- bill) at a return rate of 0.15% per month (1.80% per year), it would return $2.27 at the end of month 55. (2 points) Over a 55 month period, how much would $1 invested in R&D generate, on average? (2 points) Over a 55-month period, how much would $1 invested in non-computer R&D generate? 6. Rate of return on innovations in general and process vs. product) (6 points) Label the key features on the (updated and truncated to 32 periods) returns to R&D. You should make sure to label all three arrows and all three time brackets. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 16 18 20 24 28 32 According to the Griliches (1994) study, R&D returned 35.7%, but only 13.9% if the computer industry were excluded. This translates into approximately 3% per month overall and 1% per month excluding the computer industry, for ease of calculation. If $1 were invested in an MSUFCU CD (or the one-year T- bill) at a return rate of 0.15% per month (1.80% per year), it would return $2.27 at the end of month 55. (2 points) Over a 55 month period, how much would $1 invested in R&D generate, on average? (2 points) Over a 55-month period, how much would $1 invested in non-computer R&D generate