Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The management of Citronella Manufacturing Berhad (Citronella) is considering to go through a major expansion programme. As an executive in the company's Finance Department,

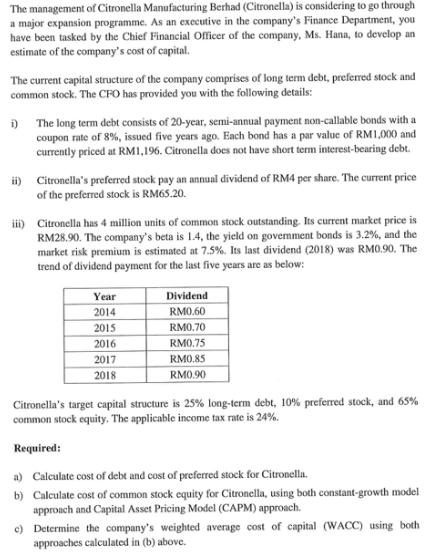

The management of Citronella Manufacturing Berhad (Citronella) is considering to go through a major expansion programme. As an executive in the company's Finance Department, you have been tasked by the Chief Financial Officer of the company, Ms. Hana, to develop an estimate of the company's cost of capital. The current capital structure of the company comprises of long term debt, preferred stock and common stock. The CFO has provided you with the following details: i) The long term debt consists of 20-year, semi-annual payment non-callable bonds with a coupon rate of 8%, issued five years ago. Each bond has a par value of RM1,000 and currently priced at RM1,196, Citronella does not have short term interest-bearing debt. ii) Citronella's preferred stock pay an annual dividend of RM4 per share. The current price of the preferred stock is RM65.20. iii) Citronella has 4 million units of common stock outstanding. Its current market price is RM28.90. The company's beta is 1.4, the yield on government bonds is 3.2%, and the market risk premium is estimated at 7.5%. Its last dividend (2018) was RM0.90. The trend of dividend payment for the last five years are as below: Year 2014 2015 2016 2017 2018 Dividend RM0.60 RM0.70 RM075 RMO.85 RM0.90. Citronella's target capital structure is 25% long-term debt, 10% preferred stock, and 65% common stock equity. The applicable income tax rate is 24%. Required: a) Calculate cost of debt and cost of preferred stock for Citronella. b) Calculate cost of common stock equity for Citronella, using both constant-growth model approach and Capital Asset Pricing Model (CAPM) approach. c) Determine the company's weighted average cost of capital (WACC) using both approaches calculated in (b) above.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The cost of debt can be calculated using the bondequivalent yield method BEY 82 4 Cost of debt 4 x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started