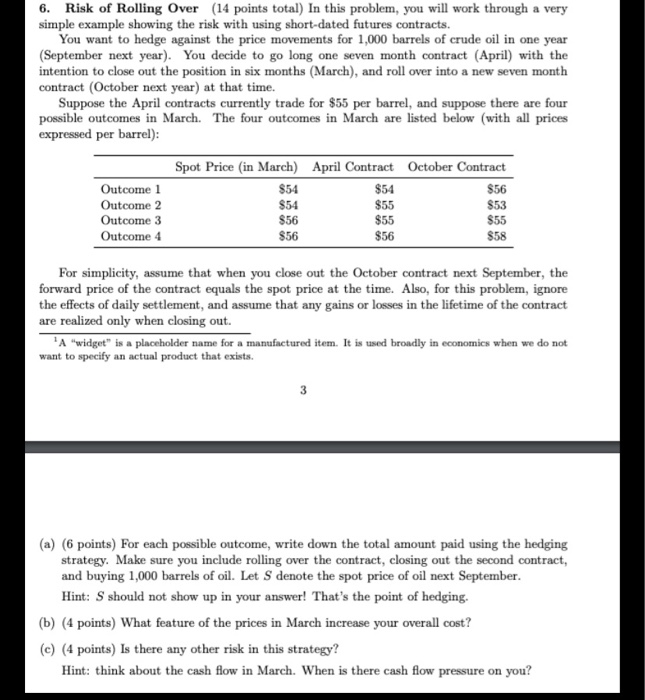

6. Risk of Rolling Over (14 points total) In this problem, you will work through a very simple example showing the risk with using short-dated futures contracts. You want to hedge against the price movements for 1,000 barrels of crude oil in one year (September next year). You decide to go long one seven month contract (April) with the intention to close out the position in six months (March), and roll over into a new seven month contract (October next year) at that time. Suppose the April contracts currently trade for $55 per barrel, and suppose there are four possible outcomes in March. The four outcomes in March are listed below (with all prices expressed per barrel): Spot Price in March) $54 April Contract $54 October Contract $56 $53 $55 $54 Outcome 1 Outcome 2 Outcome 3 Outcome 4 $55 $56 $56 $55 $56 $58 For simplicity, assume that when you close out the October contract next September, the forward price of the contract equals the spot price at the time. Also, for this problem, ignore the effects of daily settlement, and assume that any gains or losses in the lifetime of the contract are realized only when closing out. A "widget" is a placeholder name for a manufactured item. It is used broadly in economics when we do not want to specify an actual product that exists. (a) (6 points) For each possible outcome, write down the total amount paid using the hedging strategy. Make sure you include rolling over the contract, closing out the second contract, and buying 1,000 barrels of oil. Let S denote the spot price of oil next September Hint: S should not show up in your answer! That's the point of hedging. (b) (4 points) What feature of the prices in March increase your overall cost? (c) (4 points) Is there any other risk in this strategy? Hint: think about the cash flow in March. When is there cash flow pressure on you? 6. Risk of Rolling Over (14 points total) In this problem, you will work through a very simple example showing the risk with using short-dated futures contracts. You want to hedge against the price movements for 1,000 barrels of crude oil in one year (September next year). You decide to go long one seven month contract (April) with the intention to close out the position in six months (March), and roll over into a new seven month contract (October next year) at that time. Suppose the April contracts currently trade for $55 per barrel, and suppose there are four possible outcomes in March. The four outcomes in March are listed below (with all prices expressed per barrel): Spot Price in March) $54 April Contract $54 October Contract $56 $53 $55 $54 Outcome 1 Outcome 2 Outcome 3 Outcome 4 $55 $56 $56 $55 $56 $58 For simplicity, assume that when you close out the October contract next September, the forward price of the contract equals the spot price at the time. Also, for this problem, ignore the effects of daily settlement, and assume that any gains or losses in the lifetime of the contract are realized only when closing out. A "widget" is a placeholder name for a manufactured item. It is used broadly in economics when we do not want to specify an actual product that exists. (a) (6 points) For each possible outcome, write down the total amount paid using the hedging strategy. Make sure you include rolling over the contract, closing out the second contract, and buying 1,000 barrels of oil. Let S denote the spot price of oil next September Hint: S should not show up in your answer! That's the point of hedging. (b) (4 points) What feature of the prices in March increase your overall cost? (c) (4 points) Is there any other risk in this strategy? Hint: think about the cash flow in March. When is there cash flow pressure on you