Answered step by step

Verified Expert Solution

Question

1 Approved Answer

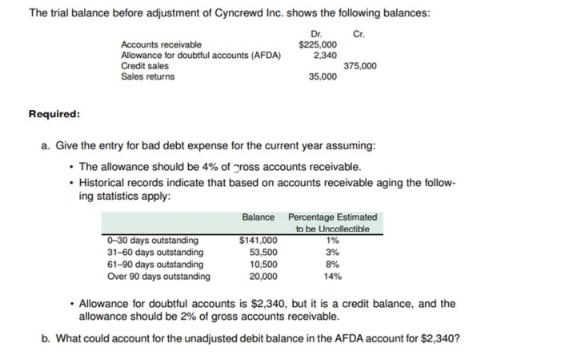

The trial balance before adjustment of Cyncrewd Inc. shows the following balances: Accounts receivable Allowance for doubtful accounts (AFDA) Credit sales Sales returns Dr.

The trial balance before adjustment of Cyncrewd Inc. shows the following balances: Accounts receivable Allowance for doubtful accounts (AFDA) Credit sales Sales returns Dr. $225,000 Cr. 2,340 375,000 35,000 Required: a. Give the entry for bad debt expense for the current year assuming: The allowance should be 4% of gross accounts receivable. . Historical records indicate that based on accounts receivable aging the follow- ing statistics apply: Balance Percentage Estimated to be Uncollectible 0-30 days outstanding $141,000 1% 31-60 days outstanding 53,500 3% 61-90 days outstanding 10,500 8% 20,000 14% Over 90 days outstanding Allowance for doubtful accounts is $2,340, but it is a credit balance, and the allowance should be 2% of gross accounts receivable. b. What could account for the unadjusted debit balance in the AFDA account for $2,340?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding the Problem and Data Problem Calculate bad debt expense for Cyncrewd Incusing different methods Explain why the Allowance for Doubtful Accounts AFDA has a debit balance Given Data Trial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started